The FTSE 100 fell on Friday after China said it was going impose security law in Hong Kong, significantly increasing tensions that had diminished during the coronavirus outbreak.

Security law means it would be made illegal for people in Hong Kong to undermine the central Chinese government under lose offences of treason, sedition and subversion.

Mike Pompeo, US Secretary of State, called the move a ‘death knell’ for Hong Kong autonomy.

Whilst Hong Kong leaders said they would co-operate with the legislation, many voiced their concerns over the move which could see a return to social unrest that caused significant economic disruption before the COVID-19 pandemic.

The real risk is any unrest spills over into the relationship between the US and China who are locked into trade negotiations and a political stand off caused by Trump blaming China for the global coronavirus crisis.

The FTSE 100 had reached lows of 5,893 on Friday morning before recovering to 5,980 at 15:30 on Friday.

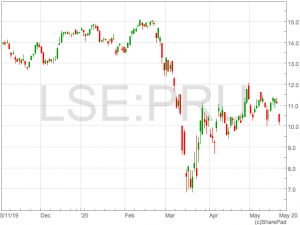

FTSE 100 shares with a substantial exposure to Hong Kong were among the most heavily hit as Prudential shed 8% and HSBC sank 4%. Asia focused Standard Chartered was down 2.8%.

Following the demerger of M&G Investments, Prudential is highly reliant on Asian earnings and disruption in Hong Kong could be highly damaging to 2020 earnings.

Burberry was one of the top risers after the luxury brand said it had seen a strong rebound in Asian sales as demand returns after lockdown measures are lifted. Whitbread was also stronger as the Premier Inn owner rebounded following the announcement of a rights issue.

Despite falling on Friday, the FTSE 100 is now down just 20% in 2020 having rallied 20% from the 23rd March low. However, there are concerns that the market hasn’t fully priced in the risk of coronavirus on the economy.

“After the shock of the COVID-19 lockdown, we have to go through a regular recession with high unemployment, low capex, low demand and that’s not what’s priced in at the moment,” said Andrea Cicione, head of strategy at TS Lombard.