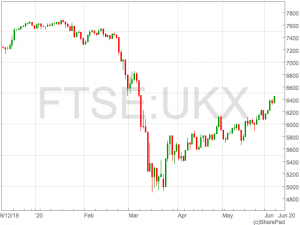

The FTSE 100 rose on Friday rebounding from a weakness in the following session as investors cheered the reopening of global economies and strong jobs data from the US.

Travle and leisure shares were the again among the top risers as more countries outlined plans to ease travel restrictions.

Turkey said it was working with a number of countries, including the UK, on reciprocal travel arrangements. An agreement with the UK would involve so-called ‘air bridges’ that would allow passengers to travel between countries with low infections rates. Greece is also exploring similar arrangements.

With Turkey and Greece being one of the most popular destinations for Europeans, the adoption of air bridges would signal an opportunity for a recovery in passenger numbers for airlines.

FTSE 100 airlines International Consolidated Airlines and easyJet surged on the prospect of a ramping up in air travel, rising over 11% and 7% respectively.

Shares in cruise operator, Carnival, were up as much as 20% and were the FTSE 100’s top riser on Friday.

Companies thats have been dubbed ‘stay at home shares’ were among the biggest fallers . Ocado has been a major benefactor of the coronavirus restrictions with shares rising 61% in 2020, but shares in the online grocery delivery service fell on Friday as investors shifted their attention to cyclical recovery shares.

Companies thats have been dubbed ‘stay at home shares’ were among the biggest fallers . Ocado has been a major benefactor of the coronavirus restrictions with shares rising 61% in 2020, but shares in the online grocery delivery service fell on Friday as investors shifted their attention to cyclical recovery shares.

Precious metals miner Polymetal was also weaker as the risk-on tone diminished demand for safe havens.

Markets were also buoyed by a fresh round of ECB stimulus and hopes surrounding AstraZeneca’s vaccine development.

US Jobs

Later in the day, equity rallied after investors received the latest instalment of job data from the US in the form of the US Non-Farm Payrolls.

The US economy added 2.5 million jobs in May, significantly beating the economist consensus of 8 million jobs lost.

In April, the US economy shed 20 million jobs and exceptions were the Non-Farm Payrolls would show further job losses in May. However, the reading showed that hiring picked up in May suggesting the recovery from the coronavirus induced downturn would move quicker than previously thought.

The jobs data triggered a wave of optimism through markets and the FTSE 100 built on earlier gains to trade at 6,455, up 1.8% on the day.

US equities also rose with the Dow Jones and S&P 500 push towards the highest levels seen since February.