The FTSE 100 was down as much as 200 points in Monday trade as Russia’s conflict against Ukraine continued to rock the global economy with the prospect of a Russia oil embargo.

However, a recovery later in the session so the index go positive as commodity companies rallied.

The price of commodities surged, with the price of oil jumping as a potential ban on Russian oil exports boost fears of a scarcity.

Brent Crude has jumped past expectations to $128.7 per barrel on Monday, beforte settling to a price of $125. WTI Crude is currently at a price of $123.2 per barrel.

“So far there have been no country-level sanctions on Russian commodity products, merely the decision of various customers not to buy,” said AJ Bell investment director Russ Mould.

“It seems we could be moving to the next stage whereby countries lay down rules to not buy oil and other commodities from Russia which in turn would reduce its funding for the war.”

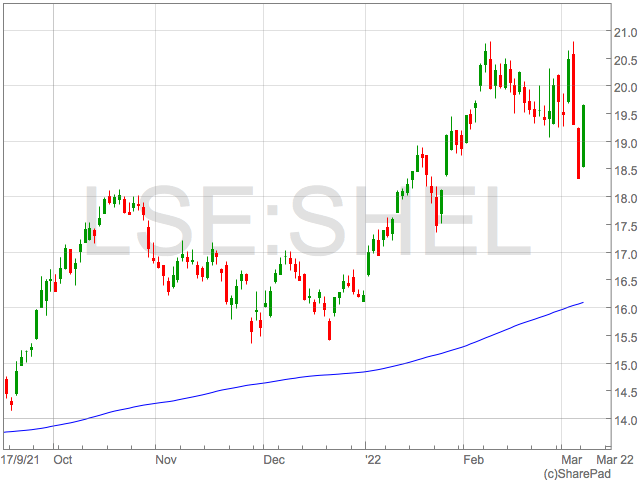

FTSE 100 oil majors BP and Shell rallied on higher oil prices with BP gaining 3% and Shell surging 7%.

However, Mould highlighted the consequences for wider economy as rising prices added to inflation that was already hurting house holding spending and company squeezing margins.

“This further surge in fuel costs will intensify the inflationary pressures already causing problems for consumers and businesses.”

UK banks

The impact of the Russia-Ukraine conflict was particularly evident in the financial sector as the prospect of higher fuel prices caused concerns around lending activities, resulting in heavy selloffs of UK bank shares. Natwest shares were down 5.4% to 191p and Lloyd’s shares fell 6.5% to 40.5p.

“Banking stocks have also been beaten down amid concerns the lending and investment business could trigger a broader slowdown which will limit consumer spending and corporate borrowing,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

“The move by Visa, MasterCard and Amex to stop transactions is likely to be adding to negative sentiment.”

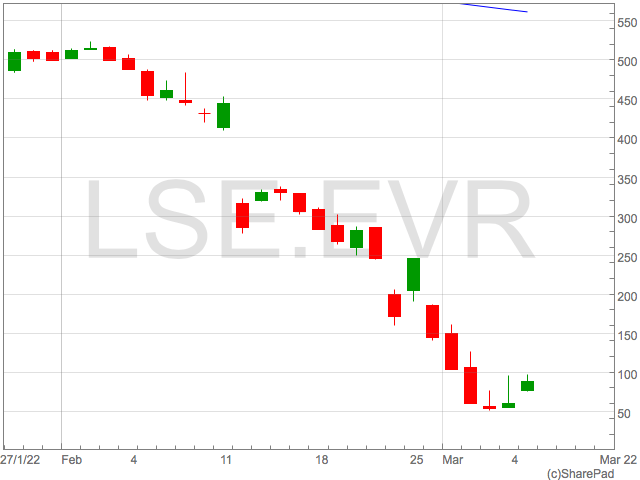

Evraz and Polymetal

The top risers included Evraz rising 47.1% to 88.1p, Polymetal International rising 29.75% to 223.3p and BAE Systems rising 6.45% to 736p at the time of writing.

Evraz and Polymetal have seen intensive market volatility since the start of the Ukraine crisis, with financial sanctions against Putin’s regime crippling the businesses.

“Russian companies trading on the London Stock Exchange continue to lose board members at pace as directors realise the optics of being linked to these businesses are toxic,” said an analyst at AJ Bell.

“However, it will make any future rehabilitation for these stocks, which already looked unlikely, even more difficult.”

Despite a highly uncertain outlook for Evraz, the plummeting prices have seen bargain hunters swoop in to buy the beaten up stock.

BAE Systems

BAE Systems continued to profit from increased demand in its services, as the arms contractor saw a spike in interest as a direct result of Russia’s war in Ukraine spurring on demand in company’s stock.

CCHBC

Coca-Cola HBC shares continue to fall this week, with a 7% drop to 1464p today. CCHBC is facing the brunt of the geopolitical situation with halted productions of their beverages. At the same time, with large portions of revenue contribution coming from emerging markets, the current situation in Russia and Ukraine is denting investor confidence in CCHBC.

Travel shares

The rippling impact of the oil prices are expected to inflate travel costs for consumers in the near future. As result, investors are departing airline shares with IAG trading down 7.8% to 113p on Monday morning.

“British Airways owner, International Consolidated Airlines Group has flown into severe turbulence today with shares down by nearly 10% in early trade, as investors fretted about mounting fuel costs and the loss of confidence among the travelling public,” said Susannah Streeter.