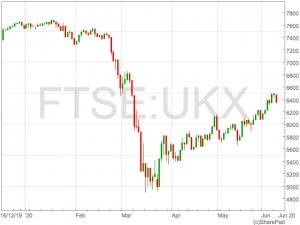

The FTSE 100 paused on Tuesday following a strong session on Monday that saw the index touch the highest levels for three months.

Steam ran out the rally caused by a strong jobs report as investors awaited further insight to the thinking of the Federal Reserve who were set to begin their FOMC meeting on Tuesday.

“The rally looks a little tired, as might be expected after the first week of June saw such a strong move higher. The positive impact from the ECB meeting and Friday’s US jobs report has waned, with no fresh bullish news to take their place,” said Chris Beauchamp, Chief Market Analyst at IG.

Analysts also pointed to decoupling of equity markets and the underlying economy in the middle of the coronavirus pandemic which is only just starting to show signs of recovery.

Economic V-Shaped Recovery?

Global equity markets have certainly produced a V-Shaped recovery with the S&P 500 erasing all of 2020’s losses when it closed on Monday, despite economic data only just starting to show signs of improvement.

“Those long- and short-term records…may well have inspired Tuesday’s losses. Investors might be questioning the wisdom of such highs in a world still very firmly in the middle of a pandemic,” said Connor Campbell, Analyst at Spreadex.

“Those long- and short-term records…may well have inspired Tuesday’s losses. Investors might be questioning the wisdom of such highs in a world still very firmly in the middle of a pandemic,” said Connor Campbell, Analyst at Spreadex.

There was also another instalment of sobering German data that highlighted the impact coronavirus had on the European economy.

“It appears the collapse in German trade – exports plunged 24% in April, while the country’s trade surplus saw a staggering decline, from €12.8 billion to €3.2 billion month-on-month – has sparked Europe’s rather significant wobble,” said Connor Campbell.

FTSE 100 movers

Most sectors were down in London in a broad selloff that targeted some of the better performing stocks in lasts week’s surging rally. Travel shares and the financials were among the biggest fallers on Tuesday.

The FTSE 100’s housebuilders fell Bellway after revealed sales figures for the coronavirus lockdown period declined, but didn’t completely collapse.

“The 3% drop in Bellway’s shares might been a bit of an over-reaction to a fairly anodyne statement, but the similar or bigger losses for Taylor Wimpey and Barratt points to a sector-wide malaise this morning,” said Chris Beauchamp.