The FTSE 100 was up 0.2% to 7,554 in late morning trading on Monday, following a strong jobs report on Friday that revealed 431,000 jobs added to the US payroll in March, and that the American unemployment rate fell to 3.6%, the lowest rate in two years.

Oil continued its decline to $104 per barrel of Brent Crude as US President Biden’s announced that the country would release one million barrels of oil per day from the Strategic Petroleum Reserve last week which calmed the spiking prices and brought it down from previous heights of $120.

A recent ceasefire between the UAE and the Houthi group which is set to see a suspension of military operations on the border between Saudi-Arabia and Yemen has also served to alleviate concerns about supply issues in the area.

Housebuilders Gain

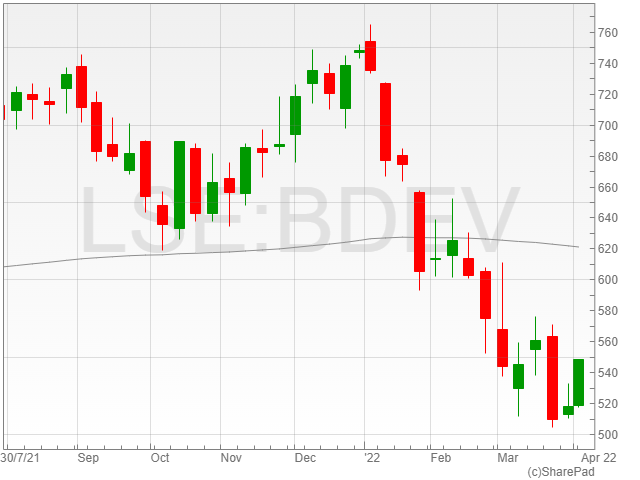

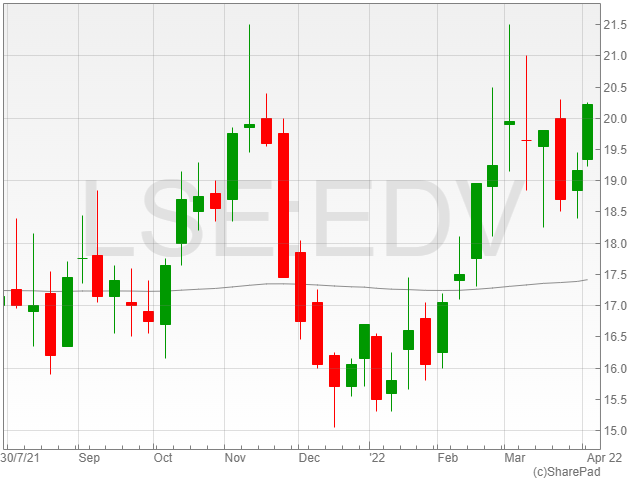

The market enjoyed positive gains across the housing sector, with Persimmon, Taylor Wimpey, Barratt Developments, Berkeley Group Holdings and Rightmove joining the FTSE 100 risers today after the UK government discarded demands on housebuilders to contribute to its £4 billion cladding fund to fix faulty cladding on houses across England.

Barratt Developments rose 5.2% to 545.6p following the £4 billion cladding fund news.

Persimmon enjoyed a boost of 5.2% to 22,615p also on the back of the cladding fund report, alongside the group’s acquisition of Bootham Crescent from York City football club for £7 million earlier today.

The top risers also included Endeavor Mining, which increased 5.3% to 2,180p after it reported the expansion of its Sabodala-Massawa mine in Senegal.

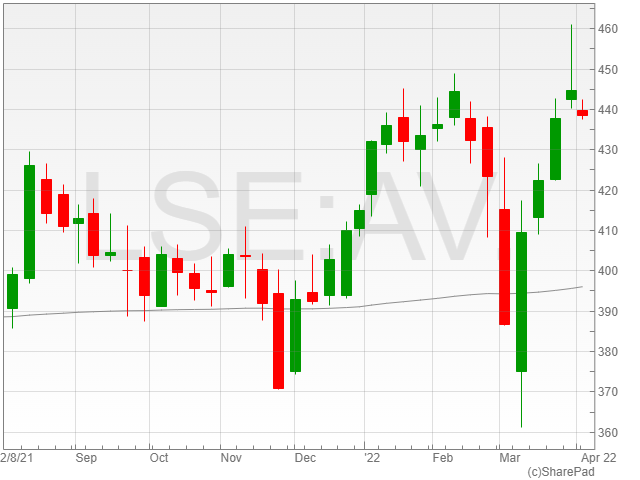

The top fallers were led by Aviva, after the British insurance company announced former Jupiter Fund CFO Charlotte Jones as its new CFO on Monday.

IAG took a hit of 1.4% to 139.1p after it experienced cancelled flights amid the spiking surge of Covid-19 cases among airline staff over the weekend.

“Hot on the heels of long delays at Heathrow and Manchester airports is news that EasyJet has cancelled 100 flights and British Airways owner International Consolidated Airlines also unable to operate all of its scheduled flights,” said AJ Bell investment director Russ Mould.

“These issues stem from airlines and airports having insufficient staff to cope with rising demand. A resurgence in Covid cases hasn’t helped, with many workers off sick.”

International banking services firm, Standard Chartered fell 1.2% to 503.4p.