The FTSE 100 was flat at 7,577 in late morning trading on Thursday, after the latest 7% rise in UK inflation muted investor optimism and consumers braced for the cost of living to spike.

The European Central Bank announced today that its interest rates would remain unchanged at 0%, despite Eurozone inflation levels rising to 7.5% in March.

The move was a sharp turn from the trends set by the Bank of England and the US Federal Reserve, which both chose to hike interest rates in 2022 to address soaring rates of inflation.

“In the current conditions of high uncertainty, the Governing Council will maintain optionality, gradualism and flexibility in the conduct of monetary policy,” said the ECB in a statement.

“The Governing Council will take whatever action is needed to fulfil the ECB’s mandate to pursue price stability and to contribute to safeguarding financial stability.”

“The expectation is that ECB chief Christine Lagarde and her colleagues will sit on their hands but the runaway nature of inflation in the Eurozone is bringing considerable pressure to bear on the central bank,” said AJ Bell financial analyst Danni Hewson.

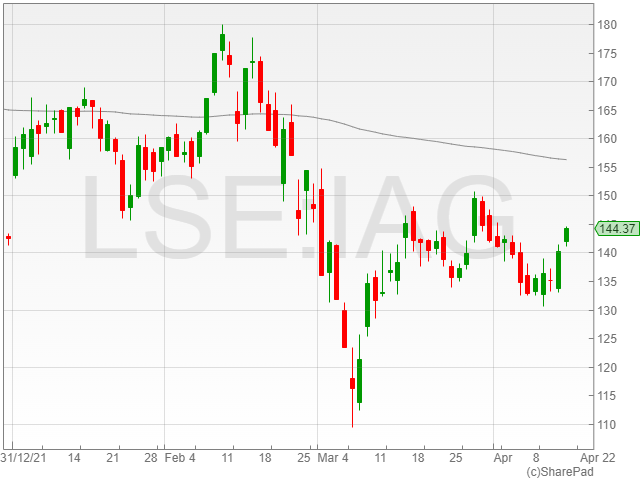

However, it wasn’t entirely bad news, as travel companies took flight with IAG shares rising 2.7% to 144.2p as families broke away from the gloomy UK weather for sunnier countries despite the crushing rate of inflation.

“The top riser was British Airways owner International Consolidated Airlines … which suggests people are prioritising air travel despite the pressures on their finances,” said Hewson.

“After so long of having their travel restricted, it seems the appeal of jetting away is very strong.”

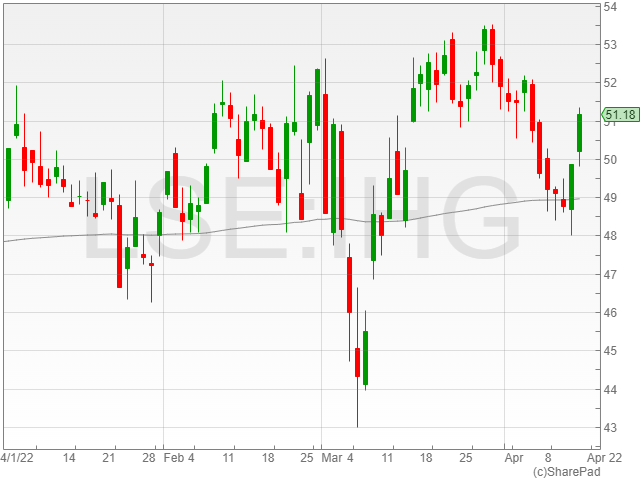

InterContinental Hotels shares increased 2.4% to 51,070p as it joined the climbing travel-focused stocks in their gains.

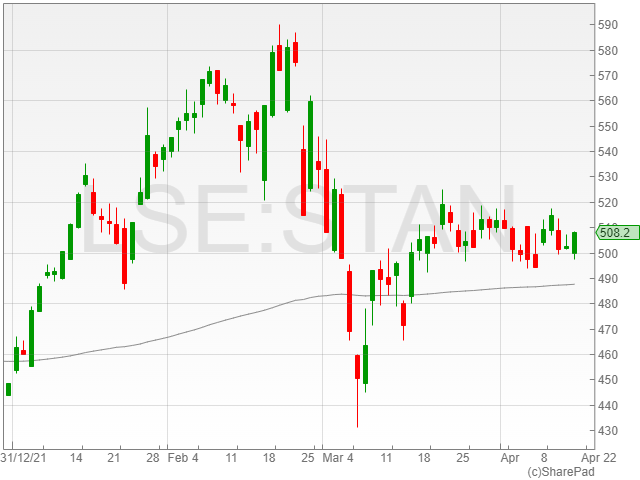

Standard Chartered shares saw an uptcik of 0.9% to 507.2p after the company announced plans to exit its operations in Africa and the Middle-East in a move to “deliver efficiencies” and “reduce complexity.”

The financial company commented that it would be focusing its business on its most significant opportunities for growth, focusing on shareholder returns after its “disciplined” opportunities assessment.

“Subject to regulatory approval, the group now intends to exit onshore operations in seven markets in AME and in a further two markets focus solely on its Corporate, Commercial & Institutional Banking business,” said a Standard Chartered spokesperson.

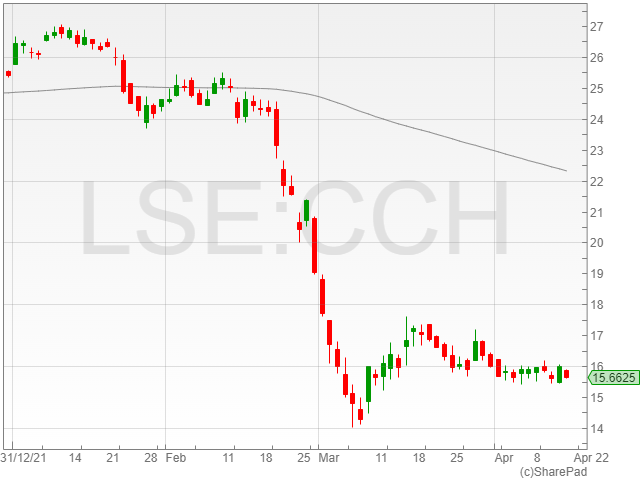

Coca-Cola HBC took a blow of 2% to 15,672p following its price target cut by Credit Suisse to 2,200p from 2,400p.

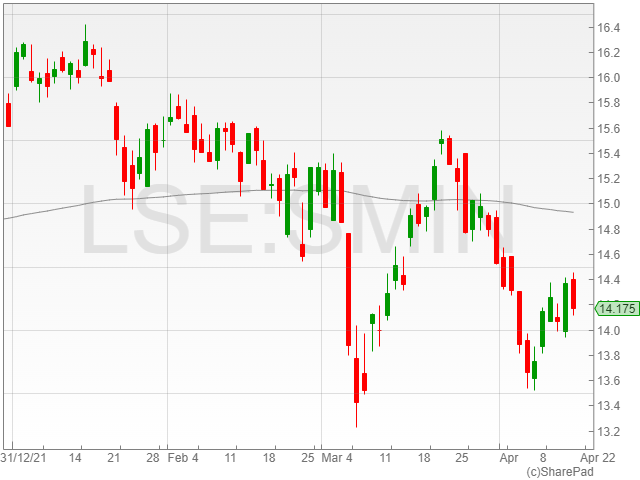

Smiths Group shares decreased 1.3% to 14,175p after the company hired a slate of new executive appointments to its Board.