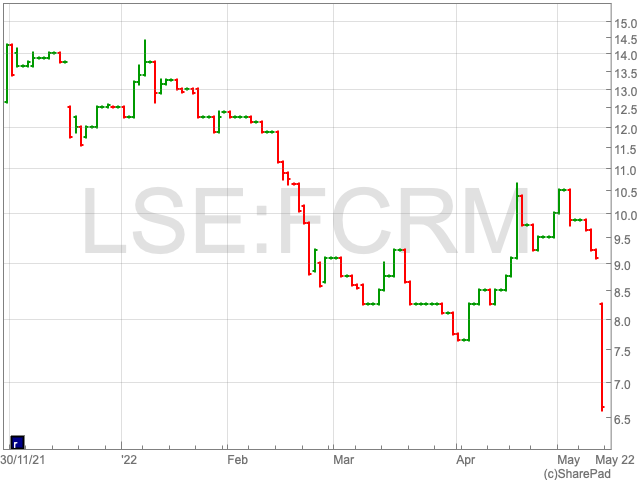

Fulcrum Utility Services announced in its trading update in which it noted the adverse market conditions of the UK energy market and reported a severe impact on its profits, leading to Fulcrum Utility shares to crater 27% to 6.75p on Friday.

Fulcrum Utility, the provider of essential utility services arranged a fundraise in December 2021 following which the UK energy market faced “turbulence” which impacted the group’s metre exchange operations, however, Fulcrum Utility’s core multi-utility contracting business remained unphased.

The group’s smart metre exchange and management contract with energy supplier E Gas and Electricity, in specific, was hindered in Q4 2021, due to the insolvency of several of the group’s other energy supplier customers and one of the group’s labour-only subcontractors.

As a result, Fulcrum was unable to service the contract in a way sustainable for the contract’s profitability for the group leading to the mutual agreement between the Board and E to terminate the contract.

Simultaneously, supply chain pressure and inflation added to the strain on Fulcrum Utility’s core multi-utility contracting business’ profitability, especially on projects which are longer-term in nature such as multi-utility and complex electrical infrastructure projects.

The impact of the wider market issues hurt the group’s financial position leading the group to anticipate a 21.8% YoY growth to £57.4m in report adjusted revenue for FY22 and expects adjusted EBITDA to be around £0.5m.

The group’s order book stands at £48m leading the Board to believe that Fulcrum Utility’s order book will “soften” as the energy market crisis continues.

Fulcrum Utility’s utility assets valued at £36m provide recurrent income leading to “attractive and predictable long-term returns”, along with providing a major growth opportunity for the firm according to the Board.

Despite current market conditions hampering the group’s profitability, the Board thinks acquiring assets at favourable prices is possible which led the Board to analyse certain asset acquisition opportunities. The group is in discussion whilst handling the due diligence over a number of opportunities.

Keeping in mind the market conditions in the UK energy market, the Board is aiming to manage the group’s operations by handling its core utility infrastructure and asset ownership growth strategies while trying to improve margins.

In January of this year, Antony Collins was named interim CEO and Stuart Crossman joined Fulcrum Utility as COO, followed by Jonathan Jager signing on as the group’s CFO in February.

Antony Collins, CEO of Fulcrum Utility, said, “Despite the challenges presented by both the UK’s energy crisis and wider difficult trading conditions, I believe that Fulcrum has the essential capabilities needed to be successful in what are exciting and growing markets.”

Fulcrum Utility’s activities are being actively reviewed by the new leadership team to guarantee peak results and discover potential to improve profitability and deliver “sustainable growth”.

The Board of Directors is satisfied that the company is ideally positioned to support the expansion of the UK’s energy infrastructure by delivering services that are critical as the country moves toward a net-zero future.