Speculation is increasing over the future of the London FinTech industry; some business leaders in the sector believe that the UK’s exit from the European Union may mean Fintech companies will move to another European country. In 20 days the Startupbootcamp is launching its next London Fintech Accelerator. The outcome of the program may shed some light of the changing climate for FinTech companies in Europe’s FinTech hub.

Startupbootcamp London FinTech 2016 will support nine promising FinTech start-ups

Starting on the 5th September, the Startupbootcamp London FinTech Accelerator 2016 hopes to boost the development of nine new and promising FinTech start-ups by offering them free office space in the UK’s capital, as well as £15,000 in funding and access to Angels and venture capitalist firms for both further funding and mentoring.

The program sounds promising; it is backed by big names in the financial industry and other sectors including MasterCard, Lloyds Bank, Intel, PwC and Amazon WebServices.

349 applications from 61 countries fought for places on popular program

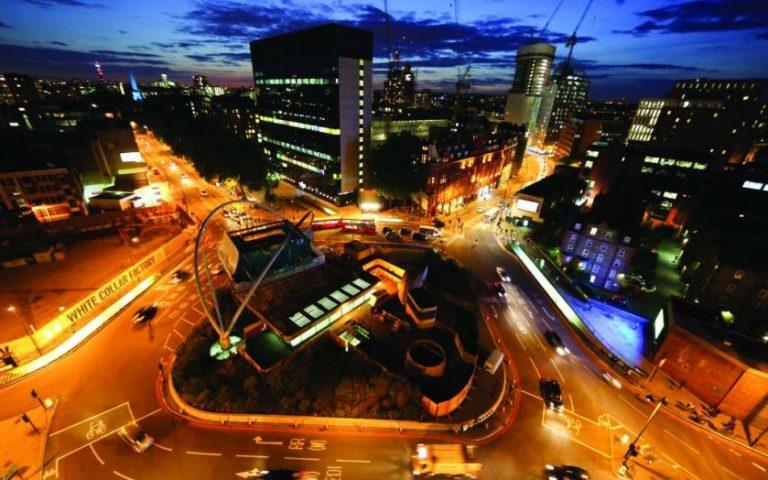

Participants’ interest was high, with 349 start-ups from 61 countries applying to gain a spot on the sought-after program. Much of the interest will have been down to the location; London is currently Europe’s flourishing hub for innovation and growth in the FinTech sector. Participating in a program organised with the help of mentors in a prime industry spot, as well as being offered own free office space right in the beating heart of the European FinTech industry, draws much excitement.

Alumni Start-Up BondIT has since been greatly successful

Alumni of the program have seen strong business growth since their participation.

BondIT is an Israel based start-up, focusing on efficient, algorithmic income portfolio management. It participated in the London FinTech Accelerator in 2015. Since then it has greatly expanded its team size and global reach. Head offices are located in Hong Kong as well as Israel. The firm has also been selected to present their latest innovations at next month’s Wealth Management Association (WMA) Fintech conference at the KPMG London Headquarters.

London accelerator might lay foundation for future of London FinTech

However, this year’s London accelerator commences at a time where the future of the London FinTech industry is less certain. The Brexit vote in June has shifted opinion on the viability of setting up a business in London – and especially in the FinTech sector. Some have started to rethink geographic strategy. Loss of access to the common European market may decrease the growth potential of a London FinTech start-up.

Not all views are that gloomy. There are optimists in the industry who believe that London will be able to sustain its culture of innovation and growth. The new and popular round of the London FinTech accelerator may be one program to watch to gain some understanding on how FinTech will develop and struggle in post-Brexit economic uncertainty. Its success may also influence the decision if next year’s Startupbootcamp accelerators will add another European location on the FinTech-programs list.

Applications are already open for FinTech & Cyber Security Accelerator in Amsterdam which will begin in January 2017.

Katharina Fleiner 16/08/2016