The cable rate failed to rebound on Friday despite a week of sharp gains and a miss in the headline Non-Farm payroll release.

The US added 164,000 jobs in April missing estimates of 192,000. while the unemployment rate fell to 3.9%, the lowest for 18 years.

The miss in the key jobs figures caused weakness in dollar with USD/JPY sinking sharply but the dollar weakness provided to reprise for GBP/USD which languished beneath the 1.3600.

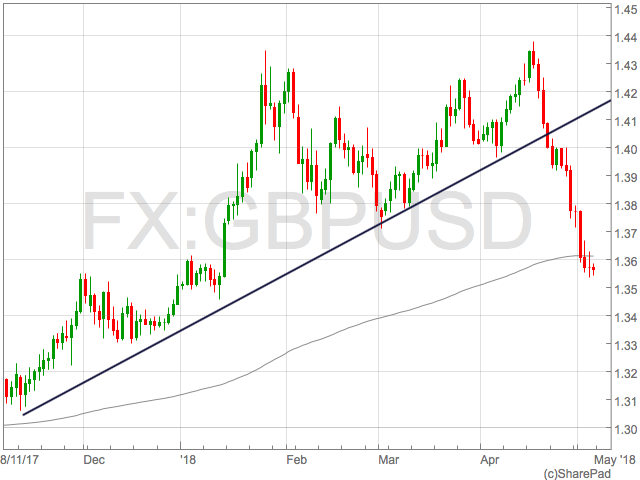

GBP/USD broke a solid 6 month uptrend in mid April and has since dropped nearly 1,000 points as the UK economic outlook deteriorates and reduces the chance of a rate hike at the Bank of Englands next meeting.

In early 2018 markets had priced in the rate hike for May but have since violently unwound this trade causing the cable rate to retreat from the highest levels since the vote to leave the EU.

FTSE 100 outperforms

The weakness in the sterling has reignited the strong negative correlation between sterling and the FTSE 100 with London’s leading index outperforming its European and US counterparts throughout the week.