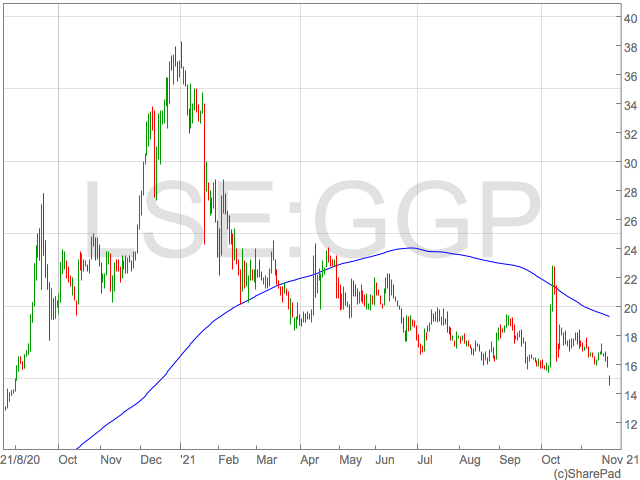

Greatland Gold shares have traded at the lowest level since September 2020 after the gold miner completed a £11.9 million ($16 million) bookbuild.

There was strong demand for the capital raise and the bookbuild was upsized from an original $10 million to $16 million.

A total of 82,000,000 shares were placed at a price of 14.5p per share. This represented a 10.5% discount to the closing price 17th November.

Greatland Gold shares traded as low as 14.5p in early trade on Friday before recovering to around 15p.

Greatland Gold said the proceeds were being used to speed up the development of the Havieron Gold deposit and fund further exploration in the area.

Funds would also be used for working capital and corporate costs.

The fundraise comes shortly after the release of their full year results which showed the company had £6.2m in cash and cash equivalents as of 30th June 2021.

The Chairman’s Statement in the full year results highlighted Greatland Gold’s plans to accelerate development in the pursuit of early cash flow.

“The Havieron gold-copper discovery is a world class deposit and continues to deliver excellent results with significant intercepts of high-grade gold and copper outside of the existing resource shell. With over 200,000 metres of drilling now completed, the equivalent distance of London to Sheffield we have significantly enhanced our understanding of the deposit and of the likelihood of continuing to upgrade to the Mineral Resource Estimate in the near-term.”

“Subsequent to the year end, a Pre-Feasibility study was released on an initial segment of the Havieron deposit which has detailed a development pathway to first gold produced and operating cashflow. The study revealed the tip of the Havieron iceberg with a fraction of the initial resource supporting the total capex of the project, justifying a fast start approach to early cashflow generation and reinvesting back into Havieron development and infrastructure. This supports our belief that the profile of Havieron makes it a globally unique opportunity for bringing a low risk, low capex tier-one gold-copper mine into production.’