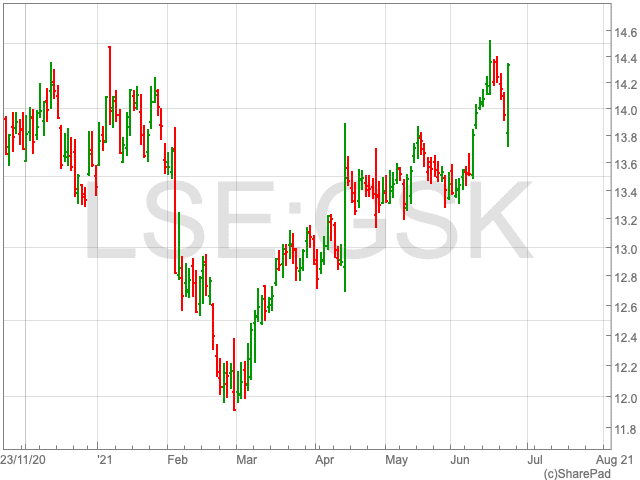

GSK Share Price

The GSK share price (LON:GSK) climbed by 2.68% on Wednesday as the company’s chief executive set out plans to secure its future on pressure from activist investors. The meeting follows a challenging past 12 months for the GSK share price, as the pharmaceuticals company has significantly underperformed the FTSE 100. However, despite being down by 14.46% over the past 12 months, the GSK share price has regained some momentum. Having added over 4% since the beginning of the year, it now stands at $1,432.20.

GSK trailed its major rivals, each bringing their variations of the coronavirus vaccine to the market, and its revenues fell, causing investors to turn away from the company. However, on the back of a meeting between Emma Walmsley and investors, many will be hoping the chief executive can bring about a positive outlook.

GSK Announcement

GSK gave an update to investors on Wednesday as the pharma company’s chief executive set out a plan to ensure long-term growth for shareholders.

The Financial Times reported that GSK will keep a stake in its ‘spun-off’ health division, which it could sell in the future to gather funds to invest in its drugs pipeline.

GSK will also break up its 68% stake in its consumer health joint venture in 2022, while it plans to retain 20%, from which it will be able to generate revenue from in time.

Walmsley has felt the pressure from investors who want to see what is in store for GSK in the future following the spin-off of the consumer division. This is particularly true of Elliot Management, the activist hedge fund, which took a multibillion-pound stake in the company this year.

Additionally, Walmsley’s ambition is to reach £33bn in sales by 2031. While over the next five years, the drugs company anticipates yearly sales growth of over 5%, and adjusted operating profit growth of more than 10%.

Finally, GSK confirmed that it will reduce its dividend after the spin-off in order to secure funds to re-invest into the company in the future. An aggregate dividend will be paid by GSK and consumer healthcare, anticipated to be in the region of 55p in 2022. While the new drugmaker will pay a dividend of 45p in 2023, the Financial Times reported.

Chris Beckett, head of equity research at Quilter Cheviot, commented further on GSK’s market announcement today.

“GSK’s announcement contained a whole host of market friendly targets, including a welcome target for double digital profit growth over the next five years that will need to be underpinned by a belief in the products in development and the segments the company will be focusing on,” Beckett said.

“The dividend reset, which works out at a 31% cut, is hardly good news, but it is not unexpected considering long-term concerns around true free cash flow cover. At 55p, the aggregate dividend across the two new companies works out to be a yield of 3.9% for FY22 versus the 6% yield for FY21.”

However, Beckett does not suspect there will be a completely clean break from the new consumer business. “The rationale for an ongoing investment in the consumer business will need to be explained by the executives. Investors won’t appreciate the overhang,” he said.

While the announcement appears to have gained some favour on the markets, much remains to be seen before the fate of the GSK share price is clear.