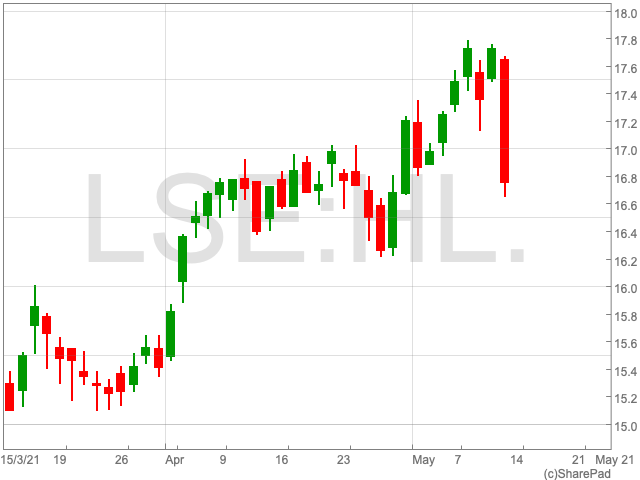

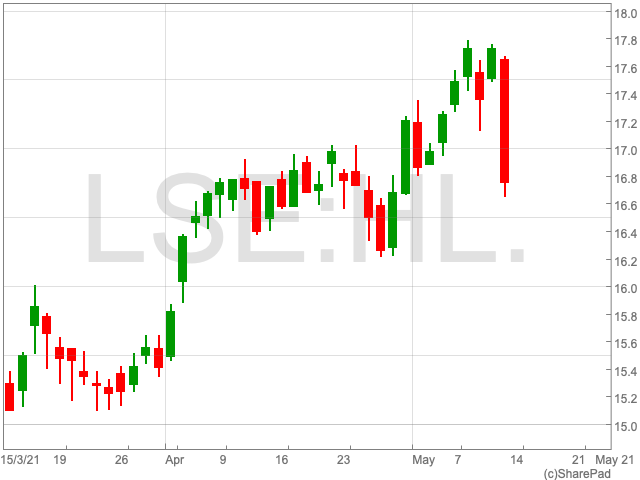

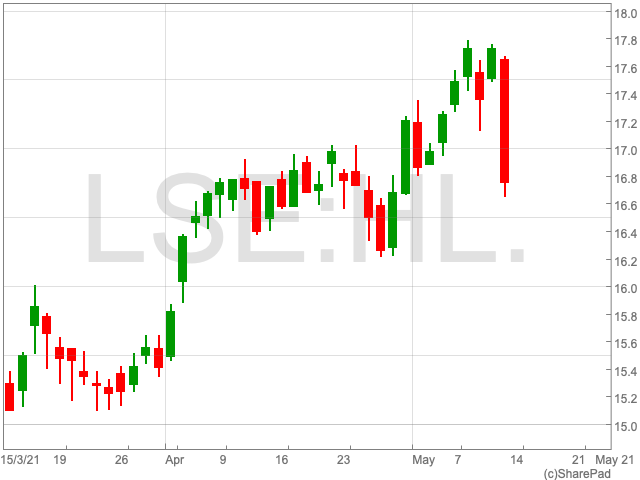

Hargreaves and Lansdown Share Price

The Hargreaves and Lansdown share price is down by 5.57% on Thursday heading into the afternoon session, now at 1,673.38p. This follows an upward surge since November, which saw the company add 25% in value. The slide came despite record levels of ISA subscriptions and share dealing volumes. With the UK on the road to recovery from the coronavirus pandemic and pressure coming on Hargreaves from competitors, now is a good time to analyse the FTSE 100 company’s credentials looking forward.

Trading Update

Hargreaves did record levels of business during the first four months of 2021, it revealed in its trading update today. The investment platform’s net inflows came to £4.6bn, exceeding analysts’ expectations by £0.3bn. Its total assets under administration also rose by nearly 30% to £132.9bn at the end of April.

Raised volatility, in addition to market highs, brought about a sharp increase in the amount of share dealing by Hargreaves and Lansdown’s clients. This resulted in a 19% increase in group revenue to £532.7m for the year to date.

“We have also continued to see significantly elevated levels of client engagement throughout the period, with a 150% increase in the number of people logging into their accounts, particularly via the mobile app,” said chief executive Chris Hill.

Proactive reported that Broker Peel Hunt restated its “buy” rating for Hargreaves and Lansdown.

Risks

Hargreaves and Lansdown has come under criticism over its high fees. The platform charges up to 0.45% on funds for the first £250,000 invested. This is significantly higher than the fees Close Brothers and AJ Bell charge – 0.25% up to £500,000 and £250,000 respectively

When investments take into account the long-term, these costs can add up, and may well begin to put off clients who may want to explore other options. “Paying too much can potentially wipe thousands off your returns over time. Check how much you are paying and don’t be afraid to move,” Justin Modray from Candid Financial Services told The Times.

If investors begin to desert the platform in search for more favourable fees then the Hargreaves and Lansdown share price could suffer in the long-term.