Get in Touch

My account

Latest Stories

© UK Investor Group UK Investor and UK Investor Magazine are registered trademarks of UK Investor Group Ltd (09932115) | All rights reserved

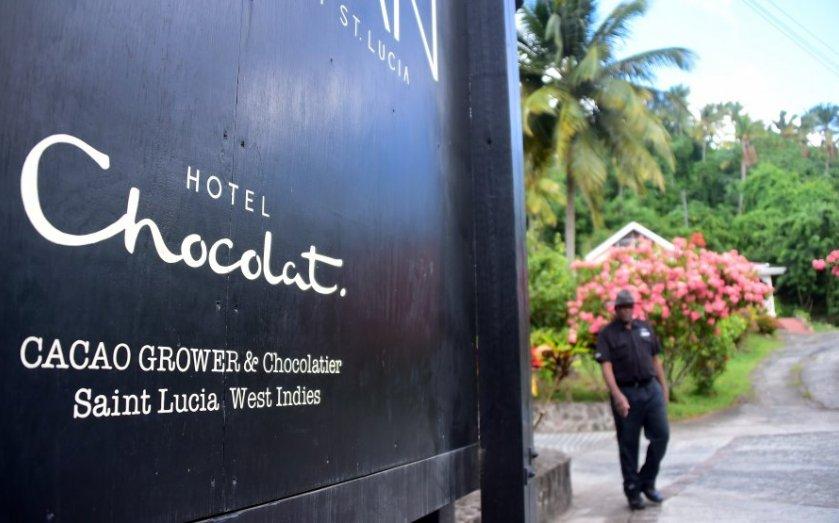

At times it seemed that chocolate maker and retailer Hotel Chocolat (LON:HOTC) could do no wrong. That has changed as slowing growth in the second quarter has led to a downgrade, albeit small.

Given the high rating enjoyed by Hotel Chocolat it is impressive that the share price has held up so well, falling 12.5p to 415p. There is normally a disproportionate reaction to a downgrade. However, it is in the minority of AIM company share prices that are lower now than at the time of the General El...

You are unauthorized to view this page.

© UK Investor Group UK Investor and UK Investor Magazine are registered trademarks of UK Investor Group Ltd (09932115) | All rights reserved