Get in Touch

My account

Latest Stories

© UK Investor Group UK Investor and UK Investor Magazine are registered trademarks of UK Investor Group Ltd (09932115) | All rights reserved

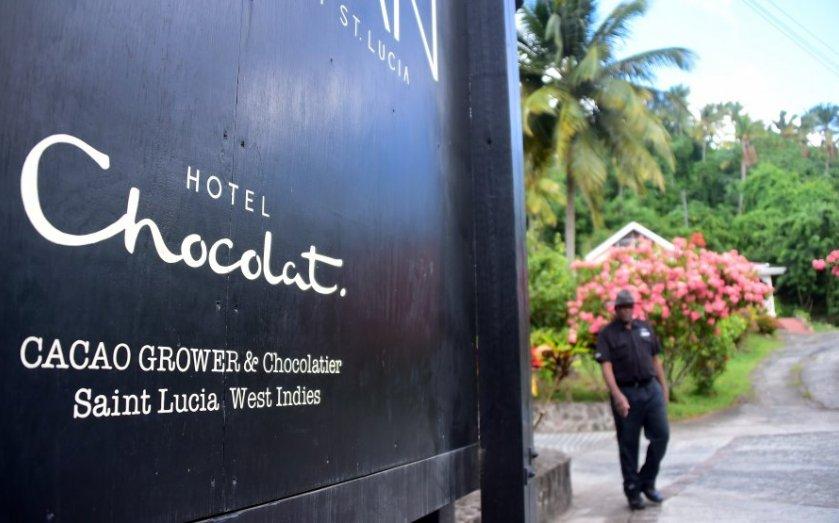

Chocolate products retailer Hotel Chocolat (LON: HOTC) has been a big success on AIM. The share price has risen from 148p to 353.5p since the flotation in May 2016. On Wednesday management will be publishing a pre-close trading statement.

In reality, there should be no significant surprises because the first half is the most important, because it includes Christmas. Hotel Chocolat remains a strong brand.

Expectations

Interim revenues were 13% ahead at £80.7m and full year revenues are exp...

You are unauthorized to view this page.

© UK Investor Group UK Investor and UK Investor Magazine are registered trademarks of UK Investor Group Ltd (09932115) | All rights reserved