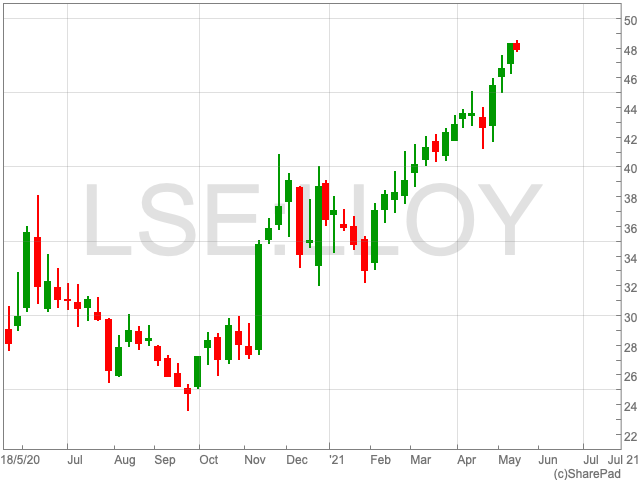

Lloyds Share Price

The Lloyds share price (LON:LLOY) has risen sharply since the turn of the year through May and into April. The steady rise came as pent-up demand and the vaccine roll-out is creating a positive mood around the UK economy. Having started 2021 at under 35p, Lloyds shares are now valued at 47.91p per share. It is an increase of nearly 31.5%.

The outlook for the UK economy is improving as the so far successful vaccine roll-out has led the governor of the Bank of England to hint at stronger than anticipated growth in the coming months. This could allow the FTSE 100 bank to capitalise. With the Lloyds share price trending towards its pre-pandemic level of well above 50p per share, investors will be curious to know whether its recent performance can be sustained.

Inflation

The UK is facing the prospect of possible inflation over the coming months. In America, inflation rose by 4.2%, causing a panic across markets. It also added to concerns that a similar phenomenon could take hold in the UK, causing knock-on effects for the Lloyds share price.

Lloyds earns revenue by lending money out at higher rates than they pay on deposits. The difference is referred to as the net interest margin. Inflation could lead to a hike in interest rates which would allow Lloyds to increase its net margins. This could further push the Lloyds share price up. However, higher interest rates could also slowdown the recovery. If this happens it could have a detrimental effect on the Lloyds share price as its business model is interwoven into the UK economy.

Lloyds Dividends

Lloyds has declared a final dividend of 0.57p per share, the maximum amount allowed under Prudential Regulation Authority (PRA) guidelines. As the bank recovers more and its cash flow improves, it could raise its dividend substantially, thereby attracting the attention of investors.

However, Nicholas Hyett, equity analyst at Hargreaves and Lansdown, suspects the Lloyds board may use the crisis as an opportunity to permanently shrink the dividend, and grow it from a lower base.

“That would leave Lloyds with a sizeable capital surplus, giving the board some significant options. Share buybacks, a special dividend, aggressive organic growth or even an acquisition are all possibilities,” Hyett said.

The Lloyds share price will likely depend on the quality of the UK recovery either way.