Brickmaker Ibstock has today raised their EBITDA guidance for 2021 after enjoying robust demand from both new houses and the home improvement markets.

The group said revenues were £409m, 29% higher than 2020. Ibstock also noted improvements in cash generation that saw Net Debt fall to £40m from £69m.

In relation to price inflation within the industry, Ibstock said they had managed to mitigate the impact of rising input cost with product price increases.

“Customer demand remained resilient in the final quarter and a combination of a strong operational performance and proactive management of inflationary pressures have ensured that Ibstock was able to deliver a strong financial performance for 2021,” said Joe Hudson, CEO of Ibstock.

“Whilst we are mindful of ongoing uncertainties, including industry supply chain pressure and cost inflation, the good momentum achieved to the end of the year provides us with a strong platform for significant further financial and strategic progress in 2022.”

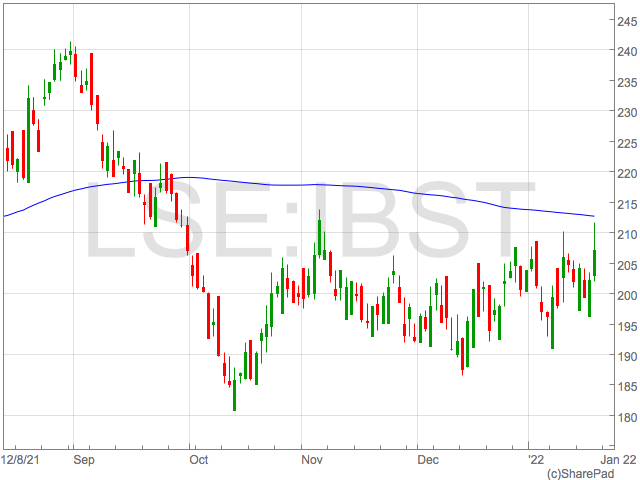

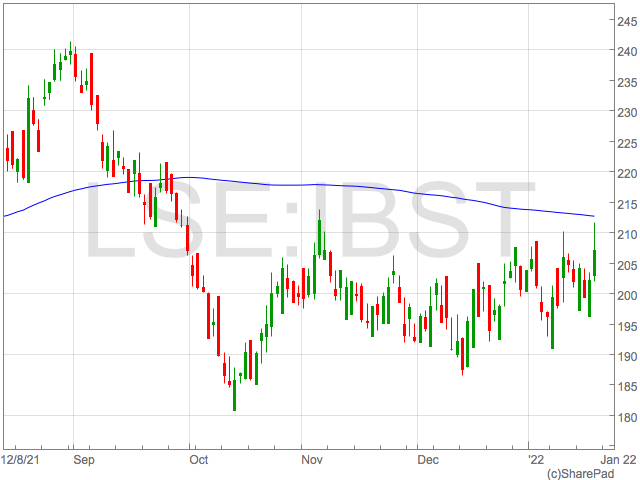

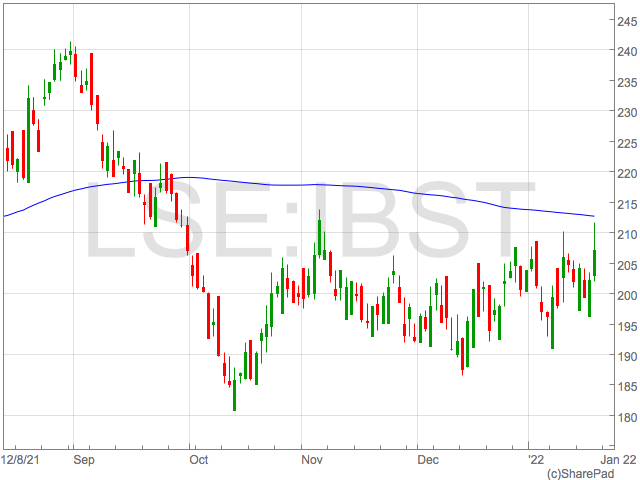

The increase in profit guidance was generally well accepted by the market and shares rose 1.9% in early trade on Thursday.

“The housing market’s resilience in the face of economic uncertainty, rising mortgage rates and cost inflation is part of the reason brickmaker Ibstock expects to outdo its profit guidance at the full year,” said Laura Hoy, Equity Analyst at Hargreaves Lansdown.

“The group’s been successful in passing on ballooning materials costs to customers without upsetting demand, no mean feat considering inflation is at a 30-year high.”

“Ibstock’s in a strong position as concerns about a cooling housing market start to creep in as well – the group gets paid as long as the houses are being built, so some stagnation won’t topple the tower.”