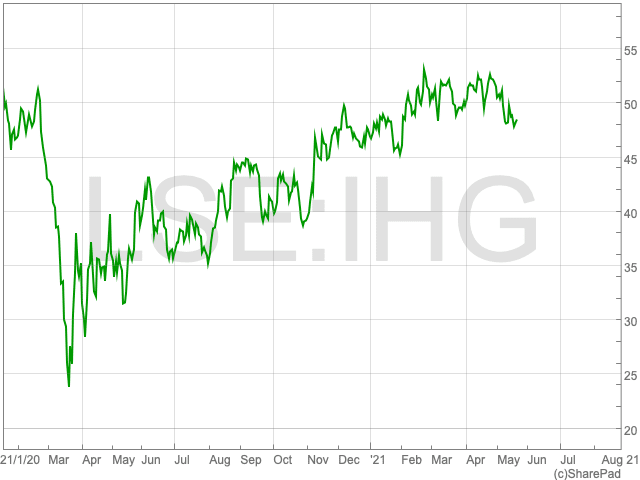

IHG Share Price

2020 proved to be an especially trying year for IHG, and it remains unclear whether or not further issues lie ahead. Having said that, the IHG share price stands at 73.68p, around its pre-pandemic level, as the return to travel appears to be factored in. While the FTSE 100 company has its books in order, it remains vulnerable to continued lockdowns.

Performance

The IHG share price is currently trading well over 40 times its expected earnings. This figure exceeds its ten-year average and is comfortably an all-time high. “That’s largely down to the abnormally low profits expected over the next 12 months,” said Nicholas Hyett, equity analyst at Hargreaves and Lansdown. With the IHG share price now trading at a similar level to before the pandemic, “it’s still a big vote of confidence from the market”, Hyett added.

The optimism on the part of investors comes despite demand drying up over the past 12 months. IHG even remained profitable thanks to the nature of its business model.

“Despite having a portfolio of nearly 6,000 hotels globally, the group only owns 25. Instead IHG licences a brand to the hotel owner, which means it’s not on the hook for hotel running costs. That’s kept cash burn to a minimum and enabled the group to offer support to its partners – with flexible payments and fee breaks. Keeping franchisees in business is crucial to IHG’s business model, so this was the right (albeit expensive) move in our view,” according to Hyett.

IHG remains well positioned financially with significant liquidity. Therefore its future prospects appear reliant on the hastiness of a return to travel.

Return to Travel

Demand appears to be picking up as the recovery is gathering pace. So far the recovery has been led by China and the US, as Europe lags behind. Of course, it remains difficult to forecast exactly when things will pick up further but the wheels are in motion.

Analysts at Peel Hunt commented on the near-term prospects of the IHG share price: “Getting the share price right from here in our view depends on the relative impact of forecasts declining further as they catch up with the prolonged lockdowns in Europe in particular, and the signs of global economic recovery speeding up as vaccines take effect,” analysts at Peel Hunt commented.

“On balance we continue to believe that IHG’s share price, now 12% below its 2019 high, has further to fall to reflect the prolonged nature of the recovery in the hotel cycle, and we reiterate our ‘Reduce’ recommendation and 4,600p target price.”