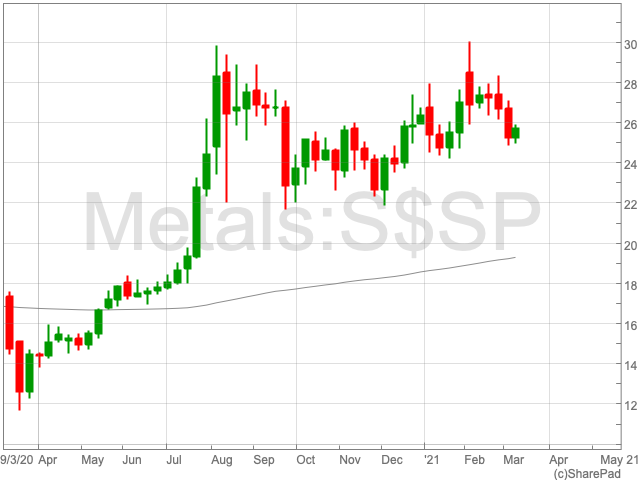

Silver rallied on Monday and into the Tuesday session, edging towards the $26 level. Earlier in the year, the devil’s metal rose by 15% to $30, its highest level in eight years. This came as Reddit investors flocked to silver by following comments on the WallStreetBets’ forum. Over the last 12 months, the precious metal is up by 52.8%.

The precious metal could yet again rally as analysts are even predicting a super cycle. One such firm is JP Morgan which has said signs of inflation support this view. “We believe that the new commodity upswing, and has started,” the JPMorgan analysts said. “The tide on yields and inflation is turning.”

A question mark arises over whether or not silver will be a part of this rally. According to analysts, it will.

“Silver is used in solar panels significantly. It hasn’t grown as much as wind and hydro, but it is an important component within the solar industry. If you do look at the longer-term dynamics, it will benefit as a result,” Hynes explained.

The metal has the potential to reach $60 this year according to Jon Deane, CEO of Trovio.

“Short-term, silver is your best trade. There is a lack of silver around the world. There is not much silver at any refineries and getting your hands on physical silver is difficult. There is still a risk of a real silver squeeze,” Deane told Kitco News.

Deane also makes the case that the metal will outperform gold in 2021.

“Silver will outperform gold this year. There’s a lack of available silver, plus it got the climate angle. Silver could trade in the $40-$50 range and potentially even hit $60 at some point this year.”

Swiss investment bank UBS has announced that it expects silver to outperform gold in 2021, following a year which saw “safe haven” precious metals hit record highs and reap the benefits of global stock market volatility.