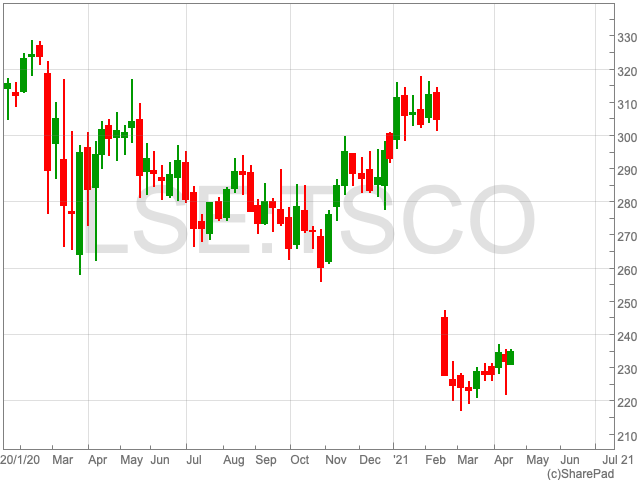

Tesco Share Price

Having plummeted in February, the Tesco share price (LON:TSCO) is trading at 234.5p. Compared to a year ago the supermarket is down by nearly 30%. Going as far back as five years ago, Tesco shares were valued at 236.36p per share, only slightly above today’s valuation. The supermarket’s low price could tempt buyers who are looking for value, however, its lack of growth over long periods could also give cause for concern.

Results

Only last week Tesco released its results for the year ending February 27. The FTSE 100 company confirmed it made a profit before tax of £825m, 19.7% lower than the year before, despite its sales in the UK growing by 7.7% to £39.4bn. A major factor was the extra costs due to Covid-19, which included £892m worth of bonuses for staff, as well as the company returning £535m of business rates relief to the government. The supermarket chain said it had taken customers from a number of its competitors as its sales grew significantly at the beginning of the first national lockdown and more recently when consumers were stockpiling goods.

Post-lockdown

While the company weathered the storm that was Covid-19, what matters now is its preparedness and performance as the UK gradually comes out the third lockdown. First of all, with a 27% market share, Tesco remains firmly positioned as the market leader, with Sainsbury’s on 15% in second place, despite the best efforts of discounters Aldi and Lidl over the last few years. Secondly, the company has said the aforementioned additional costs will only continue until the first quarter of 2021-22. If the company is correct then its balance sheet could see a reduction in costs of around £675m.

Finally, Tesco could begin to gain a competitive advantage based on its focus on supplying meat alternatives to meet growing demand from its customers. The UK’s largest supermarket has committed to boosting sales of meat alternatives by 300% within five years, by 2025. It is a market that reached $8.6bn in 2020, with analysts expecting the industry to grow to $17bn globally by 2024.