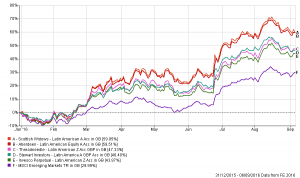

Since the January selloff, a selection of UK Unit Trusts and OEIC’s focused on Latin America have provided investors with significant gains. Returns on investment greatly outpaced benchmark gains in emerging markets.

Threadneedle Latin American, Stewart Investors Latin America and Invesco Perpetual Latin American all saw returns to investment above 40% by the start of September.

The highest performers are Aberdeen Latin American Equity with 59.51% and Scottish Widows Latin American with 59.95%, this year to date.

Emerging markets recover from 2015 slump.

After emerging markets struggled greatly under increased volatility in global financial markets as well as higher commodity prices throughout last year and the beginning of 2016, their performance has improved greatly since the start of the year. The recent Brexit vote gave this trend another boost.

Initial worries connected to the Brexit vote concerned that growing global uncertainties may spur an investor exit from riskier emerging market, to flood into so called “safe haven assets”. In the immediate aftermath of the vote, distress was felt in emerging markets. The Mexican Peso, usually a preferred emerging market currency due to its high liquidity, became the world’s second-worst performer, after the British Pound.

However, the initial signs of distress did not prevail and emerging markets got a boost in late June.

Emerging market assets, while considered to represents riskier investments, yield higher returns to their investors, which, with uncertainty and risk also growing in developed world, becomes a more attractive option.

As a result, the Brexit helped emerging markets gain nearly 8% in the days after the vote.

Latin America has by far outperformed other emerging countries.

UK Retail Funds invested in Latin America received on average around a 12% performance boost.

The Brazilian real has done extraordinarily well since the start of the year and the IBrX gained 28.34% over the last year. The Argentinian Burcap gained as much as 49.75% in the past 12 months and the Peruvian S&P/BVLPeruGeneral is up 54.59%.

UK Retail Funds reflect this divergence from the emerging market index in their Latin American activity performance.

Katharina Fleiner 07/09/2016 Information based on data from FE