Lloyds share price (LON:LLOY) has been relatively stable so far this year after a tumultuous 2020.

Despite facing huge pressure throughout the pandemic, Lloyds and other UK banks posted robust results in February given the circumstances.

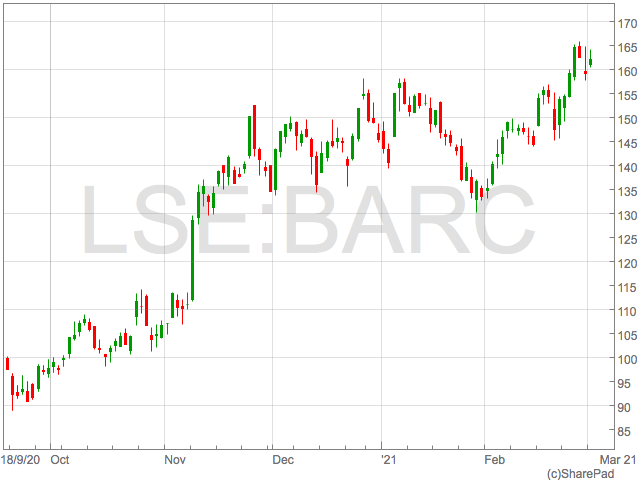

Investors are now looking to the FTSE 100’s staple institutions to explore their relative value as share prices continue to recover from sharp falls when lockdowns began. Lloyds surpassed expectations by making a respectable profit, while Natwest and Barclays both produced profits in 2020. This article will look at the recent performance of the banks and some useful valuation metrics to compare and contrast each one’s credentials as an investment proposition as the UK economy continues its recovery.

Dividends

In March 2020 the Bank of England (BoE) told the UK’s major banks to suspend dividend payments until the end of the year as a protection against loss of revenue due the pandemic. Towards the end of 2020, the BoE informed the banks that they could resume dividend payments as they were well capitalised and equipped to deal with any further disruptions caused by the pandemic. Lloyds, Natwest and Barclays resumed their dividends accordingly, with payouts of 0.5p, 3p and 1p respectively.

The newly resumed dividend payouts means Lloyds is now yielding 1.5%, whilst Natwest is yielding 1.6% and Barclays 0.6%.

These dividends are a long way off the yields investors had become accustomed to prior to the pandemic. Due to ongoing guidance from regulators, payments to investors may remain tepid in the short-term, but Lloyds has said it is committed to resuming a progressive dividend policy.

Earnings

Lloyds’ pre-tax profit dropped from £4.4bn to £1.2bn as the bank paid a £4.2bn impairment charge. Natwest, formerly the Royal Bank of Scotland, slumped to a £351m loss from a profit of £4.2bn a year earlier. Barclays was the most profitable bank out of the three during 2020, making a pre-tax profit of £3.1bn, down from £4.3bn in 2019. Barclays’ balance sheet was supported by its investment banking department which recorded robust revenues from its equities and fixed income businesses as customers rushed to the markets in 2020.

Price-to-earnings

Lloyds has the highest price-to-earnings (PE) ratio out of the three banks at 24.4, while Natwest and Barclays are at 13.2 and 16.8 respectively. Lloyds shares are the highest values based on earnings, while this may make the Lloyds share price seem expensive, it could also signal the market’s expectations of higher earnings going forward.

However, with the banks’ earnings remaining volatile due to the impact of the pandemic, investors will be paying particular attention to the valuation of banks based on their assets.

Price-to-NAV

There is little discrepancy between the banks when it comes to their price to NAV (net asset values). Lloyds, Natwest and Barclays all have Price-to-NAV measures below 1 – 0.6, 0.5 and 0.4 respectively – meaning the total value of their assets minus their liabilities is lower than the value of their share price.

This could represent excellent value for investors looking at the UK’s major banks.

However, it also reflects the current uncertainty around banks, and the future value of their assets. With all three banks trading below a Price-to-NAV of one, it suggests the market doesn’t have a high degree of confidence in the current health of banking assets such as loans and mortgages.

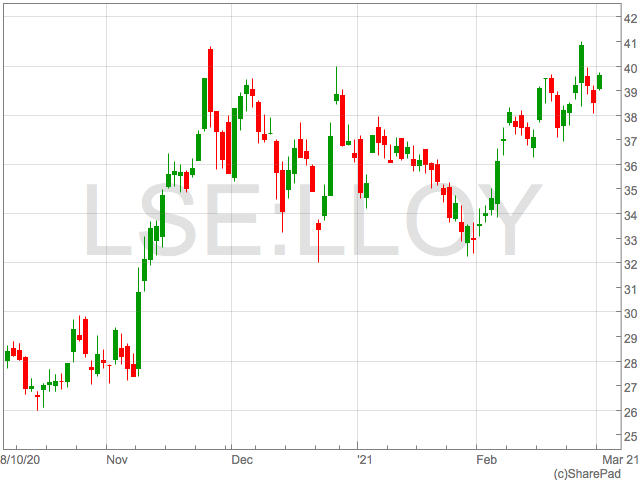

Lloyds share price

With Lloyds share price trading at 39.2p, it has performed worse year-to-date than peers Barclays and Natwest, who have seen their share prices increase by 10%.

Lloyds share price year-to-date is up 7%. With such little deviation in share price performance, it suggests the market views all three banks in much the same light.