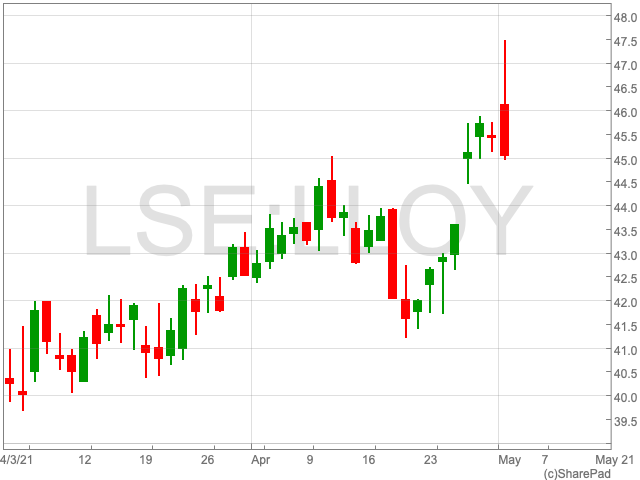

Lloyds Share Price

Despite a fall today, the Lloyds share price (LON:LLOY) has broadly continued its momentum from the beginning of 2021 in recent weeks, now standing at 45p per share. The FTSE 100 company has added 23.6% since the turn of the year, as the UK economy continues its seemingly stable path out of lockdown.

The bank finished off strong last week following the release of its solid results in a show that it could be set for a sustained recovery going forward.

Outlook

Can Lloyds continue this recovery for the remainder of this year and into 2022? Its Q1 results make good reading as the bank reversed some of the provisions it had made for loan losses following the spread of coronavirus. As a result Lloyds saw its pre-tax profit soar to £1.9bn for the quarter ending in March, well up from below £100m for the same period a year ago. It is certainly a positive start and can help to explain why the bank’s share price moved up over the last week.

However, Lloyds is not out of the clear just yet. Low interest rates provide difficulty as the bank relies on lending deposits in the form of mortgages, loans to small companies and credit cards.

“Banks make money by lending money out at higher rates than they pay on deposits – the difference is known as the net interest margin. With interest rates on savings accounts already on the floor (and zero in many cases) they simply can’t push the cost of funding much lower – whereas competition and regulatory action means lower interest rates get passed on to borrowers relatively quickly,” says Nicholas Hyett, equity analyst at Hargreaves and Lansdown.

That being said, Lloyds is expecting net interest margins to exceed 2.45% this year, which wouldn’t be too damaging for the bank, even if it doesn’t record massive profits.

“Given that low interest rates look like they’re here to stay, it’s perhaps no surprise Lloyds is looking elsewhere for growth,” Hyett said.