The Lloyds share price is set to feel the disappointment of a missed opportunity to raise rates by the Bank of England.

The Bank of England made the surprise decision to vote against hiking rates last week, leading to numerous commentators saying they bottled the chance to hike rates for the first time since the beginning of the pandemic and move against soaring inflation.

Banking shares fell immediately after the announcement as the market begun to factor in the effects of lower rates on the profitability of the UK’s leading lenders.

“There was disappointment for banks which had been holding out for some relief from the record low rates which have eaten into their lending margins,” said Susannah Streeter, Senior Investment and Markets Analyst, Hargreaves Lansdown after the announcement last Thursday.

“Lloyds which earns the majority of its income from traditional lending activities, saw its share price fall by 2%, as did NatWest, while Barclays fell by around 1%,” Streeter summarised the immediate reaction of bankings shares after the decision.

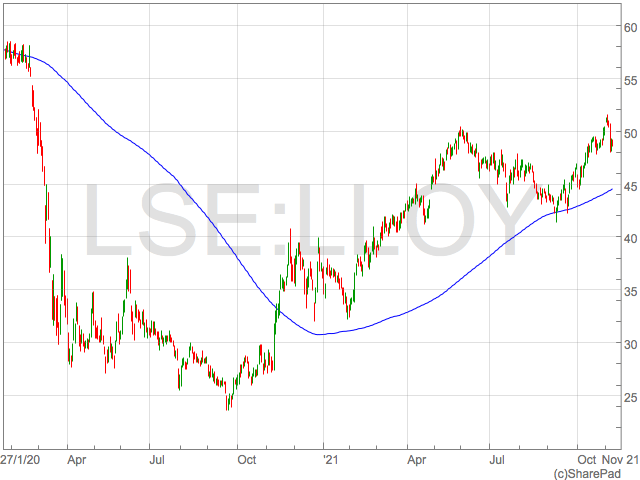

Lloyds Net Interest Margin

Lloyds shares have trended down since the Bank of England’s decision as the prospects of higher earnings driven by increased Net Interest Margin were dashed.

Lloyds recent third quarter update showed improvements in Net Interest Margin compared to a year ago. Lloyds Net Interest Margin was 2.55% in the 3 months to 30 Sep 21, up from 2.42% in the 3 months to 30 Sep 20.

Hargreaves Lansdown equity analyst, Sophie Lund-Yates, was optimistic following Lloyds third quarter release and even highlighted what a rate could do for Lloyds earnings.

“Positive trends are coming through in Lloyds’ net interest margin, which looks at the difference between what the bank charges on loans and pays on deposits. With thoughts that interest rates could budge upwards in the not-too-distant future, the banking giant could be looking forward to a meaningful boost on that front,” said Sophie Lund-Yates soon after the Lloyds Q3 update.

This ‘meaningful boost’ to Net Interest Margin has now been delayed, and with it the associated benefits for Lloyds Banking Group’s profitability.

With shares down since the announcement, it is now likely Lloyds shares remain subdued in the immediate future as we await further hints from the Bank of England on when they will actually hike.

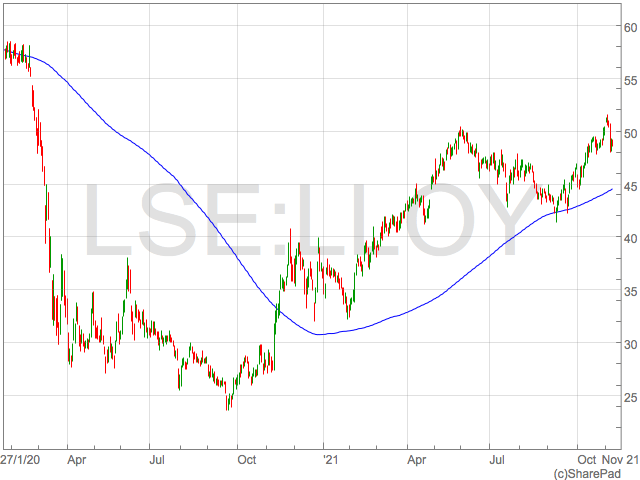

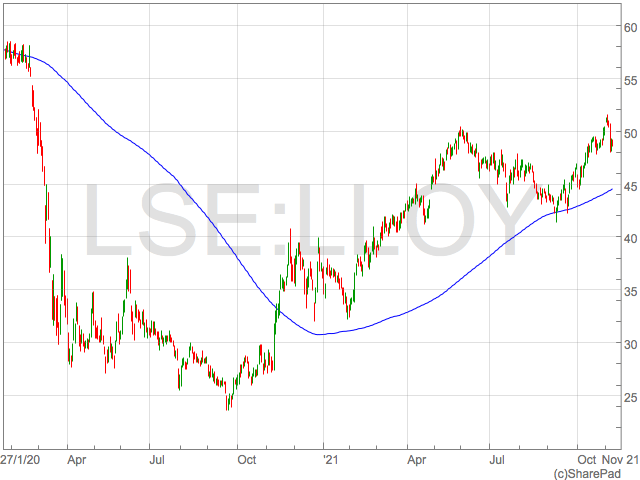

Lloyds share price

We recently discussed how Lloyds shares will struggle to reach pre-pandemic highs and what a disorderly rate hike will do to investor sentiment and equity prices.

However, the irony is now that Lloyds shares are likely to driven by the disappointment of not hiking rates as the market had started to price higher rates in, and became comfortable with the idea of higher rates. Some even saw a hike necessary to fight inflation.

The Lloyds share price is down 5% from the recent closing high of 51.5p recorded in the days running up to the BoE decision. The 51.5p level was the highest closing for Lloyds shares since March 2020.