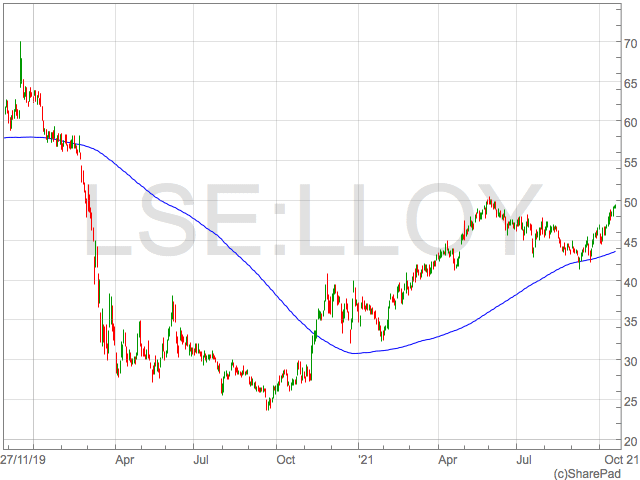

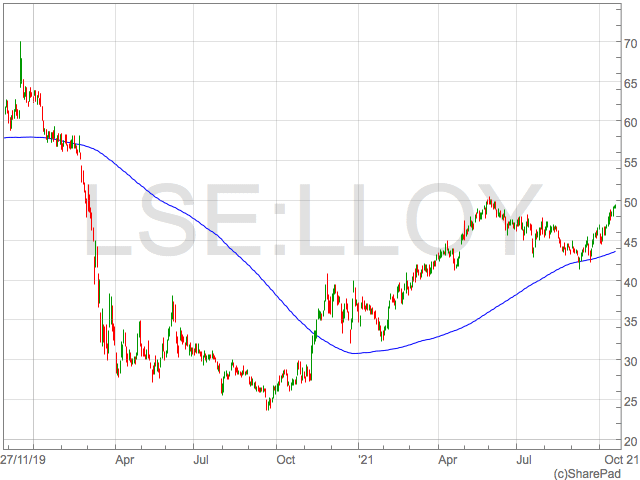

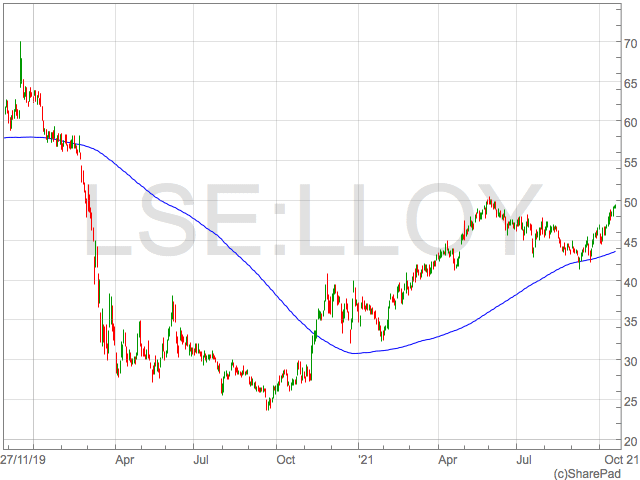

Lloyds share price (LON:LLOY) has provided investors with reason to be optimistic in 2021 having rallied 35% through the year.

The rally was sparked by strong results early in 2021 which unleashed a wave of bargain hunters picking up the beaten up stock.

“The market has been pricing in a brighter outlook for Lloyds and the bank has certainly delivered some impressive numbers in its first quarter update,” says Russ Mould, investment director at AJ Bell following first quarter results in April.

“Net interest margin is better than expected, being the difference between what it earns from interest charged on loans and interest paid on savings deposits. Costs are also better than expected, which might come as a surprise given how difficult it is to streamline a business the size and complexity as Lloyds.”

However, fast forward barely six months and long holding investors in Lloyds shares will be keen for the price to break significantly above the 50p level and return to pre-pandemic highs. Lloyds shares were trading at 64p in December 2019.

There are a number of factors at play that will dictate Lloyds shares in the short term and unfortunately Lloyds investors may be disappointed with how shares react.

Central Bank Action

The biggest influence on Lloyds shares through the rest of 2021 will be the action of central banks, in particular the Bank of England.

Rising prices driven by higher food and fuel prices are forcing the Bank of England’s hand and expectations of a rate hike have been brought forward in a dramatic shift in monetary policy narrative.

In many scenarios, rising rates would be seen as a positive for UK banks, however if we see a rate hike this year, it would be a hike into a backdrop of global stagflation fears and concerns over the resilience of the UK economy.

This increases the chances of a disorderly policy mistake that kills investor sentiment and therefore Lloyds shares.

Indeed, Pimco CEO Emmanuel Roman recently said ‘central banks are now running the markets’, which ultimately means central banks are in the control of the returns of Lloyds shares.