Majestic Corporation is a unique proposition for UK investors seeking a more sustainable form of exposure to critical minerals than traditional mining companies. No other ‘urban mining’ e-waste recycling pure-play listed on London’s exchanges has successfully achieved Majestics scale, revenues and profitability.

As the world races to deploy clean energy technologies, a critical shortage of minerals threatens to derail progress.

However, a new International Energy Agency (IEA) report reveals that recycling and “urban mining” could reduce the need for new mining projects by 25-40% by 2050 while creating a market worth $200 billion and avoiding the destruction of biodiversity.

Urban mining companies such as Aquis-listed Majestic Corporation specialise in extracting valuable minerals from discarded electronics, batteries, and other waste products that contain high concentrations of critical materials. These companies are becoming increasingly important as traditional mining alone cannot meet the surging demand for minerals essential to electric vehicles (EVs), wind turbines, and solar panels. Many of the metals processed by urban miners can also be deployed in the wider economy with broad applications in construction and industry.

“Recycling is indispensable to the security and sustainability of critical minerals supply for clean energy transitions,” the IEA report states. The analysis shows that without increased recycling, mining investment requirements would be 30% higher – meaning an additional $240 billion in capital spending would be needed through 2040 to meet demand.

The economics are compelling: recycled minerals typically generate 80% lower greenhouse gas emissions compared to primary mining while using 80% less water. For copper, one of the most critical metals for electrification, recycling could provide up to 40% of supply by 2050 in a scenario aligned with countries’ climate pledges.

The surge in EV adoption is creating particularly urgent recycling needs. By 2050, end-of-life EV batteries could provide 20-30% of the lithium, nickel and cobalt required for new batteries. China currently dominates this emerging industry with over 80% of global battery recycling capacity.

However, current recycling rates are falling behind rapidly growing consumption. The report notes that copper recycling’s share of total supply dropped from 37% in 2015 to 33% in 2023, while nickel recycling declined from 33% to 26% during the same period.

The report emphasises that recycling alone cannot eliminate the need for new mines but can significantly reduce pressure on primary supply while enhancing energy security, particularly for countries that lack domestic mineral resources. For example, in Europe, secondary supply from batteries could meet about 30% of the region’s lithium and nickel demand by 2050.

The IEA’s analysis shows the recycling market is ripe for investment, with market values for recycled battery metals growing elevenfold between 2015 and 2023. This growth comes as governments worldwide implement new policies to boost collection rates and recycling infrastructure, recognising both the economic opportunity and environmental imperative of creating more circular mineral supply chains.

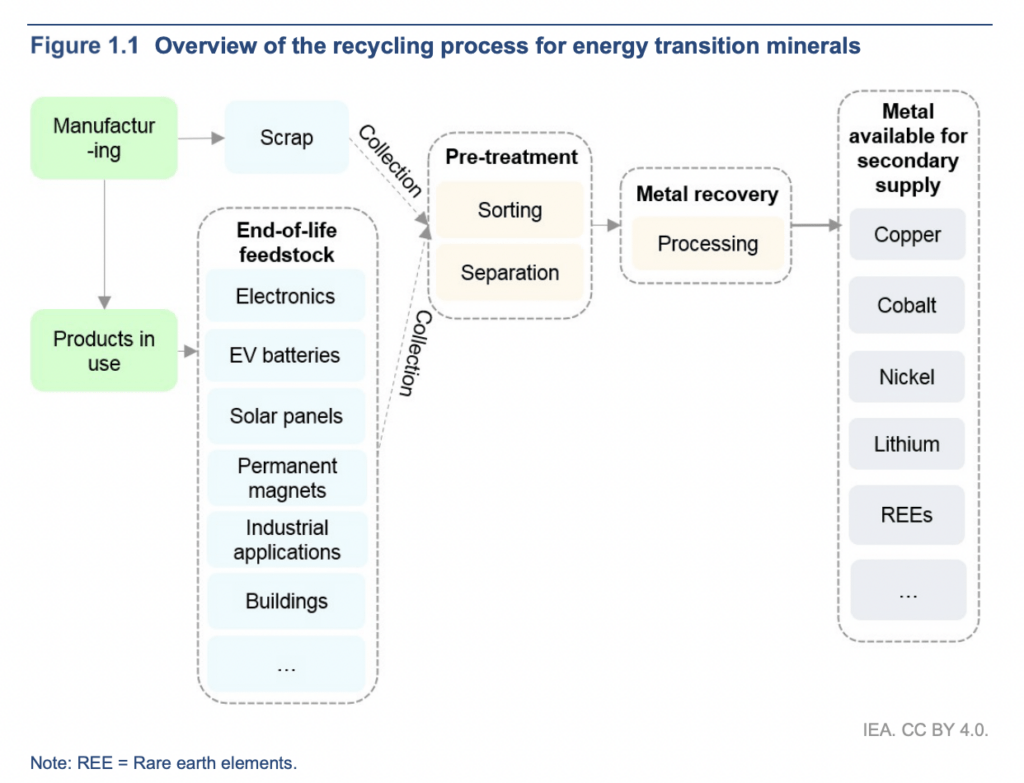

The graph above illustrates the different stages of processing and recycling critical minerals. Majestic Corporation’s operations involve collecting, sorting, separating, and processing end-of-life feedstock.

Majestic has established a network of affiliates globally that collects, processes, and ships e-waste, including chipboards, EV batteries, and solar panels, to smelters that melt the metals down and return them to the supply chain.

Majestic Corporation is the foremost London-listed critical minerals recycling pureplay, generating revenues of $25m in the first half of 2024, nearly doubling the $13m revenue in the same period last year.

Having established a network that spans the US, Asia, and Europe, the company is expanding its operations in the UK through the acquisition of a facility in Deeside, Wales, to harness the opportunity in the UK’s abundance of e-waste containing critical minerals vital for the green transition and wider economic growth.