Mitie Group shares gained 0.8% to 73.9p in late morning trading on Tuesday on the back of a 3% year-on-year uptick in revenue to £945 million in Q1 2023.

The professional services group announced new contract wins, renewals and extensions worth £778 across the financial period, contributing to its revenues and serving to replace the previous revenue from Covid-related contracts the last year.

Mitie Group mentioned £203 million in new contract wins, including US Visiting Forces, Hammerson, Poundland and GSK.

Its contract extensions and renewal rates exceeded 95%, with contracts such as DIO Ascension Islands, Cyprus and Falklands contracts, Vodafone, Starbucks and Jones Lang Lasalle.

Mitie Group also reported its completed acquisitions of P2ML, 8point8 and Customer Solar in Q1, with the former two creating a “market leading” telecommunications support services business for the company.

The firm added its acquisition of Customer Solar expanded its decarbonisation offering for its customers.

The group confirmed the three acquisitions brought its total number to seven over the last year, with a combined addition of £17 million in revenue across Q1.

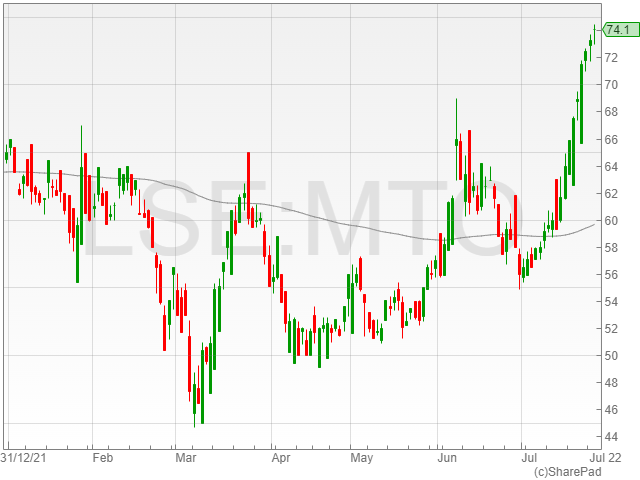

Meanwhile, its £50 million share buyback programme launched on 9 June 2022 was amended on 14 July to alter the volumes of shares purchased each day to between 25% to 50% of the average daily trading volumes in a move to mitigate the low liquidity of the stock and improve programme efficacy.

The group confirmed it had bought and cancelled 10.5 million shares at an average price of 60p until 22 July, at a cash cost of £6.3 million.

FY 2023 guidance

Mitie Group commented its labour and parts inflation remained a challenge going forward, however the firm said it had implemented a range of margin-enhancing initiatives to increase margins in HY2 2023.

The company added it was confident in delivering on its management expectations for FY 2023.