New research by estate agents Coulters Property has collated the average house price and salary in every major town and city in the UK to reveal the places where you will need to work the most – or least – to pay off your mortgage if you put down a 15% deposit.

A mortgage is one of, if not the most, important investments most people ever make in their lifetime, and it can sometimes take an entire lifetime to pay it back. Of course, this depends on the value of the property, which is why the most expensive places to buy a home in the UK are also the places it takes the average person the longest to pay their mortgage back.

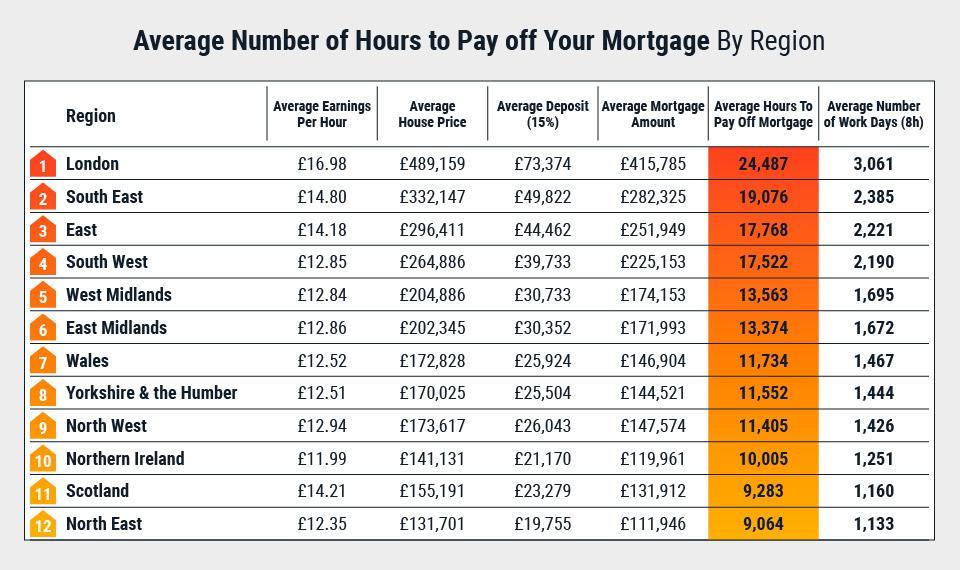

Coulters took the top 50 towns and cities in the UK by population and used data from the Office for National Statistics (ONS) to determine the average gross hourly rate of pay for all employee jobs in that area, then took the average house prices from each town and city as of August 2020 according to the Land Registry UK House Price index.

With the global pandemic of 2020, more lenders are asking for at least 15% deposit, so Coulters used this figure to calculate the deposit amount an “average house” in each town, city and region would require. An average number was then calculated for the number of hours and working days (based off an average eight hour working day) it would take for each town, city and region to pay off the average mortgage amount.

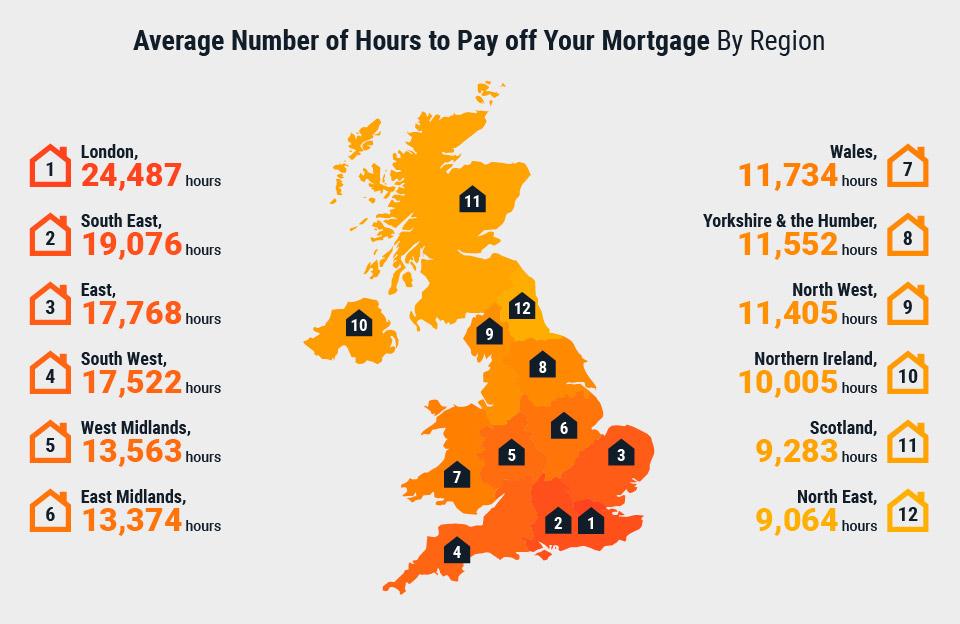

Coulters’ research has revealed that those that live in the South East, South West or East of the UK are likely to need to work twice the number of hours than their Northern counterparts, ranging from as much as 24,487 days in London to 9,064 in the North East.

This means, on average, Londoners need to work three times the total working days of someone living in the North East to be able to afford their average mortgage amount of £415,785.

In other parts of the UK, it would take 11,734 hours to pay off a mortgage in Wales, 10,005 in Northern Ireland and only 9,283 in Scotland, trailing the list with the second lowest time required to pay off the debt in full. Sunderland topped the list as the area where it is easiest to pay back a mortgage, however, needing 7,905 working hours to cover an an average mortgage of £96,678.

Mike Fitzgerald, Executive Chairman at Coulters Property, commented on the report’s findings:

“Applying for a mortgage to buy a house is a big investment, and it can take a lifetime to pay the lender back. The length of mortgage repayments are determined by the cost of properties, which are dependent on location, and several other socioeconomic factors.

“We have all heard of the ‘north-south divide’ and this is the case for the property market. Mortgages in the south are considerably higher than mortgages in the north as you can see from our research, which shows it takes homeowners in the South East and South West nearly twice as long to pay off their mortgage compared to the North East”.