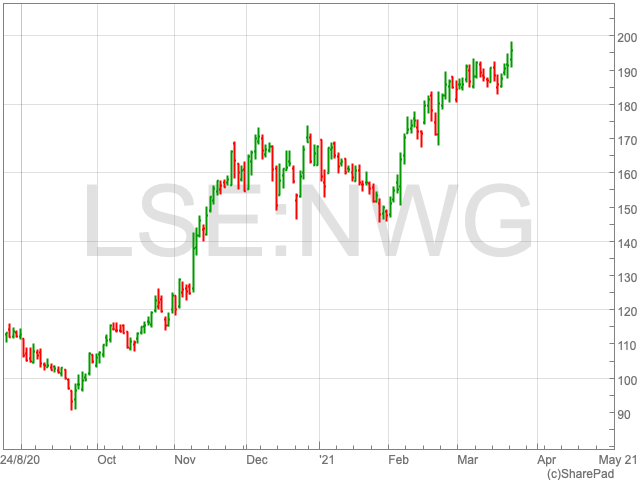

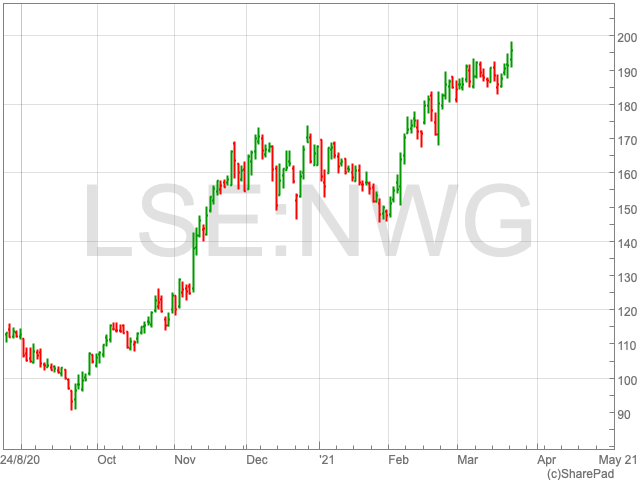

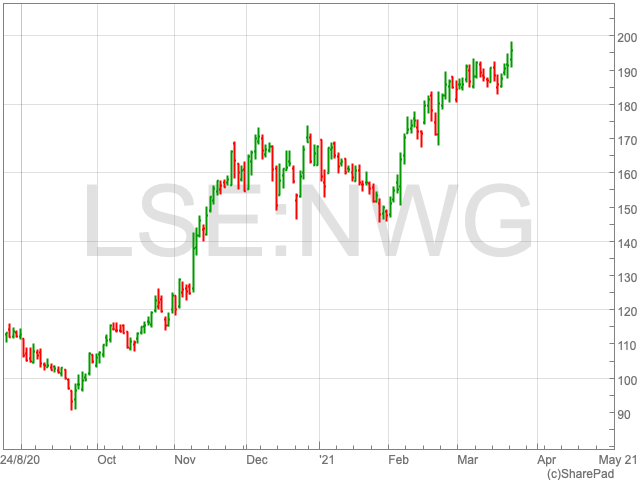

Natwest Share Price

The Natwest Share Price Price (LON:NWG) has seen a significant rise of 54.6% over the past 12 months. However, the stock remains below the level it traded at before 2020, and is also down over three and five year periods. Nonetheless, investors are looking to the future and considering Natwest, which recently purchased shares back from the UK treasury, as a viable option.

Treasury Sell-off

The UK treasury announced last week it had finalised the sale of £1.1bn worth of shares back to Natwest. The Treasury’s stake in the British bank is now down to 59.8% from 61.7% following the third sale of its holding. The shares were originally bought at around 500p apiece, so the sale represents a hefty loss.

This could prove to be good news for potential investors in the company formerly known as the Royal Bank of Scotland. The UK Government relinquishing its holdings could be seen as a show off faith in the bank’s management going forward. In addition, Natwest is planning to cancel 390m of the shares it bought back, equalling around 3% of the total. This means higher earnings per share for current and new investors.

Russ Mould, investment director at AJ Bell commented further on the buyback:

“NatWest’s move to buy back 4.9% of its shares from the Government adds up in one sense, in that the price paid, at 190.7p, comes in way below the bank’s last reported tangible book value, or net asset, value per share figure of 261p. The lowly price paid offers a welcome contrast to the majority of share buybacks,” Mould said.

However, there are some caveats for the price paid by Natwest to truly be considered a bargain. Russ Mould suggests that the bank would need to make a sustainable return on tangible equity.

“NatWest needs to make a sustainable return on tangible equity (RoTE) that exceeds its cost of capital – and last year’s negative 2.3% RoTE hardly fits that bill. NatWest had abandoned the 15% return on tangible equity target laid down by then-CEO Stephen Hester back in 2009 and given up on achieving the 12% targeted by his successor, Ross McEwan.”

In addition, the valuation of the assets needs to be on the money and not subject to further write-downs and loan impairments, according to Mould.

“The problem is that NatWest’s recent record on both counts is pretty spotty. TNAV per share continues to decline – although this is partly because the coming has been shedding assets in an attempt to shrink itself back to full health – and RoTE has, on a stated basis, been all over the place, thanks to a final rash of PPI claims in 2019, a jump in loan impairments owing to the pandemic in 2020, to name but two reasons.”

This may be why the Treasury chose to sell the shares to NatWest rather than sell the stock to institutional and retail investors, even if banking stocks are trying to forge a recovery, encouraged by hopes for an economic upturn, rising bond yields and a steeper yield curve. All three factors could help to boost banks’ profits and NatWest’s book value in the long-term.