Octopus Renewables Infrastructure Trust saw its share price increase 1% in early morning trading on Monday after the company reported a 4.8% rise in dividends and saw NAV per ordinary share increase to 102.2p compared to 98.2p in 2020.

The company announced a 5p dividend per ordinary share against 3.1p in 2021 and a Net Asset Value of £578 million compared to £344 million in 2020.

Octopus noted six acquisitions over the last year which totalled 179MW of capacity across solar and construction, wind and operational assets, alongside two developer assets across three new countries.

The company’s portfolio currently contains 31 assets across seven countries and two technologies, with a capable production of 494 MW against 315 MW in 2020.

Octopus has a projected capacity to power 337,000 homes with clean energy once fully-invested, with the potential to cut 364,000 tonnes of carbon emissions in global energy production.

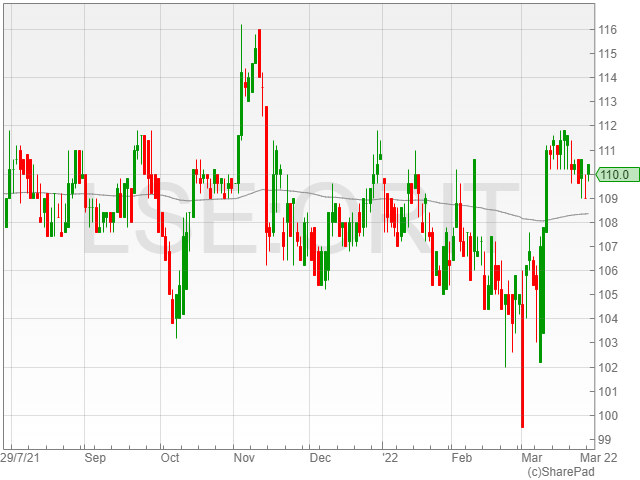

Octopus remained cautiously optimistic concerning its 2022 growth in light of rising commodities prices and the Russian war in Ukraine.

“Whilst the portfolio benefits from significant inflation protection via index-linked revenues, the Board is mindful of the need to monitor discount rates to ensure risk premia remain appropriate,” said Octopus Chairman Philip Austin MBE.

“What is clear is that the desire to avoid purchases of Russian oil and gas has led

governments across Europe and beyond to seek ways to accelerate the deployment of new

renewable capacity.”

“With the need for new renewable generation therefore as urgent as ever, and the strong

pipeline of investment opportunities identified by the Investment Manager, the Company

is very well positioned to continue growing, providing genuine positive impact by bringing

additional generation capacity into operation, whilst delivering attractive returns to investors.”