Goldman Sachs restates optimistic outlook for oil

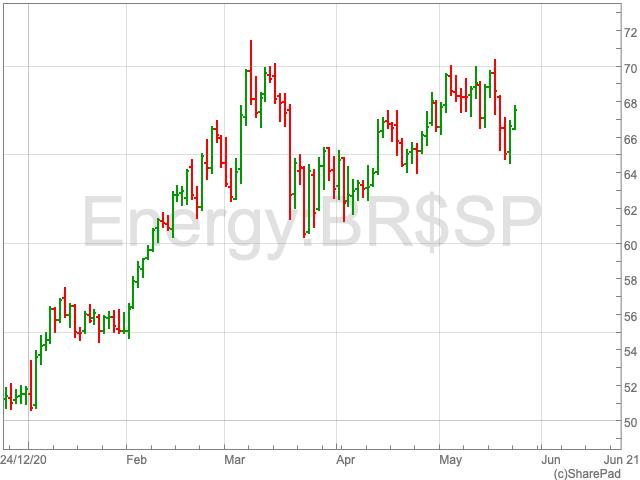

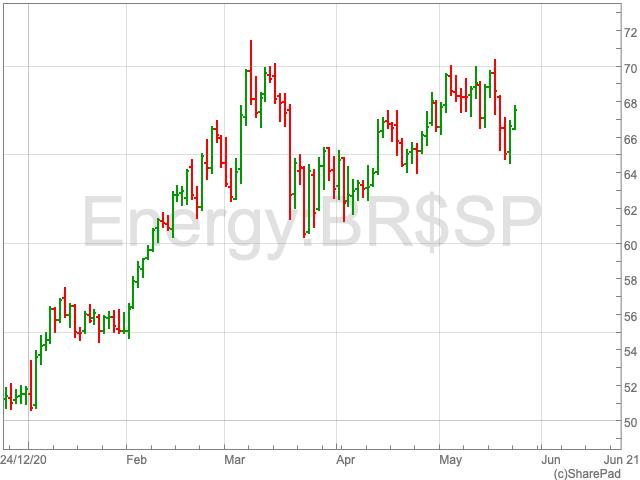

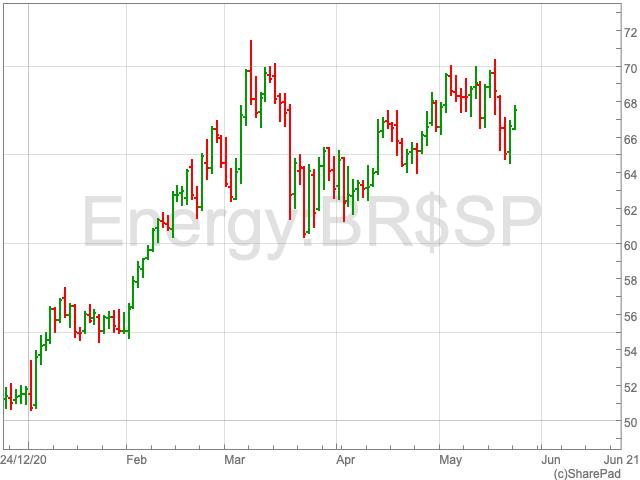

The price of oil rose on Monday as the revival of the Iran nuclear deal appears to be at risk.

The West Texas Intermediate composite is up 1.25% to $64.6796 at lunchtime in the UK, while the Brent crude oil composite is up by 1.34% to $67.492.

Despite the possibility that the hiccup could increase oil supply through Iranian exports, Goldman Sachs believes prices will continue to rise.

Just a week ago, the price of oil dropped by nearly 3% following statements by Iran president Hassan Rouhani that the US was ready to lift sanctions on his nation’s oil, banking and shipping sectors.

However, the speaker of Iran’s parliament confirmed that a monitoring deal between Iran and the UN nuclear watchdog had expired and that it would stop having access to images from a number of Iranian nuclear sites.

Diplomats from Europe said that failure to agree an extension of the deal would bring the possibility of future talks between Washington and Tehran into crisis.

“All in all, it seems to be only a matter of time before the sides involved put pen to paper on a new nuclear accord,” Stephen Brennock of oil broker PVM told Reuters.

“Investors are bracing for a fresh wave of what will surely be heavily discounted Iranian crude … yet for all this alarmism, an aggressive ramp up in Iranian production and exports is unlikely to stall the drawdown in global oil stocks”.

Analysts at Goldman Sachs believe the case for the oil price rising in the future remains solid as it will be driven by increased demand as the vaccine roll-out continues.

“Even aggressively assuming a restart in July, we estimate that Brent prices would still reach $80 per barrel in fourth quarter, 2021, with our new base case for an October restart still supporting our $80 per barrel forecast for this summer,” Goldman said.