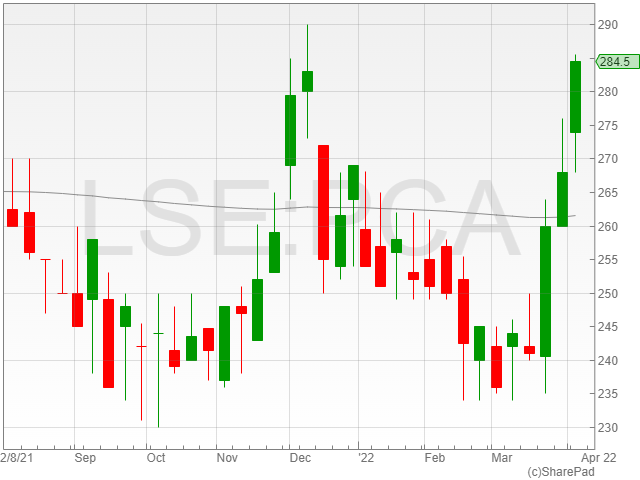

Palace Capital shares enjoyed a 2.3% rise to 280.5p per share in early morning trading on Wednesday morning after the investment company released an annual trading update projecting a strong performance exceeding market expectations for 2021.

The firm credited asset management success, lease activity and a slate of acquisitions for its promising results over the past year.

Palace Capital reported £28.1 million in cash on its balance sheet for 2021, alongside its disposal strategy ahead of target with gross proceeds of £31.5 million and an improvement to its portfolio income with steady rent collection and a reliable dividend increase.

The Group announced a 38% reduction in net debt to £73.6 million, and added that its EPRA earnings and adjusted PBT are projected to exceed market expectations.

Palace Capital announced a quarterly dividend of 3.2p per ordinary share, which is scheduled for payment on 14 April 2022.

The company confirmed a final dividend at a minimum of 3.7p to be paid in July 2022.

The property investment group said its goal is to take a higher level of risk in 2022, by using its core assets as a foundation from which to grab investment opportunities in the regional office and industrial sectors which would be riskier, yet provide stronger returns to shareholders.

Palace Capital currently aims to realign its portfolio with a distribution of 50% core assets, 40% value add/asset management and 10% invested in development.

“Following an extremely active period of portfolio management, the Company is well positioned with a higher quality portfolio delivering improved income and the opportunity for reinvestment underpinned by a significantly strengthened balance sheet,” Palace Capital CEO Neil Sinclair.

“It means that as we recover from the pandemic, we are well placed to address the future with confidence.”