Understanding the varying emotions that you or another investor might experience can really help explain the relationship between feelings and judgements towards the market.

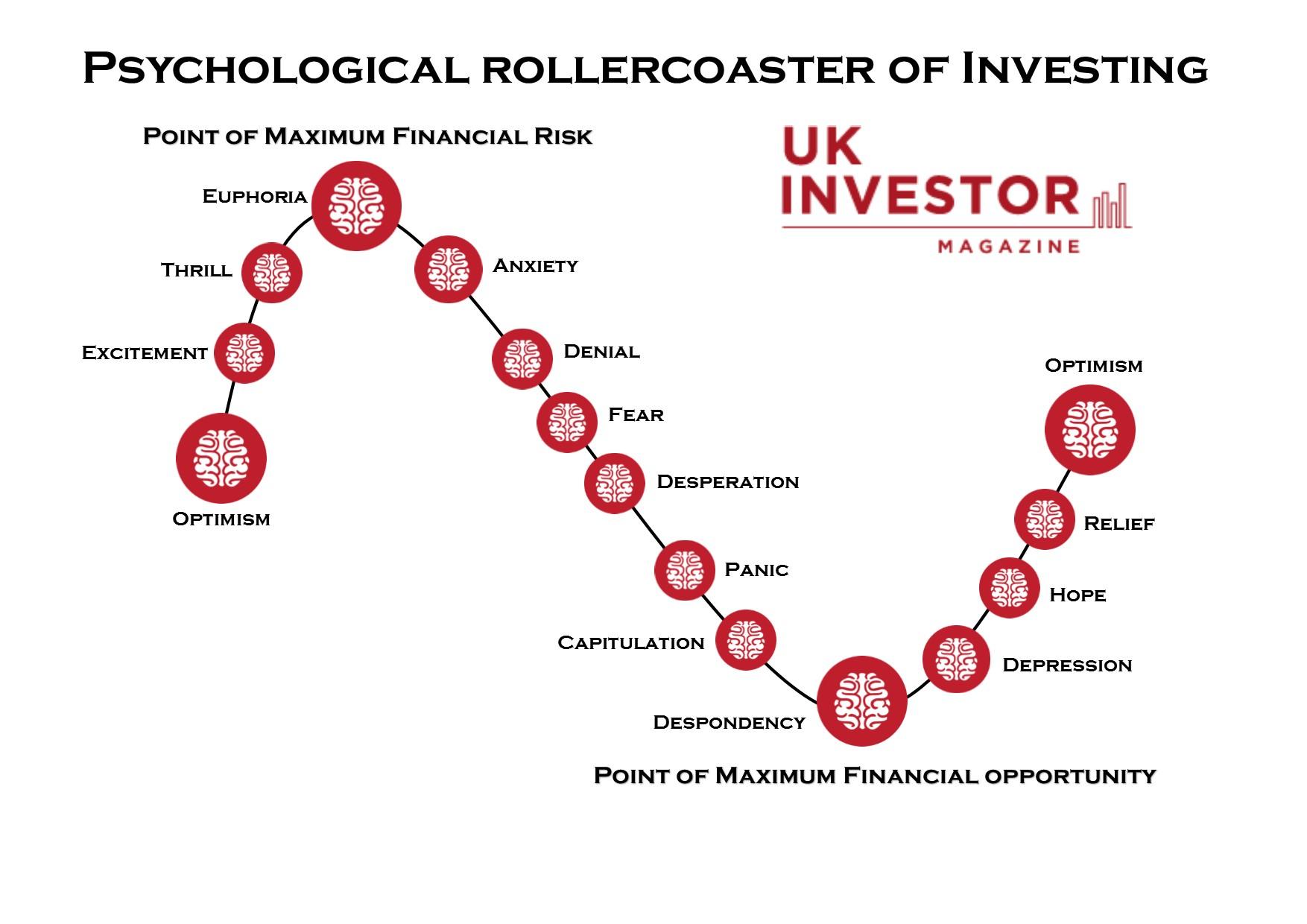

The below diagram shows the well known expression of the emotional roller-coaster experienced when investing, so next time you are investing, bear the chart in mind and ask yourself: “Where am I right now?”

Optimism to Euphoria

Whether the market is picking up, or it just starts with a positive hunch, the entering of the market is always backed by a feeling of optimism. With excitement and thrill, there is confidence in trading until euphoria is reached. At this stage in the cycle, maximum financial gain is reached. However, buying at the top will increase the chance of compounding costs with emotionally driven decisions.

Anxiety to Panic

As reality starts to set in, investors try to ignore bad news and move onto denial. At this point investors are reluctant to sell at a loss and volumes dry up. Sooner or later, investors are forced to sell moving through feelings of fear, desperation and panic.

Capitulation to Optimism

Forced by a lack of liquidity, investors often sell at a loss and remove themselves from the market due to reasons of despondency and depression. At the end of the cycle, it is not easy to start again at optimism, however, take too long and you might miss out on the recover, which can be fast and powerful.

Safiya Bashir on 14/01/2016