The benchmark yield on 10-year Treasury notes up to 1.31%

The S&P 500 index climbed to an all-time high earlier this week amid optimism around the US economy. With high oil prices, along with a positive mood around vaccine roll-outs and a pending stimulus package, confidence in the US economy is growing.

However, despite the recent rally, the US stock market could be in a vulnerable position. Investors are remaining cautious over equity markets, as bond yields rise on the possibility of inflation.

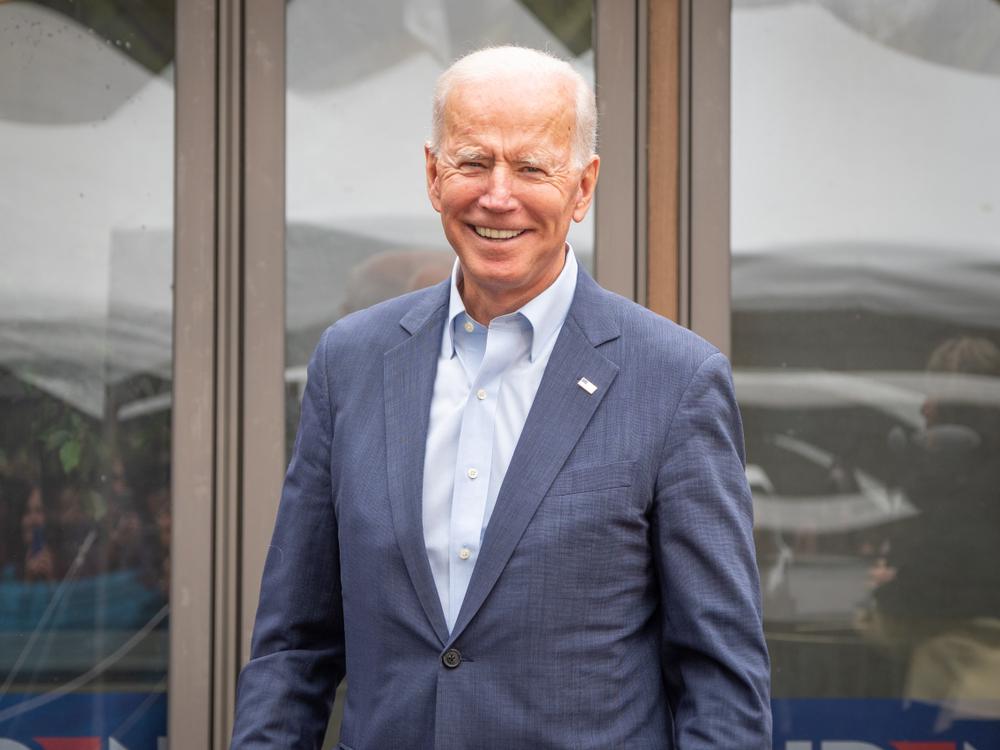

Since 2009, high prices for bonds and low yields have provided support for equity markets, as they compete for capital. However, this changed with forecasts of rising inflation, which could be exacerbated by Joe Biden’s $1.9trn stimulus package.

“Yields rise when bond prices fall, and the potential for increased government spending implies increased government borrowing, thus a larger supply of bonds driving the price down,” said Toby Sturgeon, Global Head of Fiduciary Investment Services at ZEDRA.

The benchmark yield on 10-year Treasury notes climbed to 1.31% on Friday, having reached its highest point in 12 months earlier this week, on concerns about the prospect of higher inflation. The yield on the 30-year Treasury bond rose to 2.1% on early Friday trading.

With yields creeping over 1.3%, it is a warning sign for investors looking to make gains from a strong recovery in the US economy over the coming year.

A sharp rise in yields “is something that certainly poses a significant risk,” said Padhraic Garvey, head of research, Americas at ING.

“What we don’t want to see in the very near term is (the 10-year yield) hitting 1.40%, 1.50% and still looking up,” Garvey added.

In that case, equities could become an unattractive proposition for investors. With pent-up demand, loose monetary policy, and bond yields on the up, Joe Biden’s fiscal stimulus could actually put the US stock market at risk.