Sainsbury have posted a sixth consecutive quarter of sales declines. Like-for-like Sales excluding fuel were down 2.1% in Q1.

However, shares in the in supermarket shrugged of the news and were up 4% in the first hour of trading as investors focused on higher sales volumes.

Food price deflation continued to be an issue and offset the higher volume of sales. This will give investors heart as when inflation picks up Sainsbury are well positioned for increased profitability.

Bryan Roberts, Director at Kantar Retail says “we continue to assert that the Sainsbury’s cloud has more silver lining than some.”

Major supermarkets have been forced into a price war to compete with budget competitors such as Lidl and Aldi who have snatched market share in recent years. The lower prices offered by Lidl and Aldi led to consumers voting with their feet, leaving the top four supermarkets scratching their heads as sales fell.

As the boards of Tesco and Sainsbury dawdled their share prices were destroyed. Sainsbury and Tesco shares were down 43% and 50% respectively over a year from October 2013.

Although there have been shake ups in both, questions still remain as to the future of the grocery behemoths as savvy consumers change their shopping habits in an increasingly fragmented grocery market.

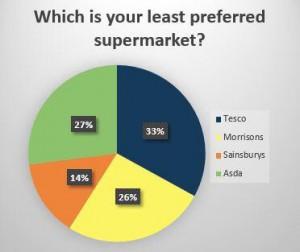

Our team went back to basics last week and simply asked consumers their views of the supermarkets. We found the Sainsbury was the least disliked supermarket among our sample taken outside Kings Cross Station. Our survey results are supported by Sainsbury’s results but CEO Mike Coupe has his work cut out.

Lidl and Aldi are planning more store openings and independent food stores are making a comeback, a factor that has been little covered. The results of our survey revealed that 95.4% of shoppers would use independent & specialist food stores if they were convenient and affordable.

The independent food store revival is most evident in London where consumers have a higher disposable income, if this trend continues outside of the M25 it could be the end of the supermarkets as we know them.