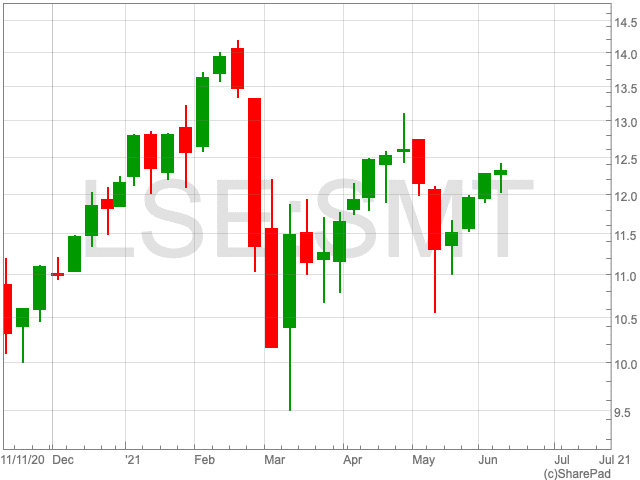

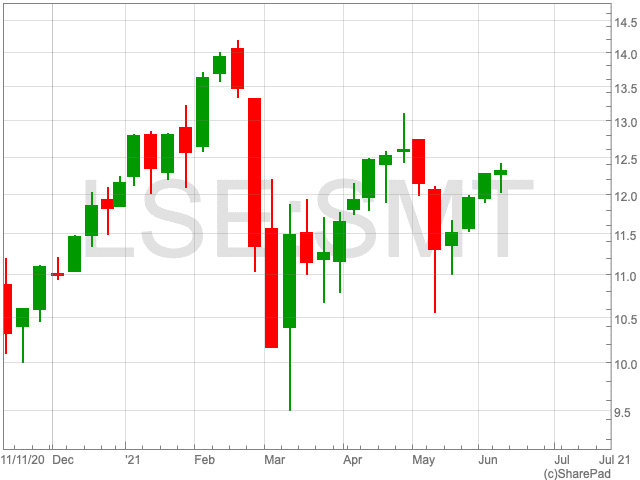

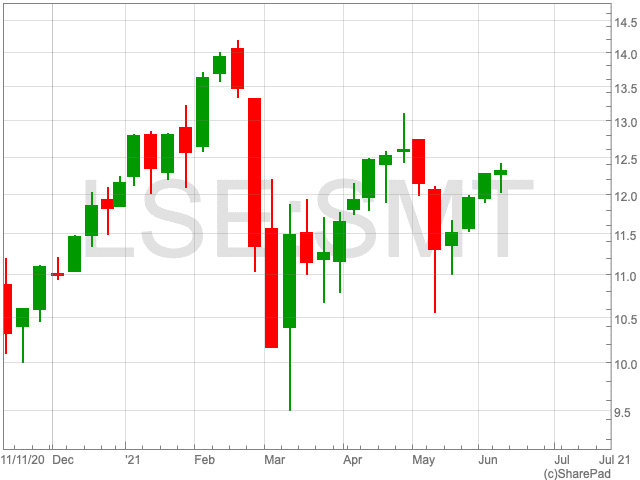

Scottish Mortgage Investment Trust Share Price

The Scottish Mortgage Investment Trust share price (LON:SMT) performed outstandingly well during 2020. However, the company faced some bumps in the road early this year, during the tech sell-off and when James Anderson, one of the fund managers, announced he would be stepping down. At the time of writing, the Scottish Mortgage Investment Trust share price is at 1,229p, nearly 200p down from its all-time-high in February. The fund seems to have responded well following its mid-February dip, and now could represent an opportune time for investors while the share price is low.

Volatility

Following a tumultuous year, the Scottish Mortgage Investment Trust share price, with both peaks and troughs along the way, is up by 0.98%. In addition to this, the short-term volatility that has occurred may serve to put investors off.

The FTSE 100 company has a high exposure to tech firms which makes it vulnerable to mass sell-offs. In addition, it seeks out companies in the early period of their growth with massive potential. For example, it bought Tesla shares as early as 2013.

More recently it confirmed it has invested £72m in Blockchain.com, the UK’s largest cryptocurrency company, which could be a sign of things to come. It is important for investors to consider the longer-term with the Scottish Mortgage Investment Trust share price for this reason.

“The managers are true long-term investors since they believe it’s the best way to capture the potential growth of their companies. Currently the trust invests in around 95 companies, eight of which have been held for over ten years, including technology firms Amazon and Tencent, and French luxury goods company Kering,” said Hargreaves and Lansdown investment analyst Henry Ince.

Over the past 12 months the Scottish Mortgage Investment Trust share price is up by 70%, while going back as far as five years, it has gained 387%.

James Anderson stepping down does remain a long-term risk as he led he trust to make some excellent decisions over the past decade. Although he will not depart until April 2022 and will be replaced by Lawrence Burns who joined Baillie Gifford in 2009 straight from the University of Cambridge where he studied geography.