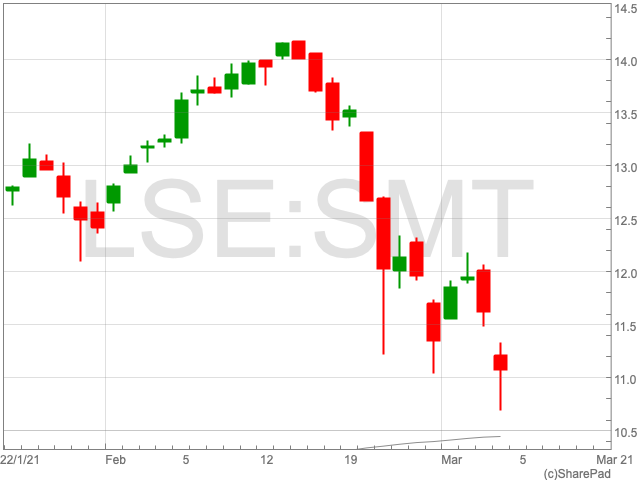

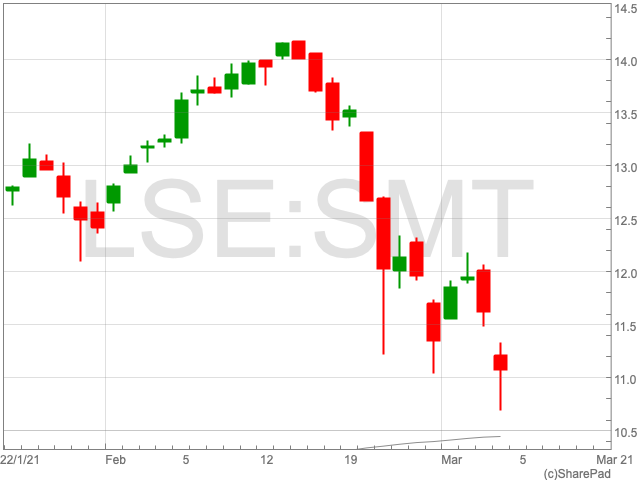

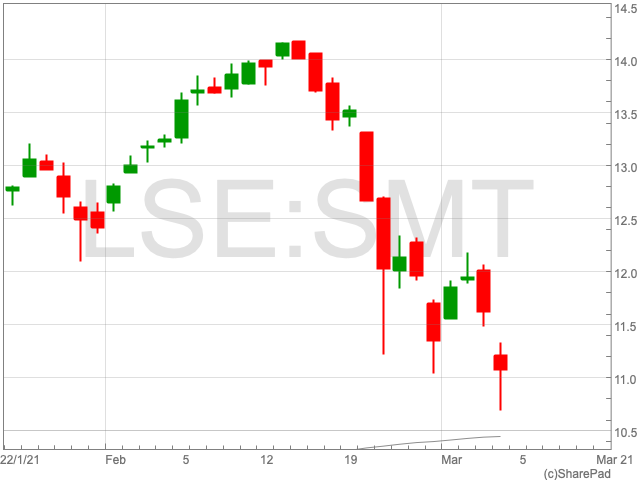

Scottish Mortgage Investment Trust Share Price

The Scottish Mortgage Investment Trust (LON:SMT) was down by 7% in morning trading on Thursday. It is a continuation of a recent trend for Baillie Gifford’s flagship investment trust which saw sharp falls throughout February. Since the middle of February, when the Scottish Mortgage Investment Trust was valued at 1,415p per share, its value has plummeted by 29% to 1,095.7.

Investors have been monitoring the trust closely as the dip could represent an ideal opportunity to buy in. This article will take a closer look at the trust’s holdings and the causes for its recent drop-off in value.

Rising bond yields

Bond yields are rising and it is causing concern for investors. The benchmark 10-year US Treasury bond yield climbed to 1.477% through the night, having reached a one-year high of 1.614% a week ago.

The yields, which are adjusted for expected inflation, have jumped recently as investors anticipate Joe Biden’s stimulus package will result in stronger US price growth.

Rising bond yields have begun to have an impact on US stocks, in particular those held within the Scottish Mortgage Investment Trust.

“The higher the yield on bonds, the more we see this push to move out of stocks,” said Jeffrey Carbone, managing partner at Cornerstone Wealth, North Carolina.

US tech stocks

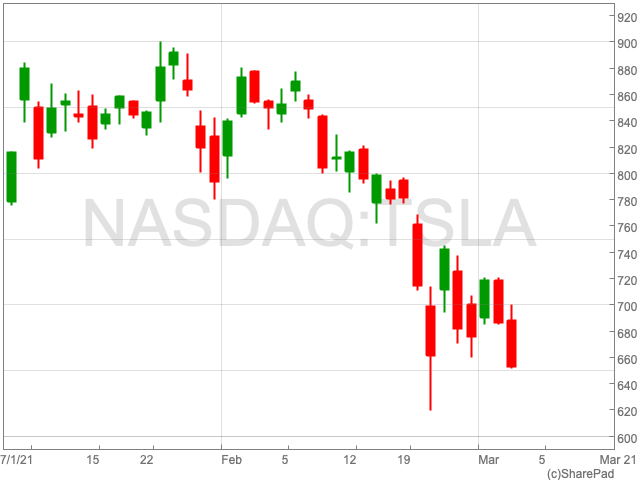

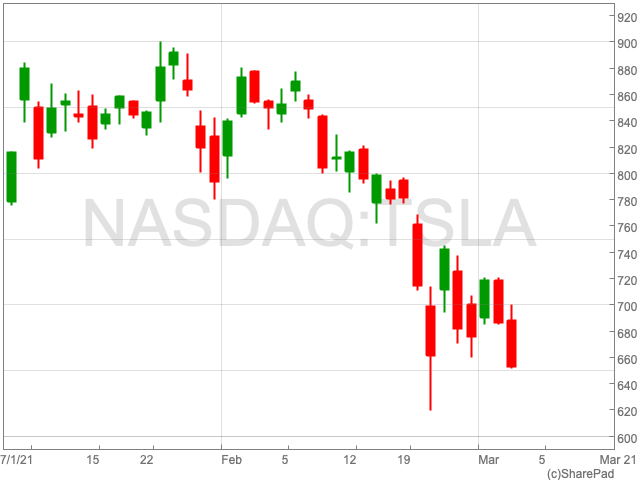

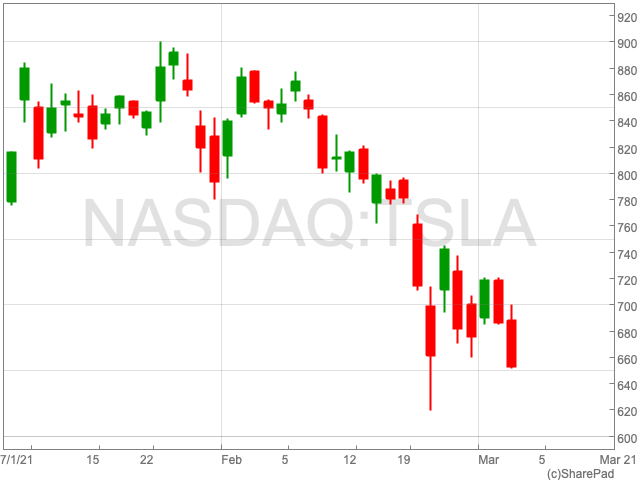

The S&P 500 dipped by 1.31% on Wednesday, losing 50.51 points, as investors sold off their technology stocks following the continued news of rising bond yields. Tesla, the Scottish Mortgage Investment Trust’s fourth largest holding, has been particularly affected in recent weeks by the move away from technology and high-growth stocks.

In January, Tesla was close to breaking the $900 mark following massive growth during the pandemic. However, the electric car manufacturer has since plummeted, now trading at $653.20 per share.

Amazon, one of the notorious FAANG stocks, and the Scottish Mortgage Investment Trust’s third largest holding, also bore the brunt of investors’ move away from tech. From 3,380p per share on 2 February, the online retailer has since dropped to 3005p per share, a fall of 12%.

Asia

The Scottish Mortgage Investment Trust has holdings in some of Asia’s top companies, however, even they could not escape investors’ renewed scepticism. Technology companies saw dips across the region yesterday. In Japan, the Nikkei 225 dropped by 2.3% to 28,930.11, while the the Shanghai Composite lost 2.05% to 3,503.49.

The Scottish Mortgage Investment Trust’s top holding, Tencent, the Chinese technology company fell by 4.56%, while Alibaba, the online retailer, and the Scottish Mortgage Investment Trust’s sixth top holding, fell by 2.56.

Both Tencent and Alibaba have seen dips over the past month or so, in line with their American counterparts. Tencent fell from 766.5HKD on January 25 to 690HKD today, a fall of 11%, while Alibaba dropped from 265HKD TO 227.2HKD, a fall of 17%, over a similar time period.