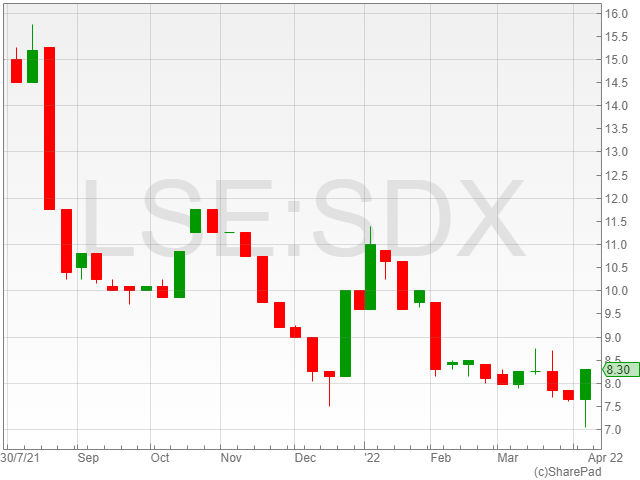

SDX Energy shares were up 2.1% to 8.2p in late afternoon trading on Friday after the energy firm reported the successful spudding of its MSD-20 infill development well on its Meseda field.

The company began drilling operations at the site on 5 April, and is currently aiming for the Asl formation reservoir at approximately 3,1800ft true vertical depth subsea (TVDSS).

The well is estimated to take around six weeks to drill, finish and tie-in to the group’s existing infrastructure.

The MSD-20 is expected to cost around $900,000 to $1 million to drill and tie-in, with an initial production of 300 barrels of crude oil per day.

The resulting contribution to the company’s cashflow is projected to recoup the project’s costs in an estimated five to six months, based on the current price of oil.

The well is the third of 13 total wells in the company’s drilling project on the Meseda and Rabul oil fields based in the West Gharib concession in the Egyptian Eastern Desert.

The energy firm’s first two wells have already been tied-in and are actively contributing to the company’s oil production.

SDX Energy is currently aiming for a production growth to 3,500 to 4,000 barrels of crude oil per day from its 13 wells by early 2023.

“I am pleased that we have spud MSD-20, the third well in the campaign, so quickly after bringing MSD-21 and MSD-25 onto production, which is testament to the efficiency of the operations team in country and bodes well for the rest of the campaign,” said SDX Energy CEO Mark Reid.

“West Gharib is a very high margin asset in our portfolio with a Netback of US$37/bbl at US$71/bbl Brent in FY2021.”

“I look forward to updating the market further as the campaign progresses.”