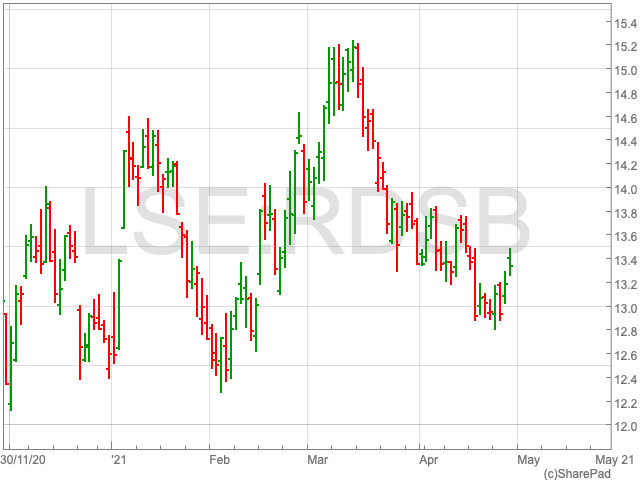

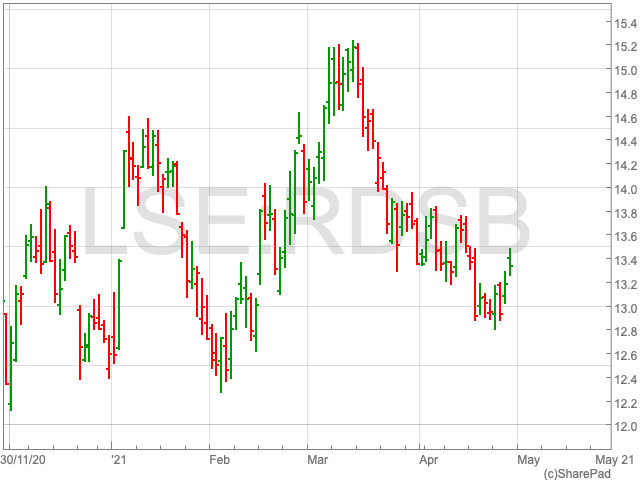

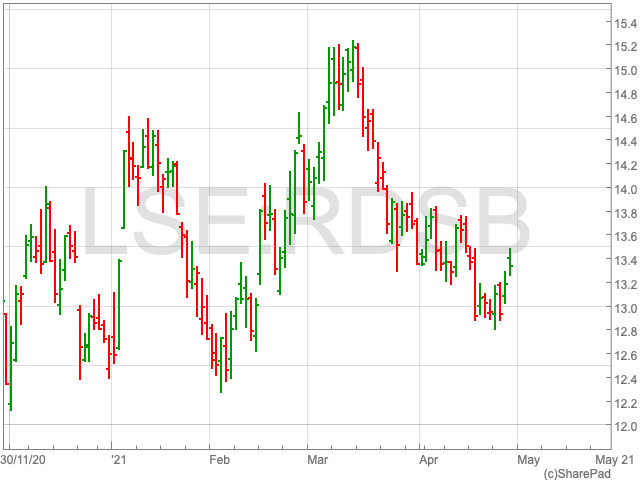

Shell Share Price

The Shell share price (LON:RDSA) is up by over 1% on Thursday as the Anglo-Dutch company announced its results for the first quarter of the year. This follows a sharp decline, from early March through to late April, when the company’s stock tumbled from 1,584p per share to 1,355p, a fall of 17%. It is a continuation of what has been a volatile year for the oil giant which has struggled to recover from a dramatic fall at the beginning of the pandemic.

Q1 Results

Shell announced on Thursday that its profits rose during Q1 as the oil giant showed signs of recovery from the pandemic-induced downturn through a resurgence in energy consumption and prices. Profits at the Anglo-Dutch FTSE 100 company increased by 13% to $3.2bn compared to the same period the year before. The oil industry more generally is in the early stages of a recovery following the damage caused by Covid-19, which made energy companies tighten their spending and reduce costs.

As a result, Shell made the decision to increase its quarterly dividend by 4% thanks to its improvement in trading. It is the second increase since the company cut its payout, for the first time since the second world war, by two-thirds at the beginning of last year due to the pandemic.

Oil

The immediate outlook for the Shell oil price is dependent on the price of oil. “Market sentiment was dented on worries that a surging number of COVID-19 cases in some countries, especially in India, will slash fuel demand,” said Kazuhiko Saito, chief analyst at commodities broker Fujitomi Co. This caused the price of oil to fall on Monday as Covid-19 cases surged India, one of the world’s biggest oil importers. However, Brent crude futures is up 2.5% to $68.72 on Thursday, while West Texas intermediate (WTI) crude futures are up by 2.25% to $65.11 a barrel.

The technical committee of the OPEC+ has forecast global oil consumption to rebound by 6m bbl/day this year, according to delegates who attended the panel. US benchmark crude futures are up more than 6% so far this month amid signs of a consumption recovery in some parts of the world. However, if the anticipated global economic recovery doesn’t arrive then it could spell trouble for Shell.