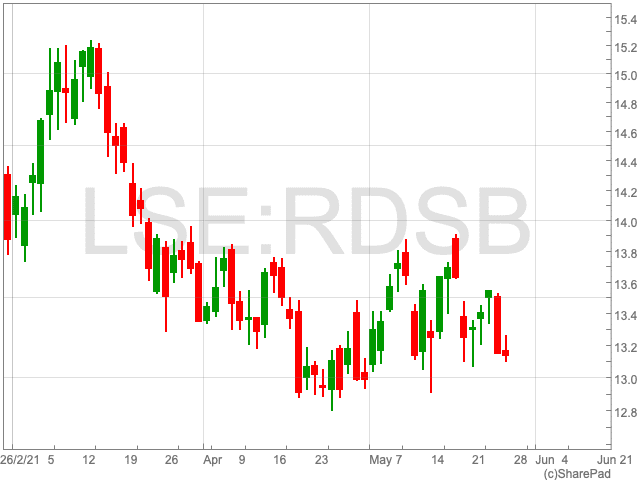

Shell Share Price

The Shell share price (LON:RDSB) has been moving sideways for the past two months now and appears unsure of its next move. Having reached 1,583.6p in early March, its highest point in over a year, it is now sitting at 1,375.4p per share. Investors appear to be awaiting news that could influence the FTSE 100 company’s value. Since the beginning of the year, the Shell share price is up by 4.3%. The energy company has performed well in line with the relatively strong performance of oil prices.

Transition to Clean Energy

The lack of speed over the company’s transition to clean energy remains a concern for Shell. If the company’s board does not handle the situation delicately then the Shell share price could be adversely affected in the coming months.

Just recently, UK Investor Magazine reported that Legal & General Investment Management (LGIM), one of the UK’s largest fund managers, has come out as being critical of Shell’s efforts to tackle climate change.

At the company’s AGM last week, LGIM voted against the FTSE 100 oil giant’s energy transition strategy. The fund manager told the Guardian that it was standing alongside activists as it does not buy the credibility of Shell’s plan.

Although LGIM did say that some progress was being made. “We remain concerned that the strength of interim targets (up to 2035) and disclosed plans for oil and gas production fall short of the level of ambition required for the company to credibly claim alignment with a 1.5C pathway,” the company said.

The result builds further pressure on Shell and now means the oil giant will be required to consult shareholders and report on their views within six months.

For now, the ball appears to be in Shell’s court. The company has time to go away and conjure a plan to appease its shareholders, as well as protecting its immediate-term interests. It serves as a warning to the company of the increasing power of activism by shareholders, especially when they pool their resources.

The oil giant could well come out and deliver an update to its strategy which could then push up the Shell share price. The consequences of not doing so could be a mass sell-off, as investors appear to be at the end of their tether.

Oil

For investors less concerned about the long-term, Shell could be viewed as a means to making a nearer-term profit, via oil.

Demand for oil is rising again as the world continues its emergence from lockdown. Both Brent and WTI are up by around a third since the beginning of the year.

“The euphoria is reflected in the general belief that the economic revival will be soon coupled with oil demand recovery,” Tamas Varga, an analyst at PVM oil brokerage told the Financial Times. Demand for oil is expected to peak around the next decade, which leaves the possibility for a period when consumption is growing while output slows, as many companies will redirect resources to other sources of energy.

The future of the Shell share price could therefore depend on the board’s ability to navigate both its transition to clean energy and the continued demand for oil.