For the co-founders of Sydney-based start up Simply Wall St, investing in the stock market was a little too complicated. Undoubtedly, there are plenty of people who would say the same; however Simply Wall St’s goal is to change that, and the company have created software that can provide everybody with the knowledge and information to be a successful investor. Its founders, Al Bentley and Nick van den Berg, firmly believe that investing in the stock market can, and should, be simple and enjoyable for everyone.

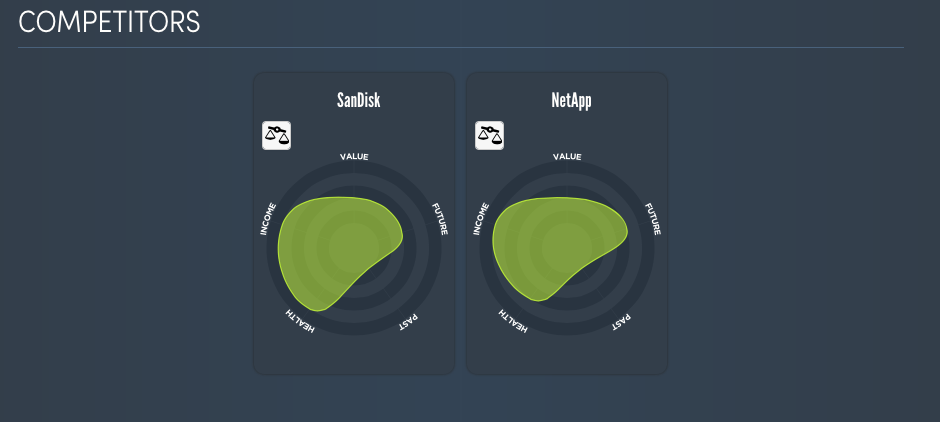

Simply Wall St turns complicated financial data into easy to understand visuals. On a daily basis, the company produce over 9,000 detailed infographics and visual analyses on all the companies listed on primary US, UK and Australian stock exchanges, with financial data provided by Standard & Poor’s Capital IQ. Investors can log in online and create a personalised portfolio of stocks they are following, and their brilliantly designed site enables you to easily see the stocks previous and present performance, potential and value.

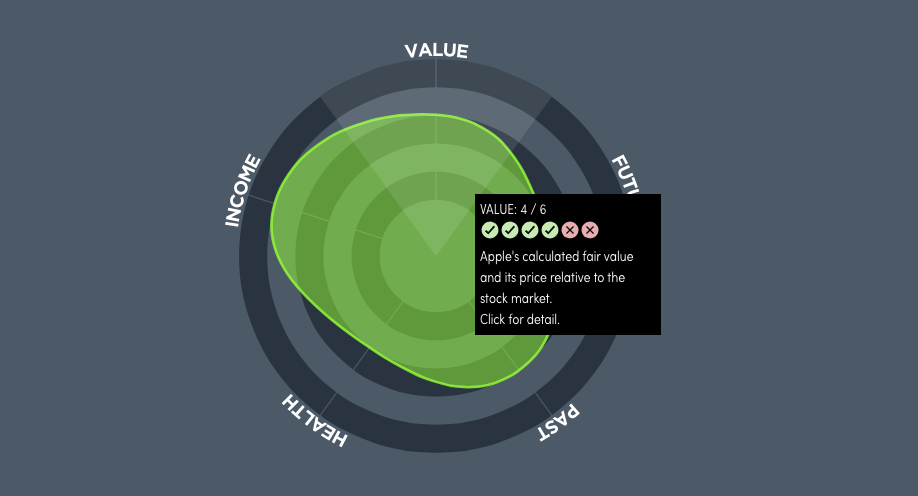

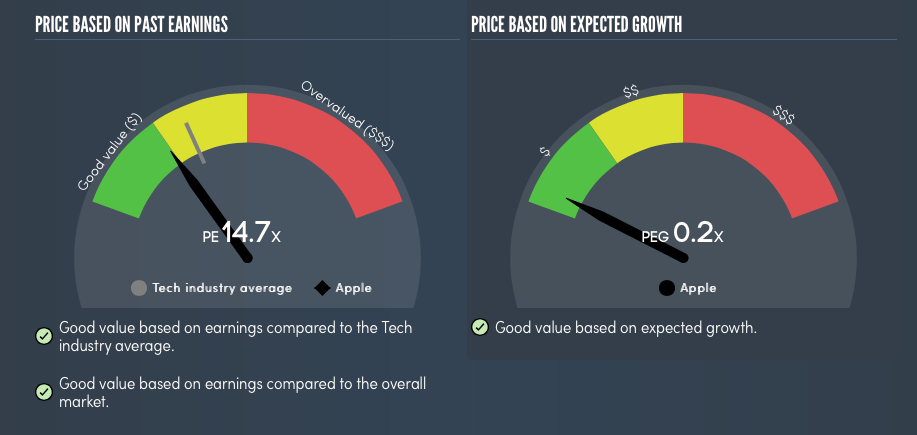

Their free service uses a unique method to analyse stocks, creating a ‘snowflake’ for each company, generated from 30 financial checks in 5 different core areas of a company: Value, Past Performance, Future Performance, Health and Income. The larger and greener the snowflake becomes, the more checks the company has passed and the healthier investment it is.

The company have just raised $600k in one of the biggest Australian seed rounds this year, with Michael Quinn from Innovation Capital leading the oversubscribed opportunity and involvement from Sydney Angels and the Sidecar Fund. The amount they have managed to raise from investors is impressive; Bentley and van den Berg have clearly got fundraising down to a fine art. But what exactly is their secret?

When looking for seed funding, Bentley believes that finding the right lead investor is key.

“You really need to focus on finding the right one as the rest will follow after this. When we were looking to raise Simply Wall St’s seed round of $600,000 we selected Mike Quinn and reached out with a cold email – yes those do work!

“After getting to know him we decided we wanted him as he really understood what we were doing and most importantly liked working with us.”

It’s also important to select the right type of investment. Whilst many start ups are now going down the crowdfunding route, it may be worth considering other options before ‘leaping on the bandwagon’.

The funds will be used to take the startup out of Beta, start monetization and expand in the UK and US markets, which currently account for more than 75% of users.

“This funding will further our mission to empower casual investors to make profitable long term investment and actually understand the stock market,” Bentley said.

As shown by the response to their request for investment, Simply Wall St has a unique and clever business idea; one that will hopefully drive their business to greater success. However, perhaps the most important piece of advice Bentley has to give is that starting a company is anything but easy; he spent three months living underground in his van in order to get started.

“I had to move to Sydney and I was bootstrapping, so I spent 3 months living in my van parked in an underground lot at the co-working space. It was tough, but it was worth it.”

For more information and to sign up to Simply Wall St’s free service, visit simplywallst.st.

Miranda Wadham on 02/09/2015