The FTSE 250 was down 1.1% at 21,235.9 and the AIM was down 0.1% at 1,045.2 on Wednesday.

The market was led by energy companies as the price of oil remained steady at $112 per barrel and the approaching energy price cap rise leading to investors seeking energy stocks.

Travel companies suffered a hit as Trainline and Trustpilot joined the list of FTSE 250 fallers.

FTSE 250 Risers

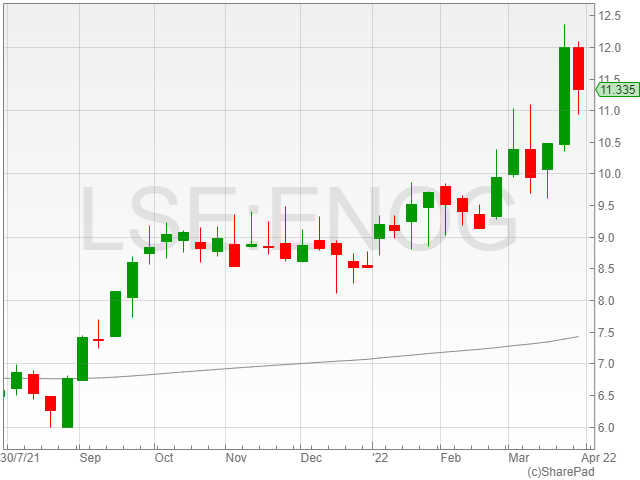

The FTSE 250 risers included Energean with a 2.8% rise to 11,370p in the lead up to the rising energy price cap on 1 April 2022. Morgan Stanley also quoted the stock to be ‘overweight’.

Capricorn Energy was up 1.9% at 220.8p and Tullow Oil increased 1.8% to 52.1p as the price of Brent Crude remained steady at $112 per barrel.

Greencoat UK Wind shares rose after Jefferies upgraded the stock to a buy from hold.

FTSE 250 Fallers

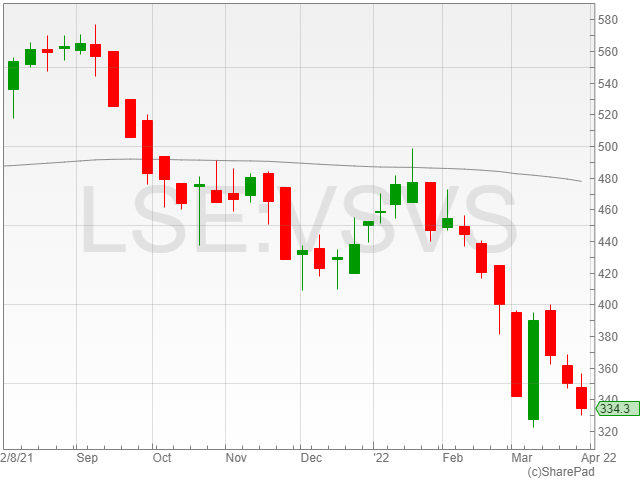

The FTSE 250 fallers were led by Vesuvius with a 6.3% loss to 334.1p as Barclays cut the stock to ‘underweight’.

The Trustpilot Group fell 6% to 146.3p as the stock continued to sink following a poor update last week.

Travel related shares were down on Wednesday with Trainline giving up 5.6% to 202.4p and Easyjet dipping 2%.

Petropavlovsk shares dropped 6.8% to 4.6p as the company said its in the initial phase of restructuring due to its significant exposure to Gazprombank, a Russian bank facing asset freezes due to sanctions imposed by the West.

AIM Risers

The AIM risers were topped by Keras with an 81.2% rise to 0.07p after it secured control of the US Diamond Creek phosphate mine.

Empire Metals soared 48.7% to 1.4p after the company reported high-grade intercepts at its Gindalbie gold project.

88 Energy enjoyed an increase of 32.1% to 0.9p, despite disappointing results from its Merlin-2 well reported yesterday.

AIM Fallers

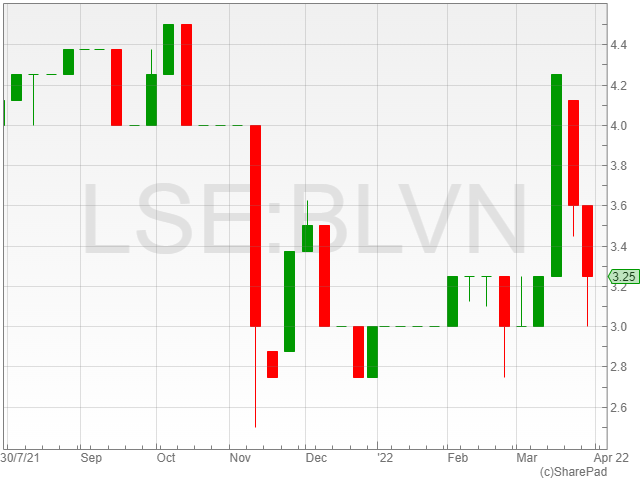

The fallers were led by BowLeven with a 9.7% decline to 3.25p after a $1.2 million loss in its half-year results, and its Cameroon joint-venture partner Lukoil’s inclusion in sanctions against Russia.

Malvern International continued its decline with a fall of 9.5% to 0.09p as the academic services provider announced a debt restructure of £2.6m earlier this month.

The LoopUp Ground decreased 9.4% to 6p may be due to the company issuing more options to PDMR of the group.