The FTSE 250 and AIM tracked global equites with sharp decline following a report from the Office of National Statistics that the UK economy shrank by 0.1% in March, shaking investor confidence.

Investors were also spooked as the prospect of surging US inflation heightened fears of an economic slowdown across international markets.

“The FTSE 100 tumbled after weak UK GDP numbers and higher than expected US inflation figures stoked fears about a global economic slowdown,” said AJ Bell investment director Russ Mould.

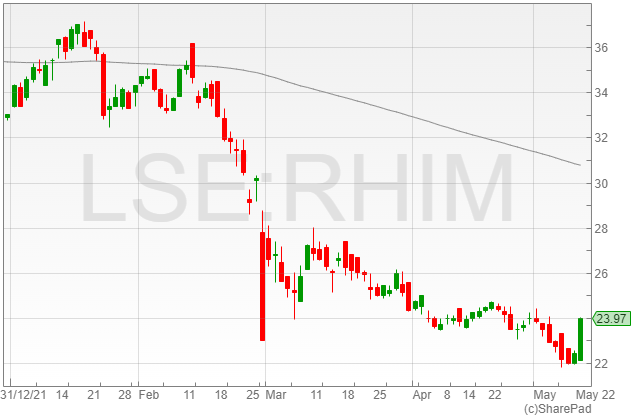

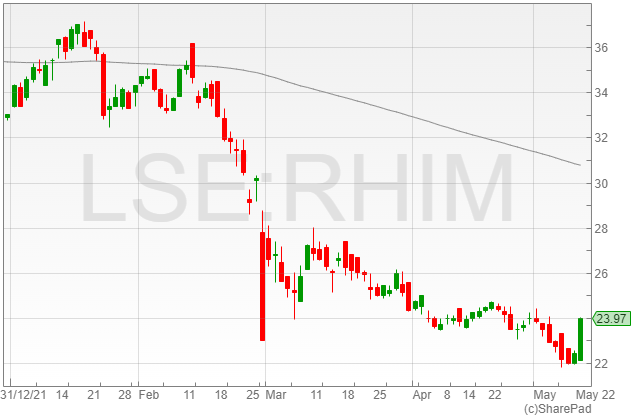

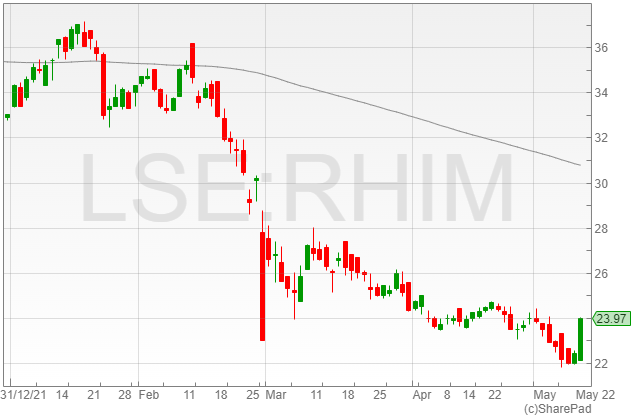

RHI Magnesita shares increased 6.5% to 2,388p after the refractory products supplier announced an EBITDA rise of 50% in Q1 2022 as a result of continued high demand for steel and industrial products.

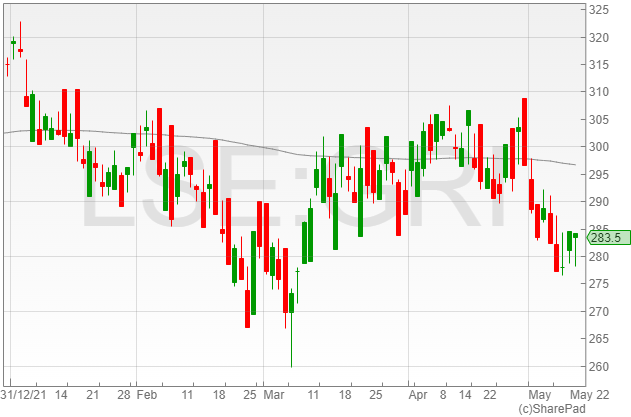

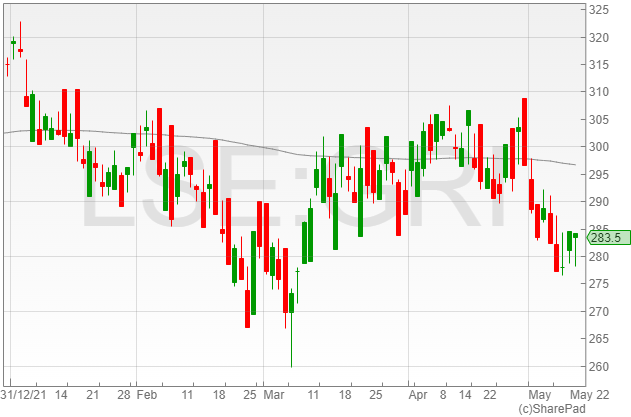

Grainger shares were up 0.4% to 232.3p following a profits rise to £98.8 million in HY1 2022 from £44.5 million year-on-year.

“We are delivering on our growth plans which will see us double in size in the coming years, providing exceptional earnings growth and attractive high single digit total returns to shareholders,” said Grainger CEO Helen Gordon.

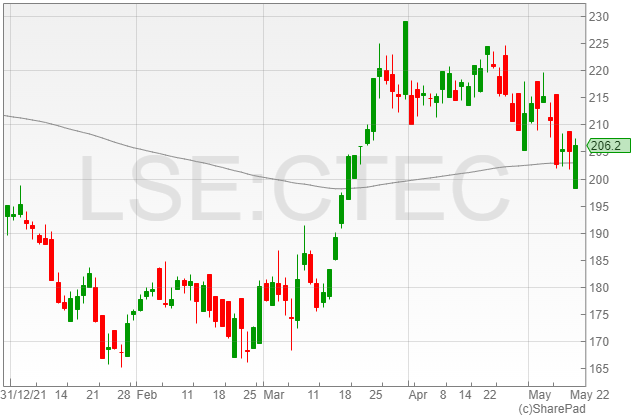

ConvaTec Group shares gained 0.7% to 206.6p after the group reported revenue for the four months to 30 April 2022 of 4.1% on a reported basis, with a 7.5% growth on a constant currency basis and a 6% rise on an organic basis.

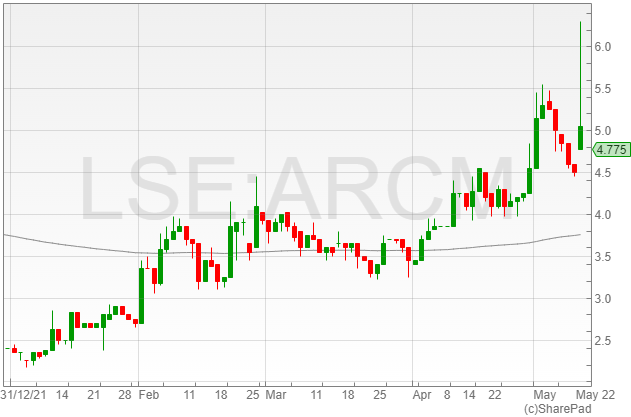

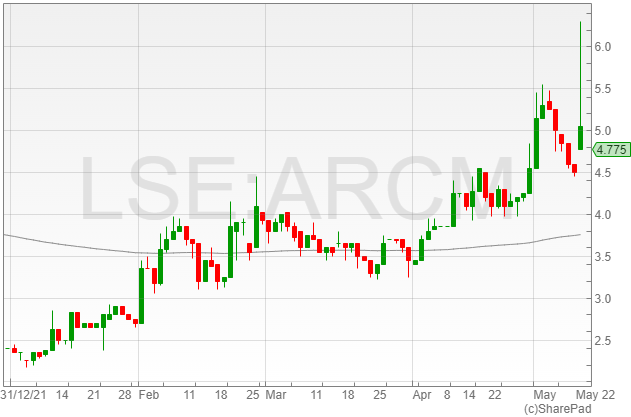

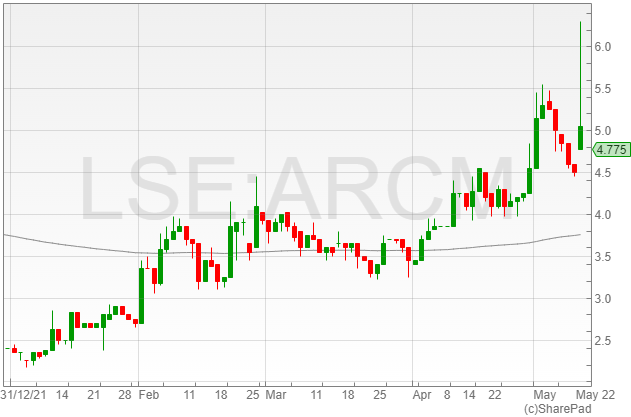

Arc Minerals shares were up 18.8% to 5.3p following an agreement with an Anglo American subsidiary to form a joint-venture with Ango-American in Arc Minerals’ copper-cobalt project in West Zambia.

Anglo-American is set to buy 70% ownership of the operation for an aggregate investment of up to $88.5 million, including cash consideration of up to $14.5 million.

“This agreement represents a major turning point for Arc and follows many months of negotiations. I am delighted to be signing this agreement with Anglo American which will, upon execution and completion of the definitive agreements, result in the potential for significant investment by a reputable major mining company in the tenements in north west Zambia and a very exciting time ahead for us,” said Arc Minerals executive chairman Nick von Schirnding.

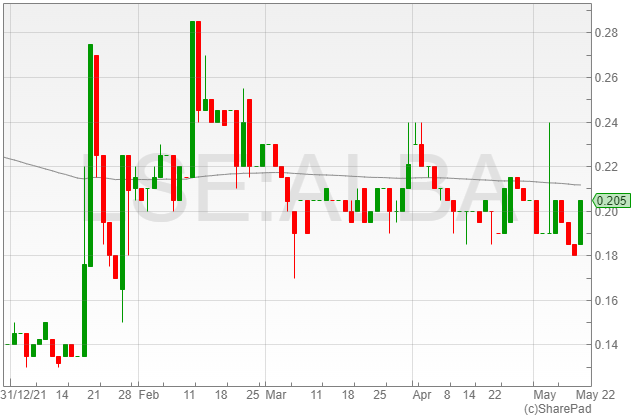

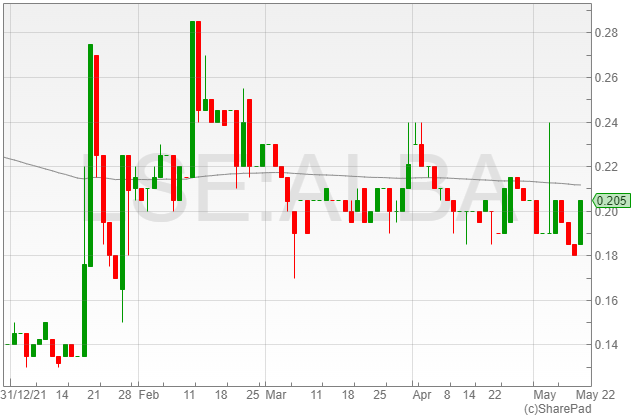

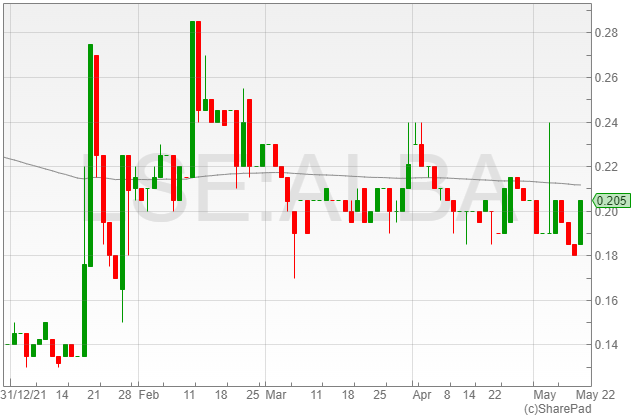

Alba Mineral Resources shares gained13.8% to 0.2p on the back of its 54%-owned portfolio company GreenRoc Mining significantly updating its resource estimate for its Amitsoq Graphite Project.

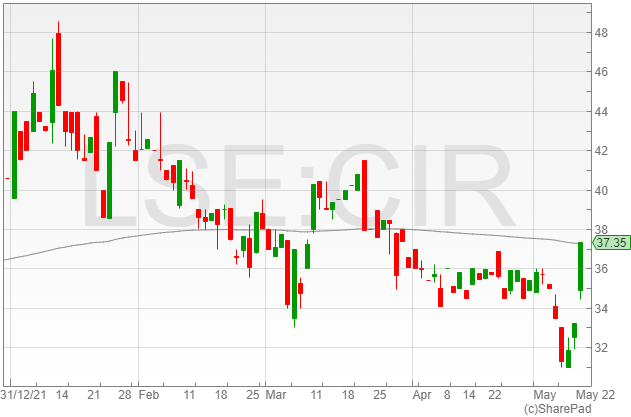

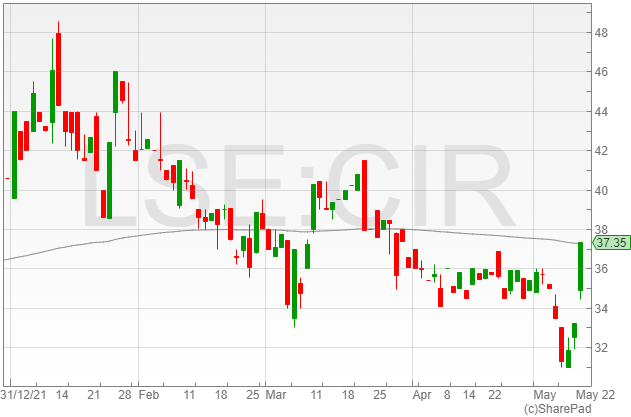

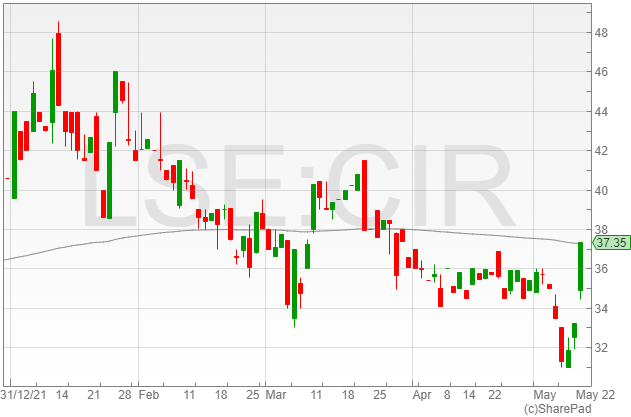

Circassia Group shares increased 12.5% to 37.3p following a reported revenue ahead of market expectations for the initial four months of 2022, with clinical revenue rising 17% year-on-year and trading growth up 23% against the same period last year.

The company said it expects its EBITDA for FY2022 to come in “materially ahead of its expectations” based on strong growth in the year-to-date.

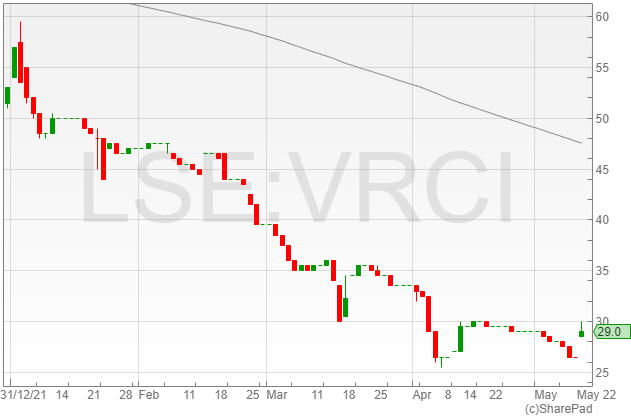

Verici Dx shares were up 11.3% to 29.5p following the successful results of its blinded, international, multi-centre validation study for blood test product Tuteva.

The product is reportedly a next-generation RNA sequencing assay, which demonstrated positive performance in detecting acute rejection after a kidney transplant.

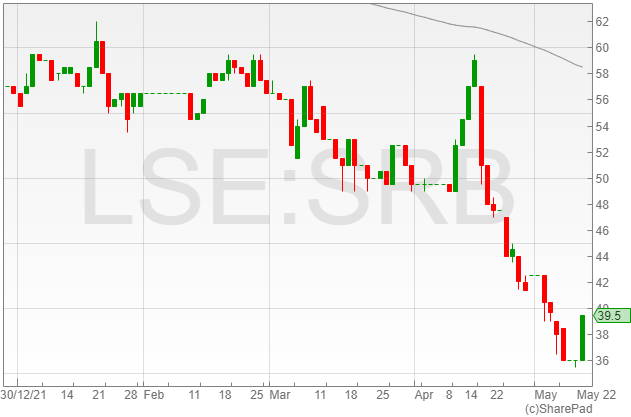

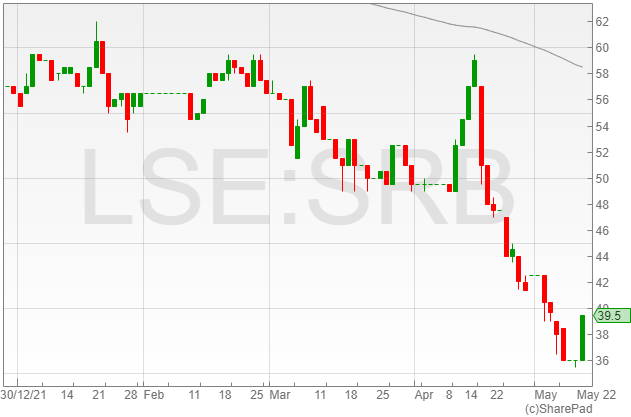

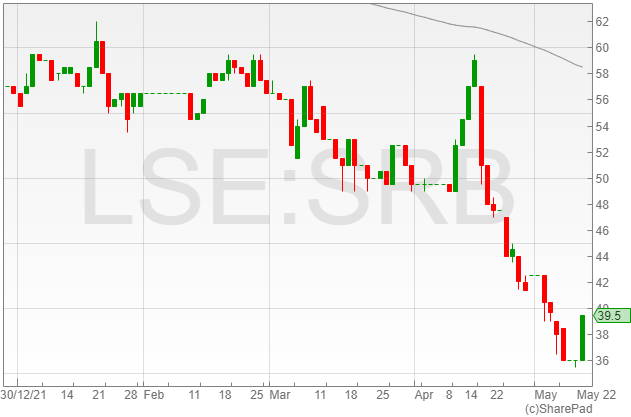

Serabi Gold shares gained 9.7% to 39.5p in light of a production of 2,919 ounces of gold from its Palito Complex, its highest level so far this year.

“It is very pleasing and a testament to the hard work of the team at the Palito Complex that we have managed to produce 2,919 ounces in April,” said Serabi Gold CEO Mike Hodgson.

“As investors will recall we experienced production challenges in the first quarter on the Julia Vein at Sao Chico, and this resulted in us moving away from sublevel long-hole mining method, for the more selective, albeit slower shrink stoping method. So it is really pleasing to see this change bearing fruit coupled with continued excellent performance at Palito.”

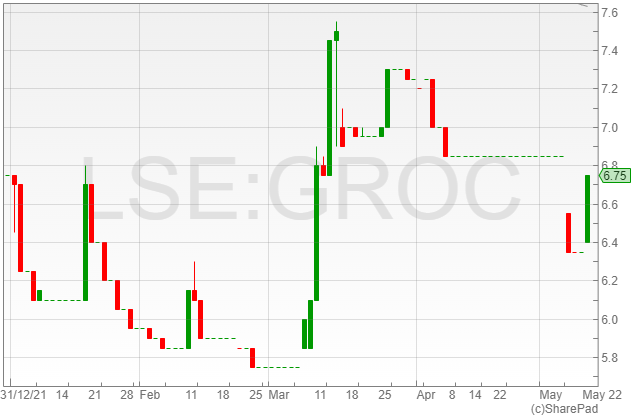

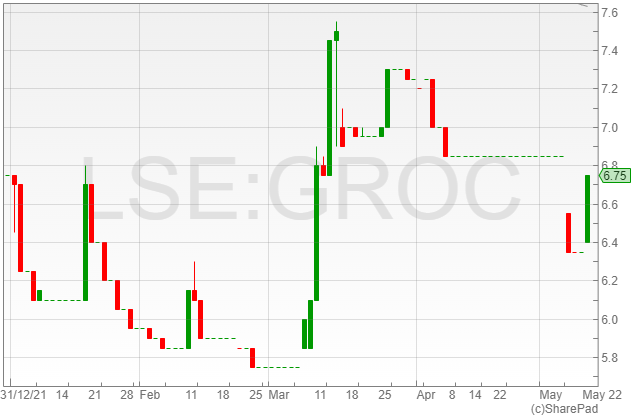

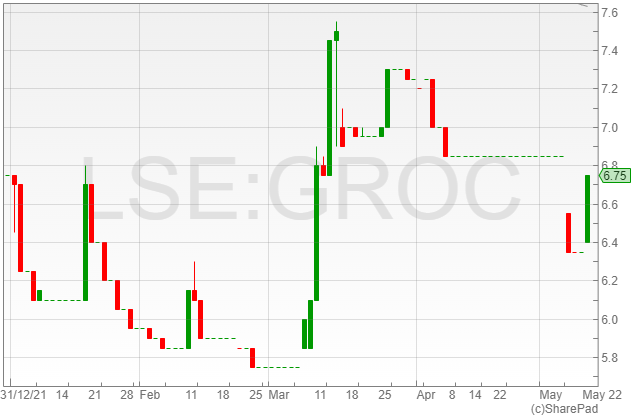

GreenRoc Mining shares increase 6.3% to 6.7p following the firm’s revised resource estimate for its Amitsoq graphite deposit to 5-15 million tonnes (mt) at a grade range of 18%-22% graphitic carbon (cg) compared to its initial estimate of 1.7-4.5 mt at a grade range of 24%-36%.

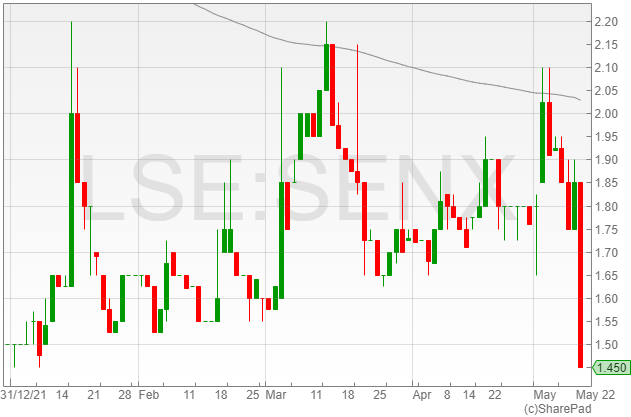

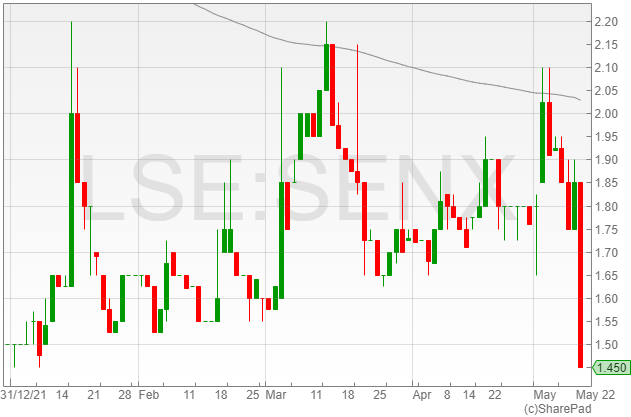

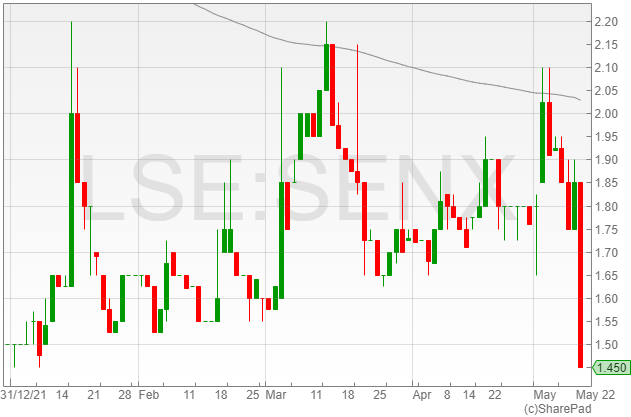

Serinus Energy shares plummeted 21.6% to 1.4p following a 47% plunge in production in Q1 2022.

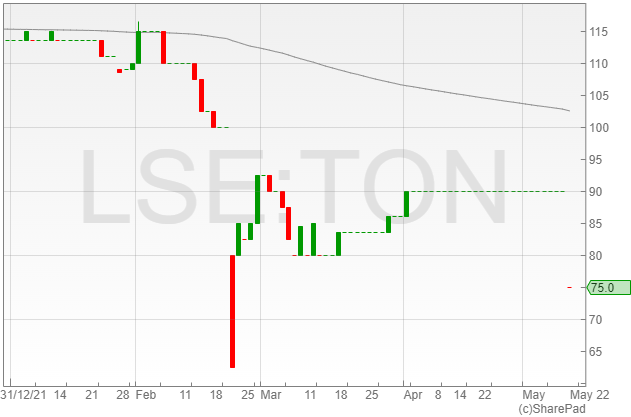

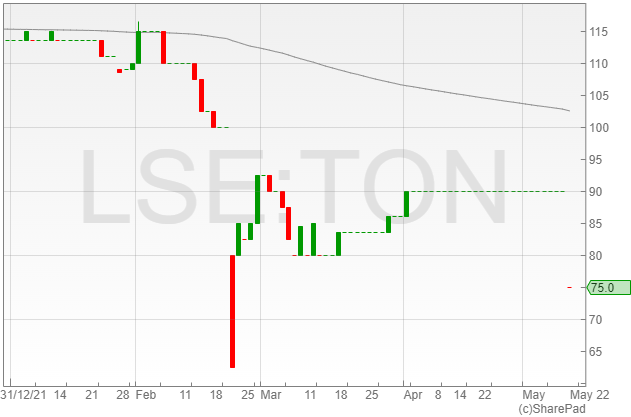

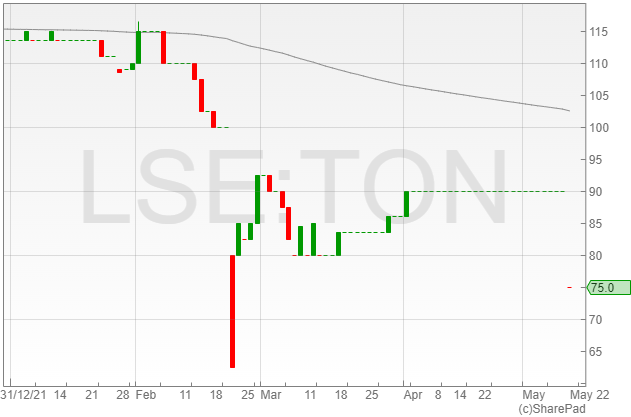

Titon Holdings shares dropped 16.6% to 75p after the Titon swung to a pre-tax loss in FY1 2022 of £250,000 from a profit of £550,000 year-on-year.

“We are disappointed with the trading performance of the Group over the six months period to 31 March 2022, which, despite good levels of sales in the UK has resulted in a loss for the period,” said Titon Holdings CEO Keith Ritchie.

“We continue to be impacted by the constraints in supply of raw materials and components but are hopeful that some of these supply chain pressures will reduce in H2.”

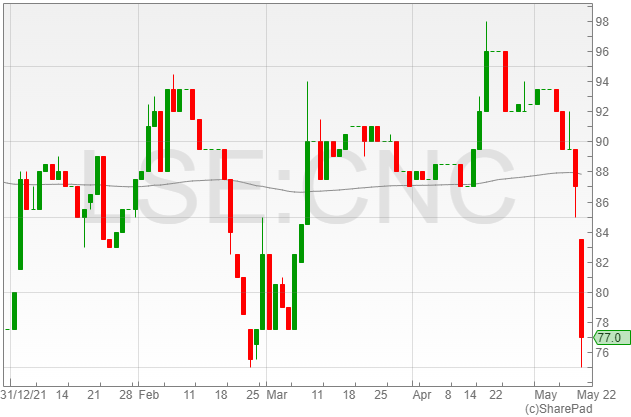

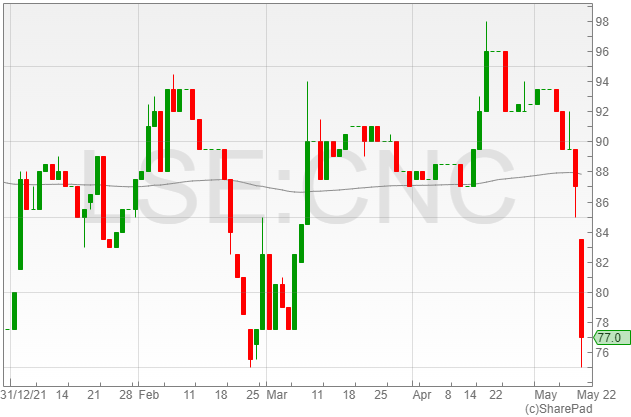

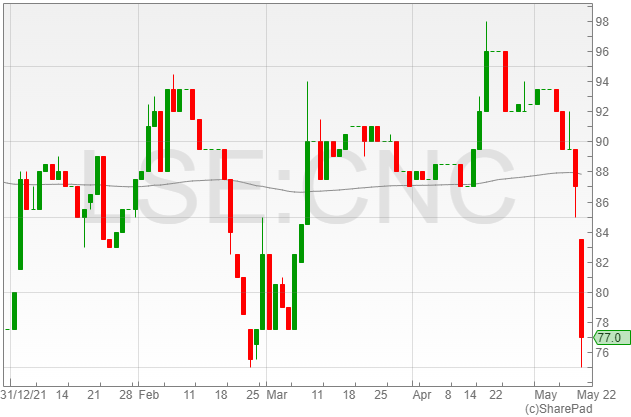

Concurrent Technologies shares dropped 11.4% to 77p on the back of company warnings over component shortages impacting ship product capabilities and a subsequent expected delay in recognised revenues.