The FTSE 250 was down 0.6% to 20,986.8 and the AIM was down 0.4% to 1,055.2 on Tuesday as the breakdown of Russia-Ukraine peace talks and the spiking cost of living dampened investor optimism heading after the easter break.

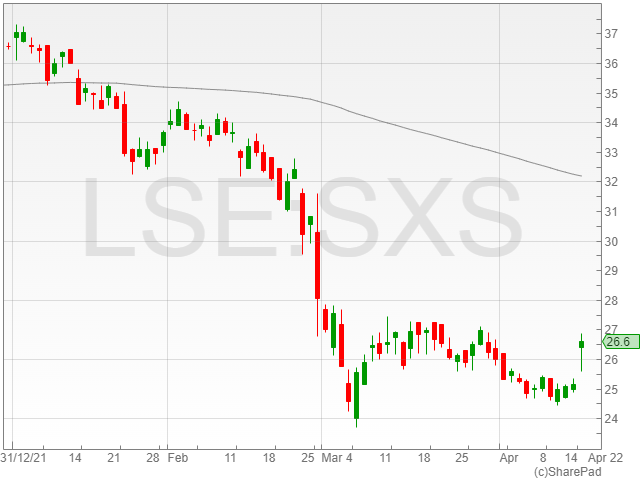

Spectris shares increased 5.5% to 26,540p after the company reported its divestment of Omega Engineering to Arcline Investment Management, along with its upcoming £300 million share buyback scheme.

“Today’s announcement is yet a further example of our approach to optimising our assets and successfully divesting businesses at multiples higher than the group as a whole,” said Spectris CEO Andrew Heath.

“This disposal, in conjunction with the share buyback programme, delivers clear value for shareholders, whilst also allowing us to take advantage of new growth opportunities for our core businesses, in line with our purpose.”

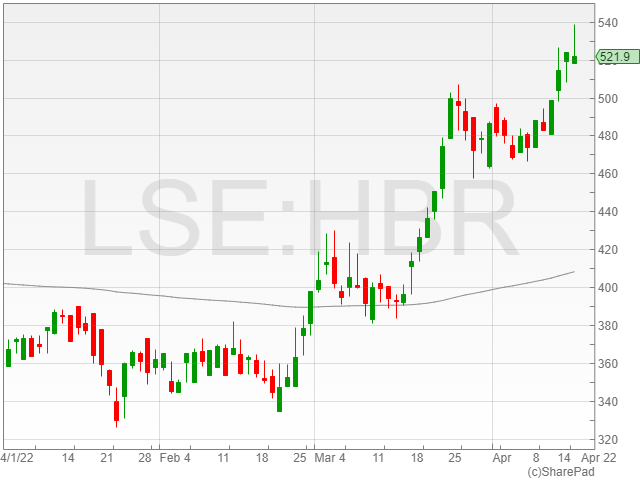

Harbour Energy shares rose 0.9% to 524.5p after the company reported its exit from the North Falkland Basin, with Navitas scheduled to buy all the shares in Harbour’s indirectly held subsidiary POEPL, via which Harbour holds its rights in the North Falkland Licenses.

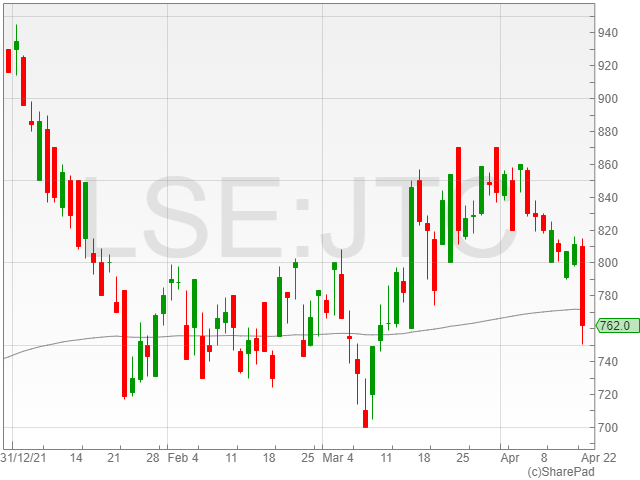

JTC shares saw a decline of 6.4% to 758p following the group’s 57.2% drop in operating profits to £9 million compared to £21 million last year.

However, the company noted a pre-tax profits hike of 147.2% to £27.8 million against £11.2 million year-on-year.

The SSP Group fell 5.9% to 230p after Deutsche Bank reduced the stock to a hold from a buy recommendation and cut the firm’s price target to 265p from 333p.

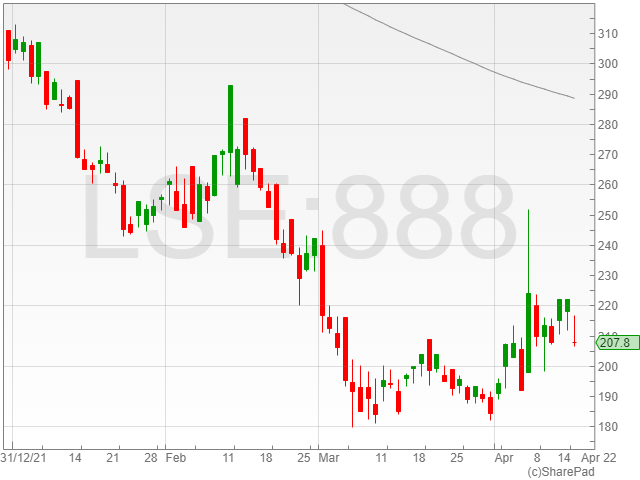

888 shares dipped 3.7% to 210p following Berenberg’s ‘buy’ recommendation, with a price target cut to 500p compared to 545p.

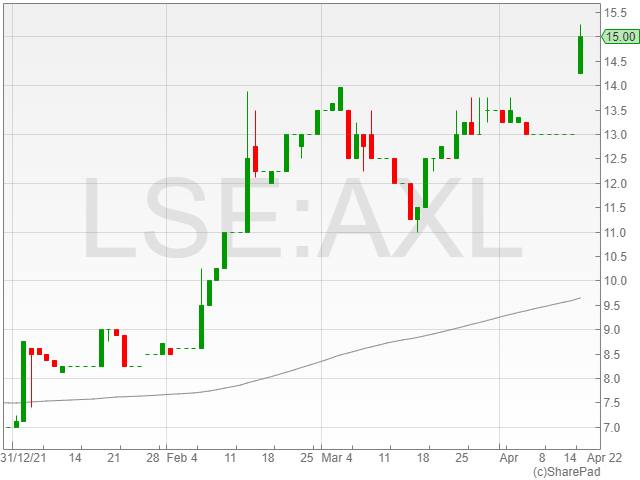

Arrow Exploration Group shares increased 15.3% to 15p after the company reported positive results from its RCE-2 Well, following its spudding on 2 April and its total drilled depth of 9,674 ft from 14 April.

The RCE-2 Well’s casing was finished on 18 April and cementing has been scheduled for 20 April, followed by a production testing programme.

“From the data we have, several of the pay zones are attractive and like the RCE-1 well, we believe more than one pay zone will be productive,” said Arrow Exploration CEO Marshall Abbott.

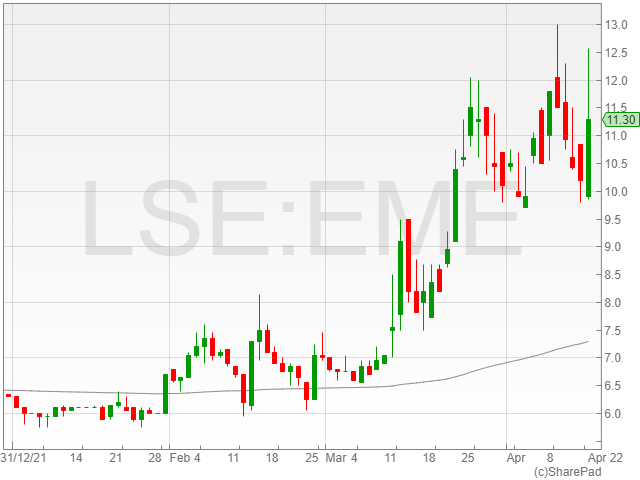

Empyrean Energy shares rose 10.5% to 11.2p after the firm announced elevated methane levels in its Jade drilling update, supporting the company’s prediction of light oil in the Chinese prospect.

“Drilling operations continue to run smoothly and safely, with progress to date right on schedule,” said Empyrean Energy CEO Tom Kelly.

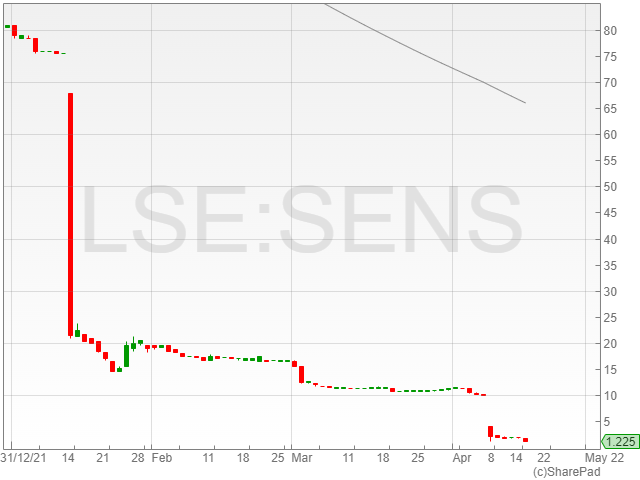

Sensyne Health shares plummeted following the firm’s proposed delisting from the AIM junior market, pending approval from shareholders at its general meeting on 20 May.

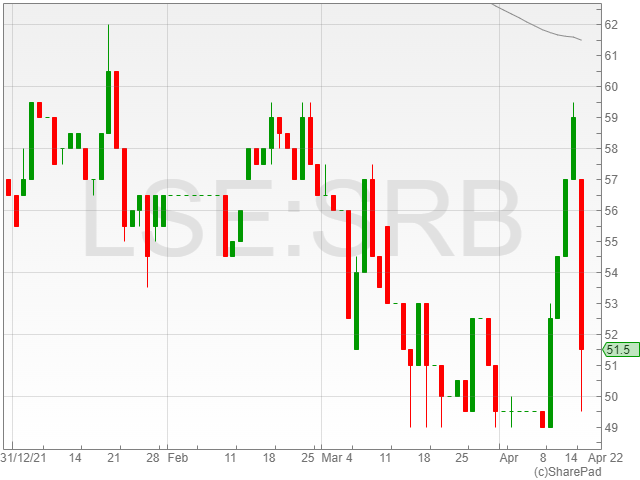

Serabi Gold dropped 13.5% to 51p after its 13% decline in gold production over the first quarter to 7,062 ounces from 8,087 ounces year-on-year had a reported knock-on effect on its full-year production guidance.

“At Palito, the first-quarter production results have been disappointing with 7,062 ounces produced, and while March was a significantly better month with improved grades and production, it was not possible to recover earlier shortfalls in planned production,” said Serabi Gold CEO Mike Hodgson.

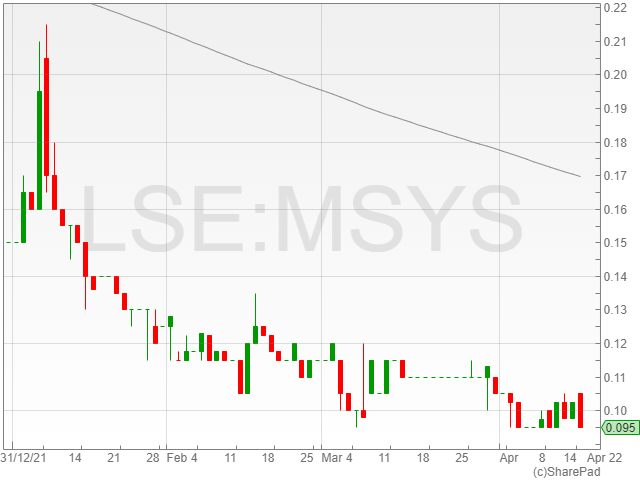

Microsaic Systems shares dropped 7.3% to 0.09p following the company’s announcement of a manufacturing services framework and initial contract with Innovenn UK Limited worth £400,000.

The agreement will reportedly see Microsaic refine and miniaturise existing monitoring technology for environmental and human health diagnostics.

“Microsaic’s business model has been transitioned to offer additional services which leverage the considerable depth and breadth of technical design, engineering and delivery expertise within its team,” said Microsaic acting executive chairman Gerard Brandon.

“By offering the skillsets that created the smallest compact mass spectrometer in the world, partner customers such as DeepVerge can outsource their engineering development of existing and new monitoring equipment and concentrate on growing their business.”