The FTSE 250 was down 0.17% to 21,138.7 and the AIM was flat at 1,055.4 on Monday, as London more domestic facing markets suffered after the latest UK GDP figures reported a dismal 0.1% growth in February.

“It’s a difficult time to be an investor given how markets stubbornly refuse to break out into a decent rally. So far this year we’ve had enough ups and downs to make anyone owning shares and bonds travel sick,” said AJ Bell financial analyst Danni Hewson.

“The new trading week got off to another mixed start, with markets initially down across Europe and Asia before some territories managed to make positive progress.”

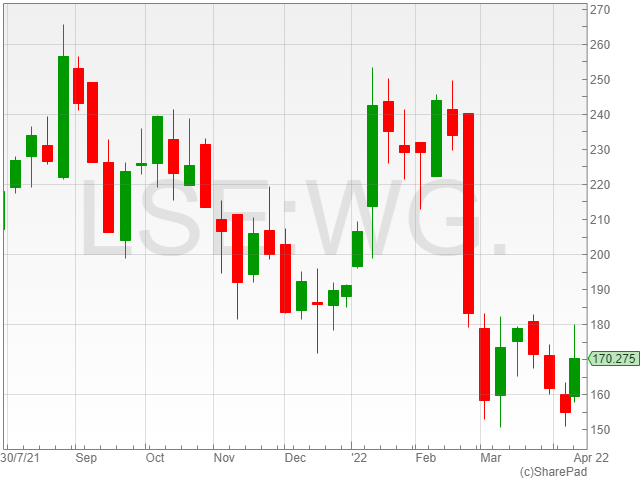

The Wood Group was up 13% to 175p after the company reported a guided revenue of £6.4 billion ahead of its annual results on 20 April.

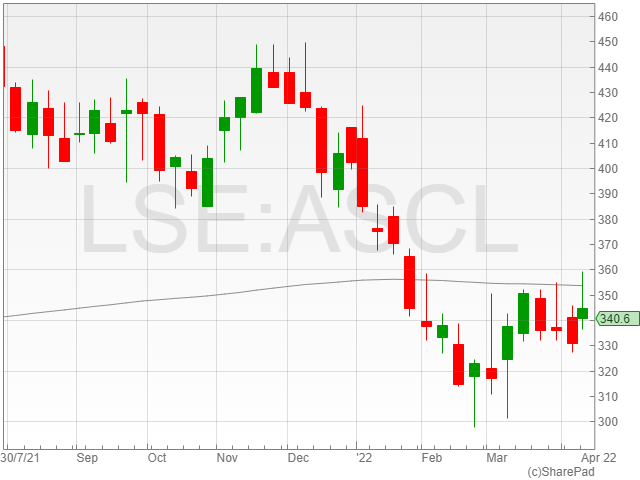

Ascential shares rose 3.8% to 343.7p following a statement that it was discussing “the merits” of separating some of their assets by potentially demerging its digital sector and listing it in the US.

“We are not hugely surprised to note this development given Ascential management’s long-standing commitment to maximising shareholder value and optimising the group’s portfolio of businesses,” said Shore Capital analyst Roddy Davidson.

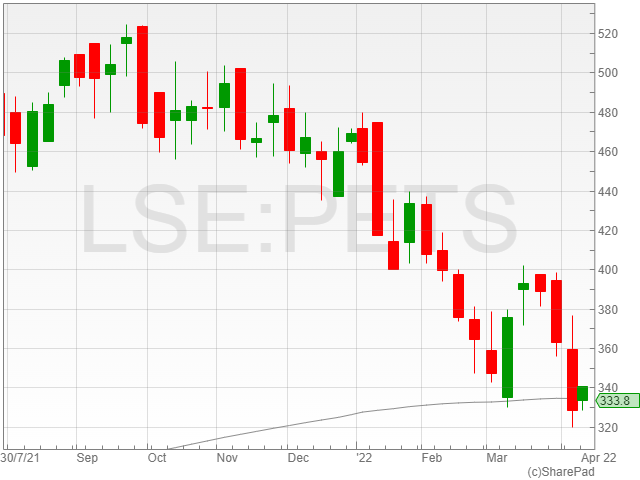

Pets at Home enjoyed a 1.5% rise to 333.7p on the back of Berenberg’s “buy” recommendation of the shares.

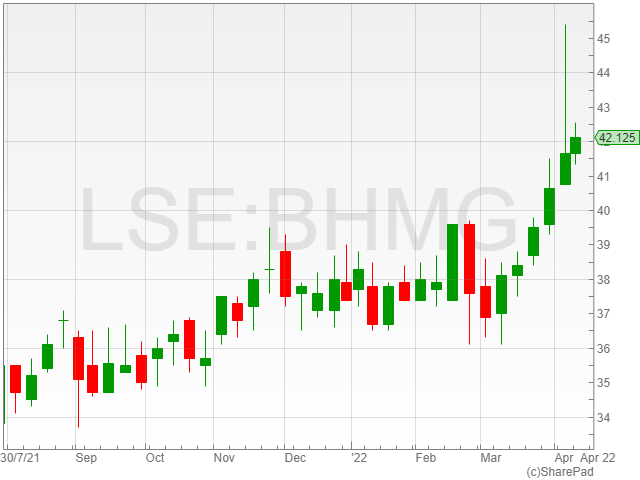

BH Macro Limited shares increase 1.2% to 42,150p after a report from Kepler Trust Intelligence assured investors of the company’s high diversification and impressive track record so far in 2022, noting its NAV performance rise of 5.5% in March alongside its exposure to rising interest rates.

Aston Martin Lagonda Global Holdings fell 6.1% to 816.2p after Goldman Sachs cut the group’s price target to “neutral.”

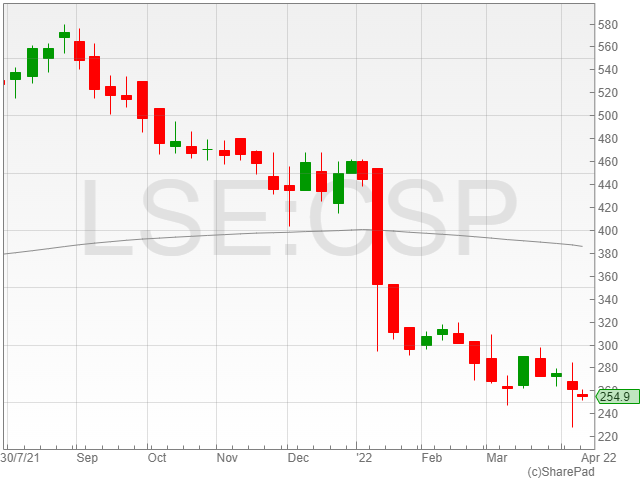

Countryside Properties continued its decline with a 2.4% fall to 254.5p following its selection of “execution-related” failures across its properties and a heads-up warning of the company’s half-year revenue fall of 13%, alongside the group’s 42% drop in adjusted operating profit over the past year reported last week.

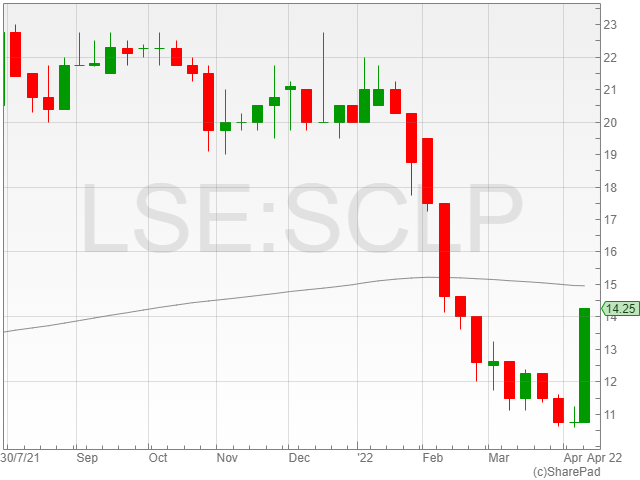

Scancell Holdings shares spiked 27.9% to 13.7p after the firm announced the opening of trial recruitment for its first-in-human clinical trial with its Modi-1 treatment for patients with triple negative breast cancer, ovarian, head, neck and renal cancer.

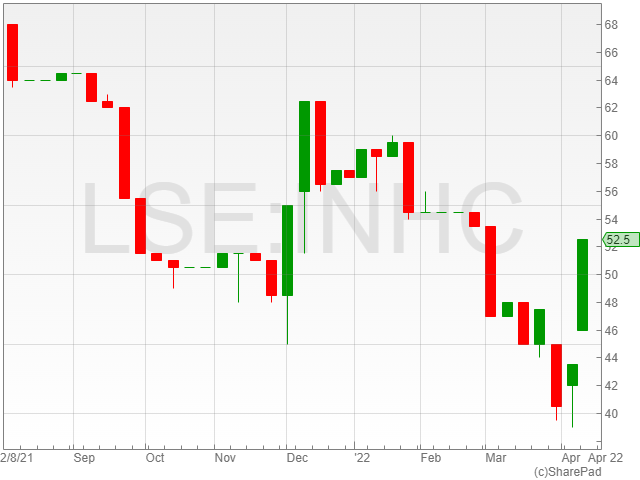

Induction Healthcare shares rose 20.6% to 52.5p following the company’s reported £6.6 million in annual recurring revenues for its Induction Attend Anywhere, after the NHS renewed 94% of its existing contracts with the digital health platform for its remote consultation programme, vastly exceeding management expectations.

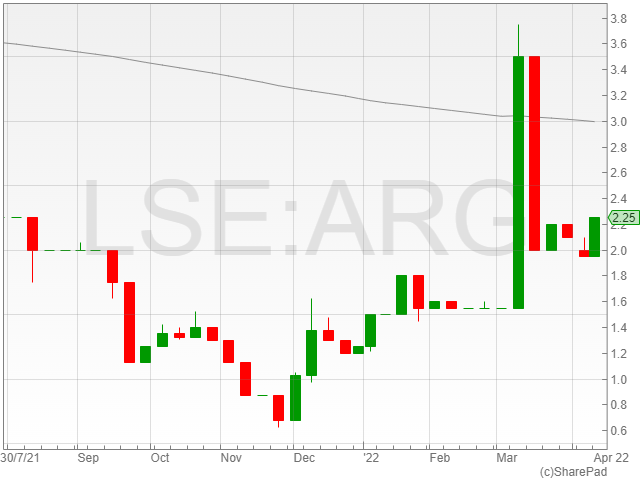

Argos Resources enjoyed a boost of 15.3% to 2.2p after the oil and gas exploration company announced the provision of a second term for its PL001 licence from 1 May to 31 December from the Falkland Islands government.

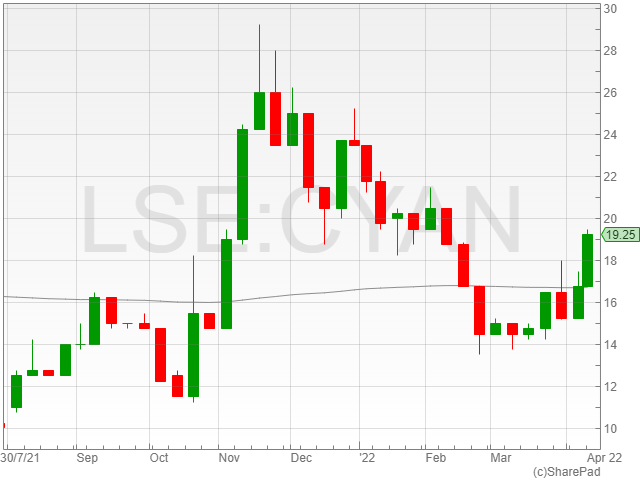

CyanConnode Holdings shares rose 14.9% to 19.2p on the back of a successful multi-million pound contract in the Middle-East and North Africa region (MENA), and a £2 million fundraise which the company is set to use for investment in short-supply inventory components.

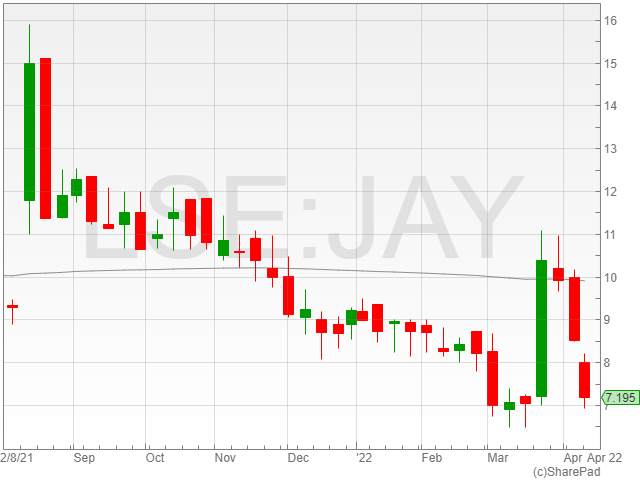

Bluejay Mining shares took a dip of 16% to 7.1p after the group released an update from its Disko-Nuussuaq Field programmes, in which the company opted to double its collection and analysis of modern data for its entire suite of projects and commence diamond drilling in 2023 instead of the original timeframe for 2022.

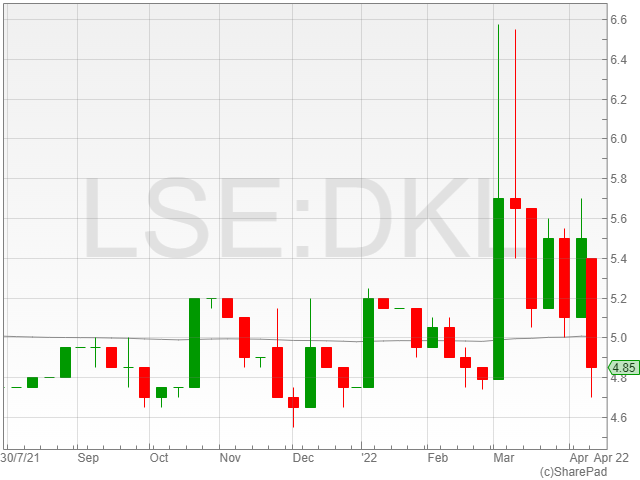

Dekel Agri-Vision shares fell 10.9% to 4.9p following the firm’s March palm oil production and cashew project update, which revealed that the company’s palm oil production was 50.5% lower in March 2021 than it was in March last year due to a seasonal production change across the Cote d’Ivoire, Ghana and Nigeria.

The group’s cashew production was also reported at 15% capacity in the interim period due to Dekel awaiting the arrival of key equipment to commence proper production for the project.