The UK’s Small & Midcap indices joined European indices in a strong rally with the FTSE 250 trading up 1% to 20,121 and the AIM All-Share index up 0.6% to 961.6 on Tuesday.

FTSE 250

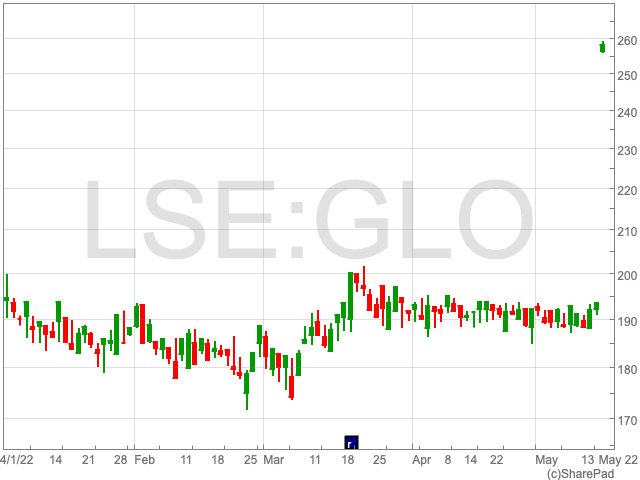

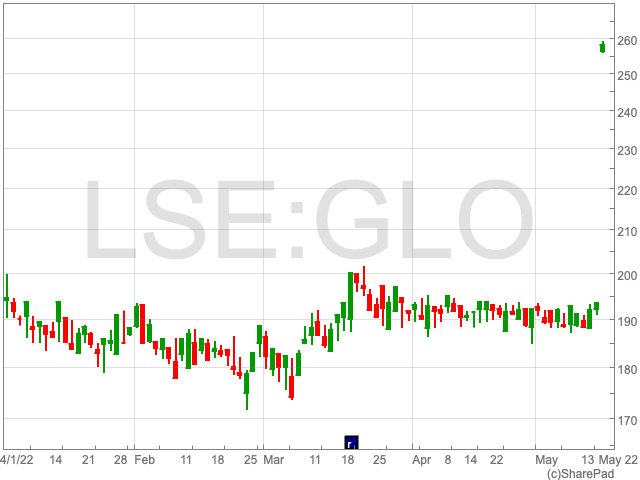

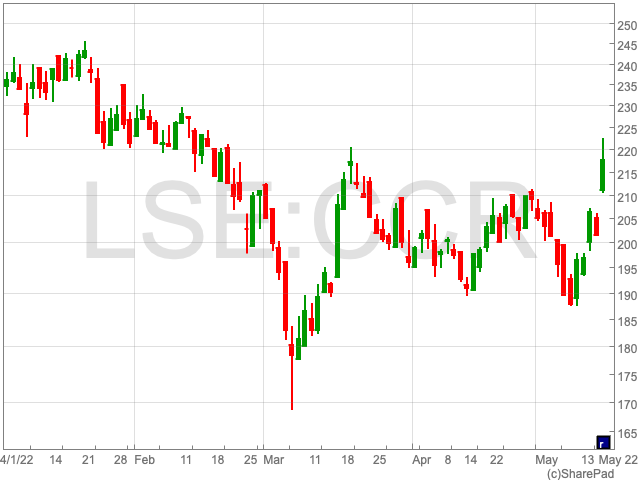

ContourGlobal shares skyrocketed 32.5% to 256p after the group agreed to a £1.75bn takeover bid from Kohlberg Kravis Roberts & Co which is a US private equity firm.

“Power generation business ContourGlobal, which has struggled to gain traction on the stock market after a 2017 IPO, looks set to disappear from London as private equity firm KKR swooped for its portfolio of energy projects from across the world,” says Russ Mould, Investment Director, AJ Bell.

“With Contour set to recommend the takeover offer, which is pitched at a healthy premium, the deal looks like a fait accompli at this stage.”

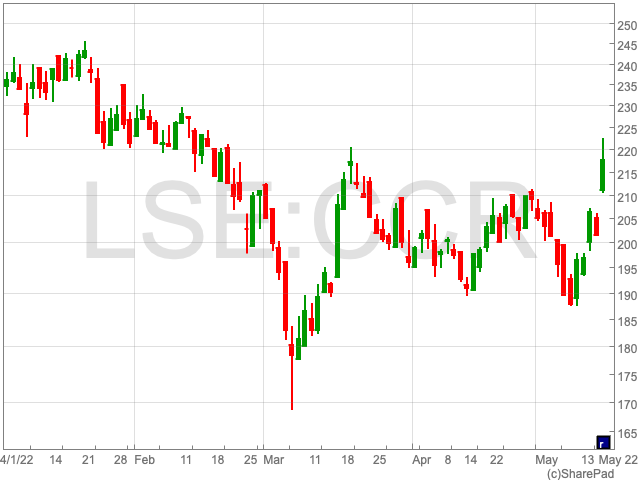

C&C Group shares rose 6.1% to 217.5p following the group’s final results in which it noted a pretax profit of £45.7m compared to a loss of £121.3m in 2021 due to restrictions easing and increased demand for the group’s drinks. C&C recorded a rise in revenue from £1.02bn to £1.79bn in 2022.

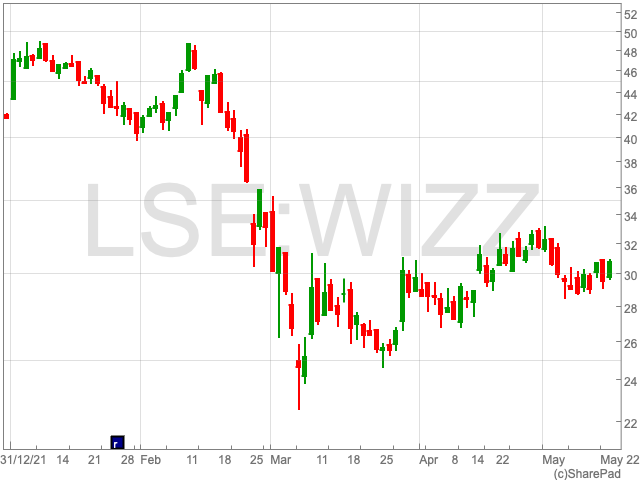

Wizz Air’s shares jumped 4.2% to 3,077p after the company revealed plans to apply to the EU Aviation Safety Agency and the Malta Civil Aviation Directorate for an air operator’s certificate and an operating licence for its Malta subsidiary. Wizz Air Malta, a new airline subsidiary in Malta, is expected to begin operations in October.

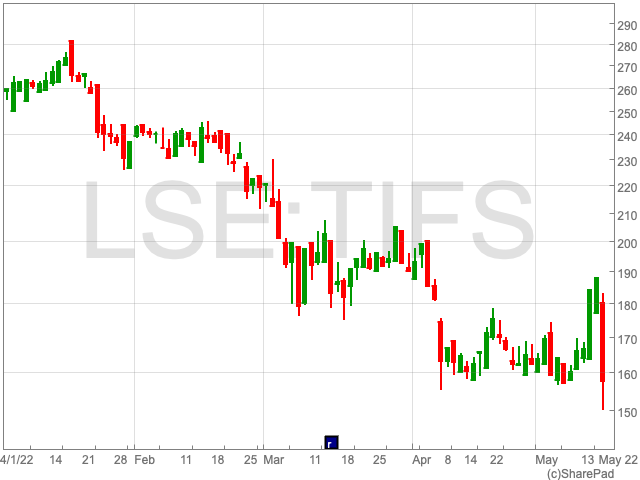

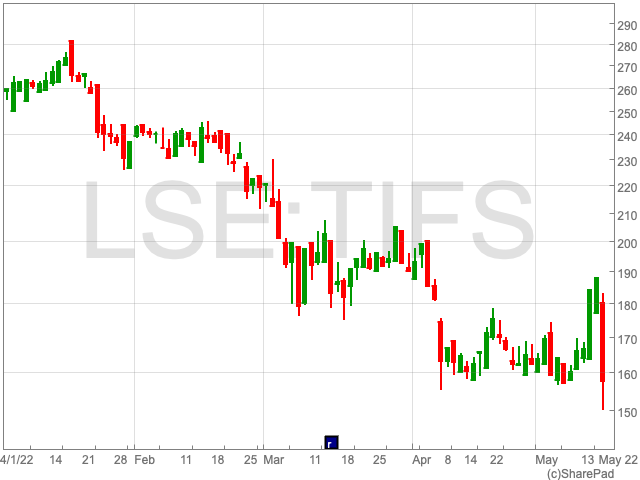

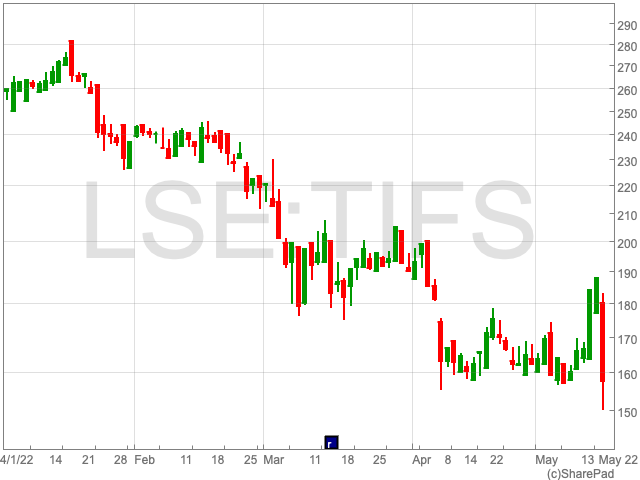

TI Fluid System shares fell 16.2% to 157.6p, following TI Fluid System’s trading update, which stated that margins in the first half of 2022 will be “modestly” lower than H2 2021 due to production problems due to conflicts in Ukraine and lockdowns in China, continued inflation, and a time lag on recoveries. However, the company stated that it expects to outpace revenue in 2021, but it did not indicate how much.

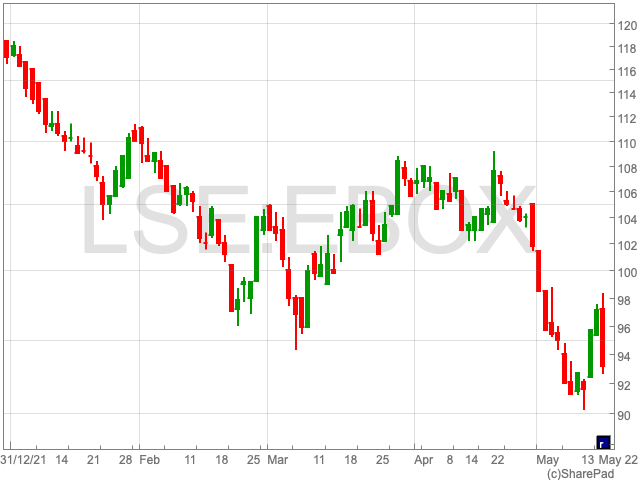

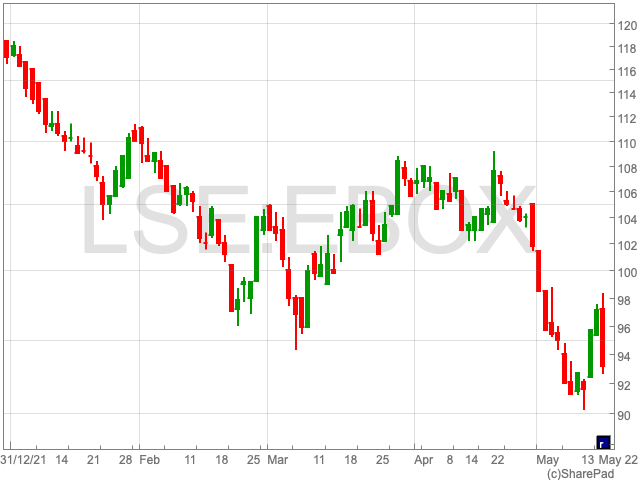

Tritax Eurobox shares fell 4.1% to 93.1p despite the group reporting a “strong” financial performance in H1 2022 due to signing leases on two assets worth €1.3m. The group’s pretax profit more than doubled from €41.2m to €109.2m and rental income rose 42% to €27.6m in 2022.

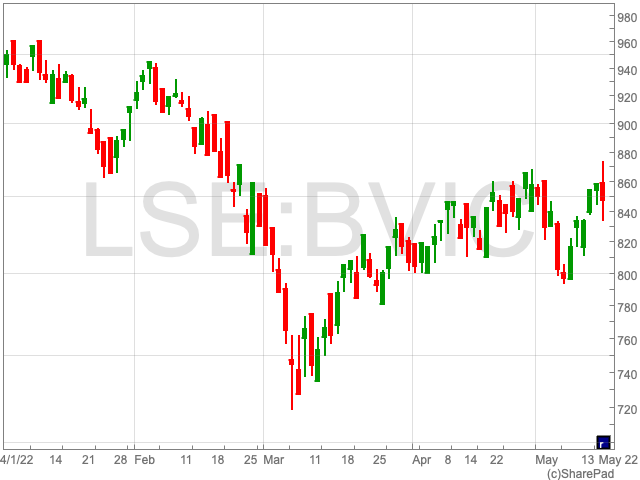

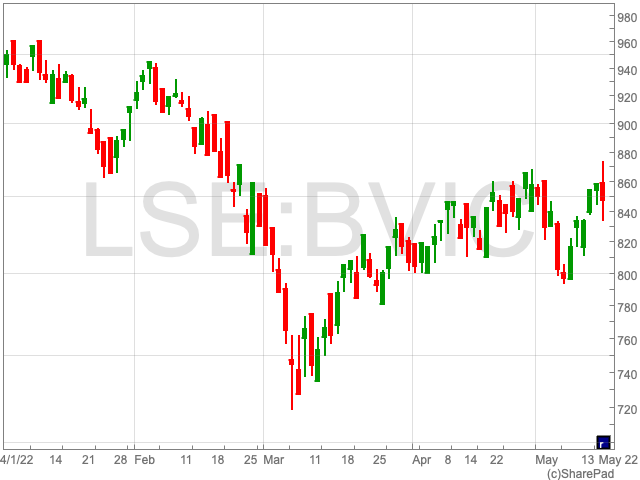

Britvic shares fell 1.1% to 845.5p as the group expects inflationary pressure and changing consumer behaviour to hurt sales in 2022. However, in its half-yearly results, the group noted a “strong” financial performance with a 17% rise in revenue from £617.1m to £719.3m. Britvic’s pretax profit soared 49% to £59.3m from £39.8m in 2021.

AIM All-Share

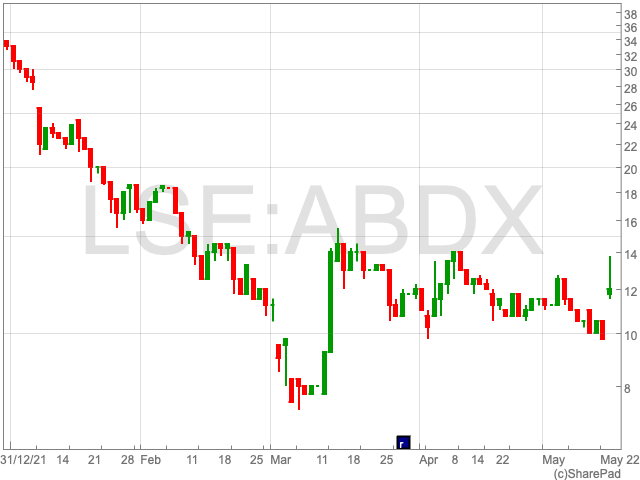

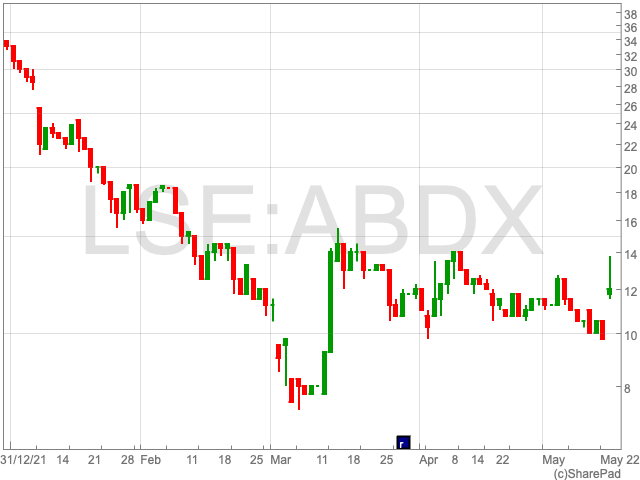

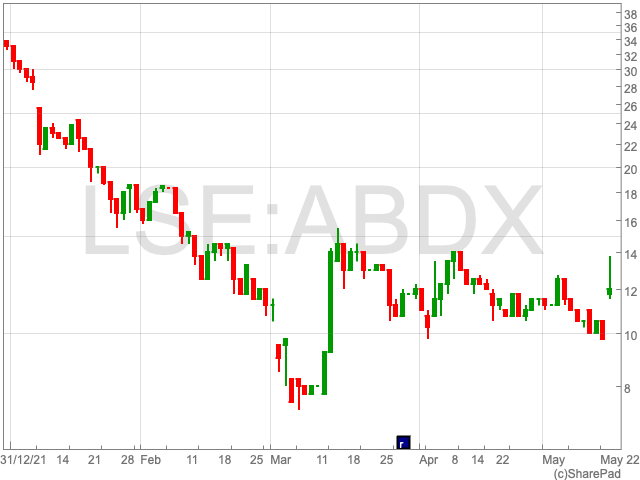

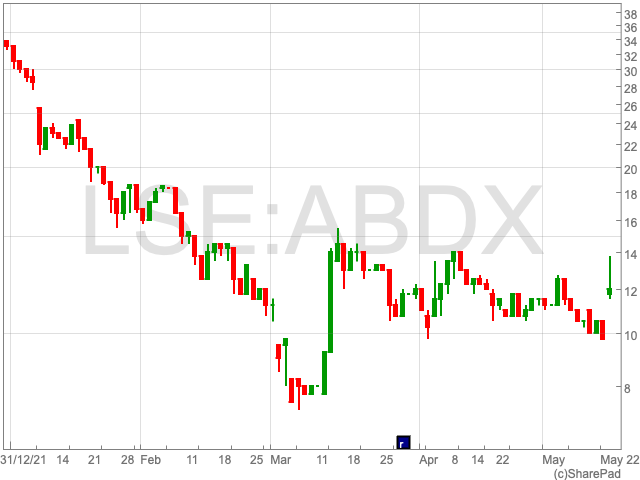

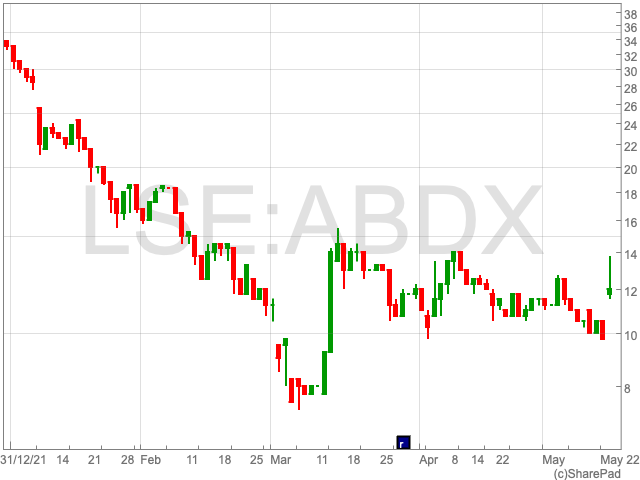

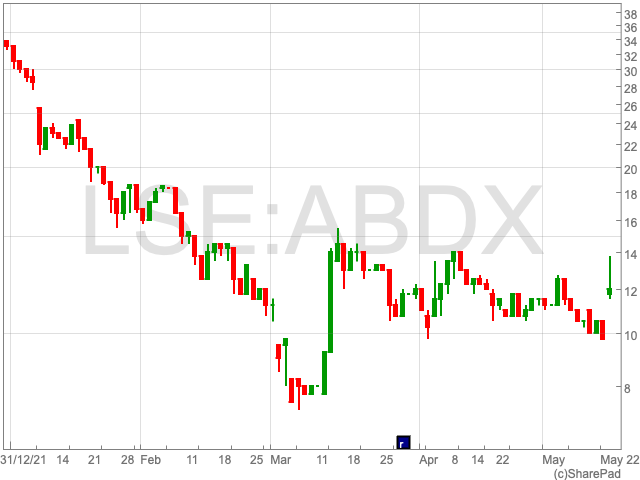

Abingdon Health shares were trading up 20.5% to 11.75p after the group signed a significant European contract with an unnamed European customer for £2.7m, to supply components for a Covid-19 rapid antigen test. The contract is currently for a period of 12 months with the option to extend later.

Corcel shares gained 14.3% to 1.4p following the announcement of the mining company completing its MRE on its Wowo Gap nickel-cobalt project in Papua New Guinea, a project it recently acquired.

The MRE proves Wowo Gap as a deposit of similar size and grade to Mambare, another company project in Papua New Guinea, where the deposit is predicted to contain 110m tonnes at 0.81% nickel for 891,000 tonnes of contained nickel and 0.06% cobalt for 66,000 tonnes of contained cobalt.

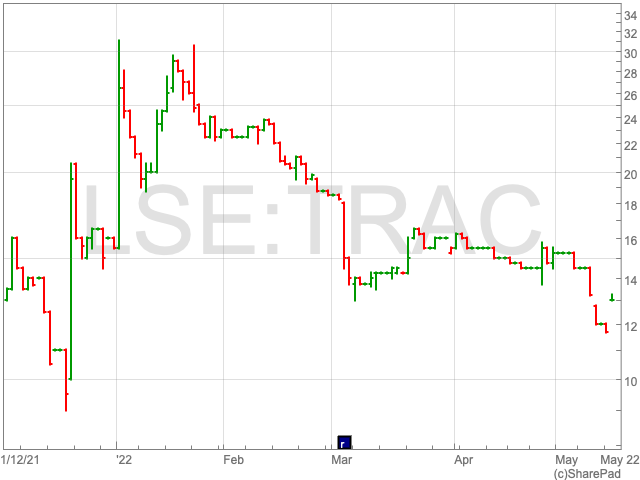

T42 IoT Tracking Solutions saw its shares climb 11.11% to 13p after the security firm for the freight industry announced a commercial order from Olimp Bulgaria, a global leader and exporter of security seals, for its tracking solutions and services.

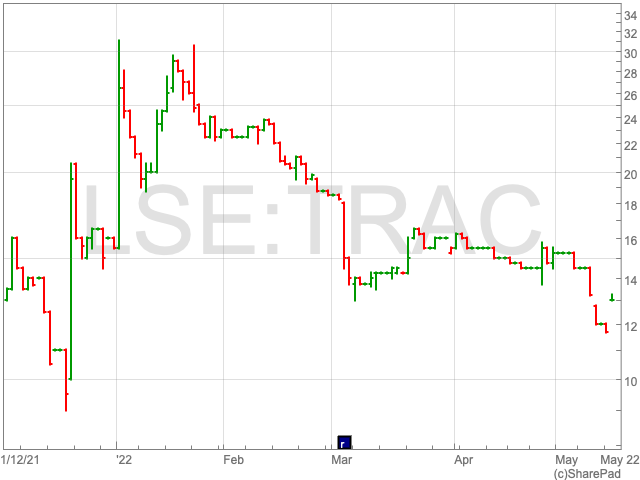

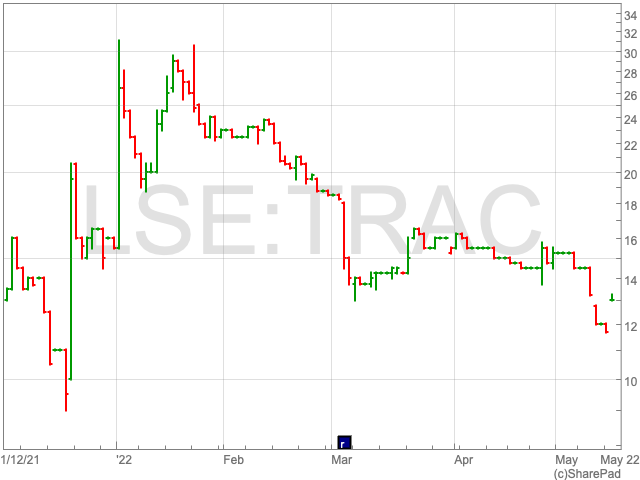

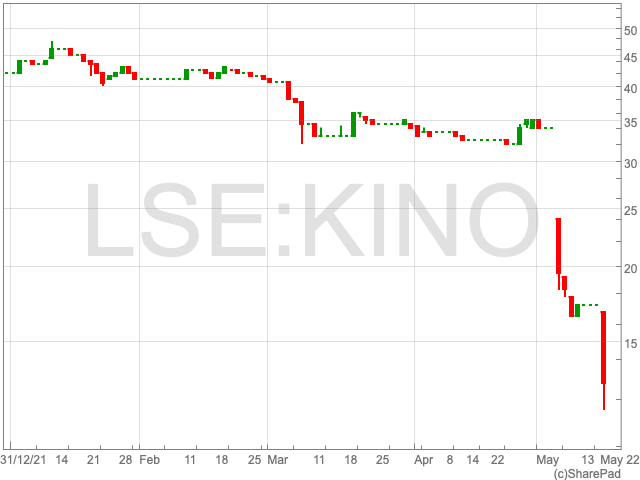

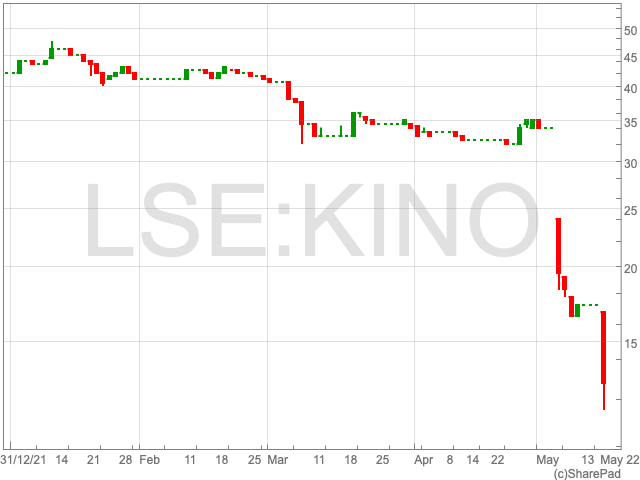

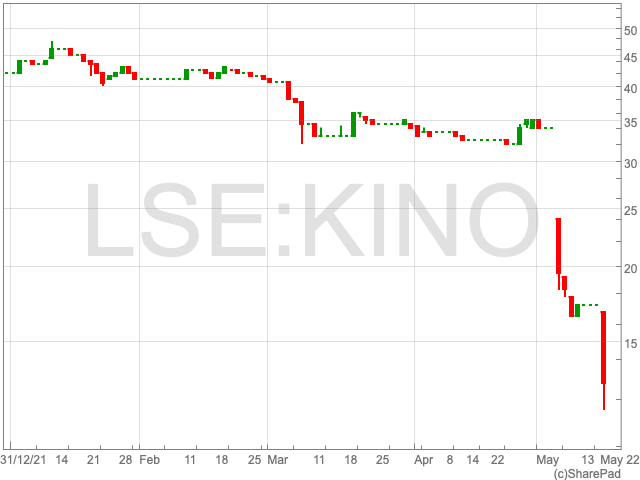

Kinovo shares tanked 26.1% to 12.8p after the property services company announced its subsidiary DCB Kent has engaged two partners of CFS Restructuring as joint administrators. Kinovo is calculating the impact of DCB’s administration based on the funds it has advanced to the subsidiary to sustain its working capital, which is presently £3.7m.

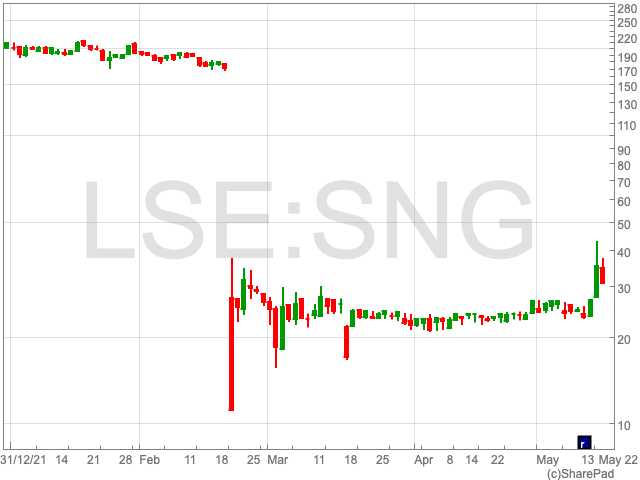

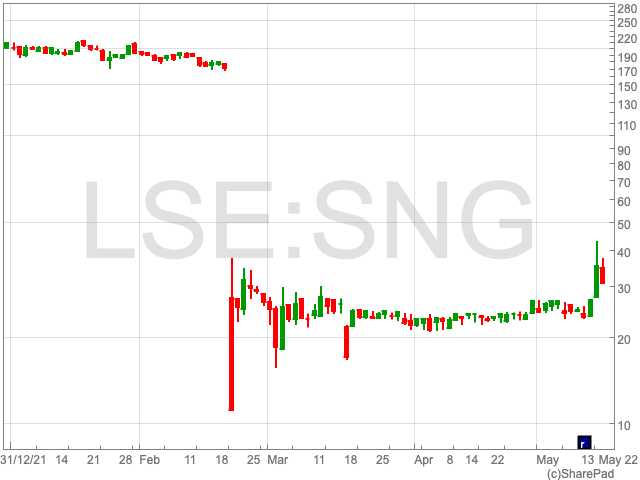

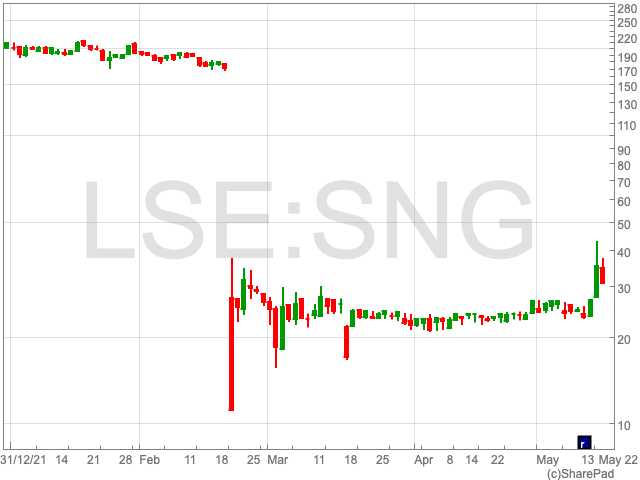

Synairgen shares reversed 13% to 30.4p after the company stated that an analysis revealed higher treatment effects with SNG001 in high-risk patient sub-groups, with major impacts shown in individuals who had clinical evidence of reduced respiratory function on Monday.

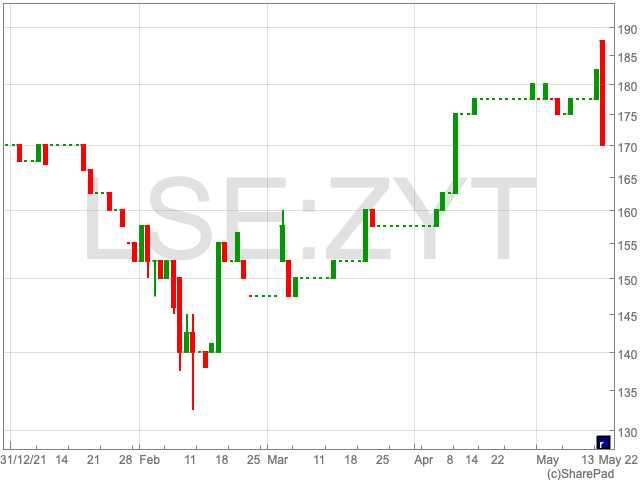

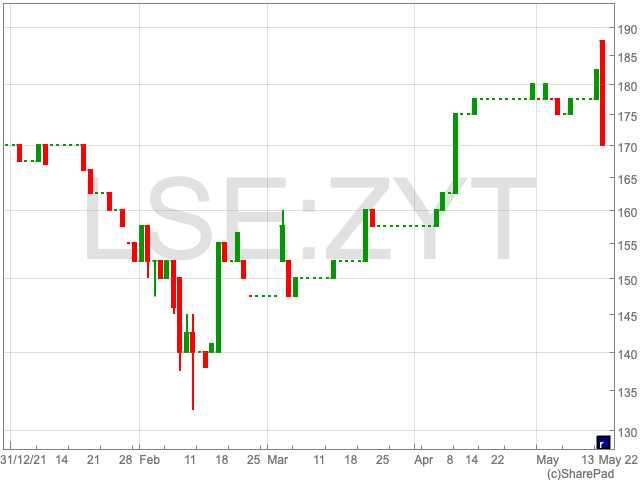

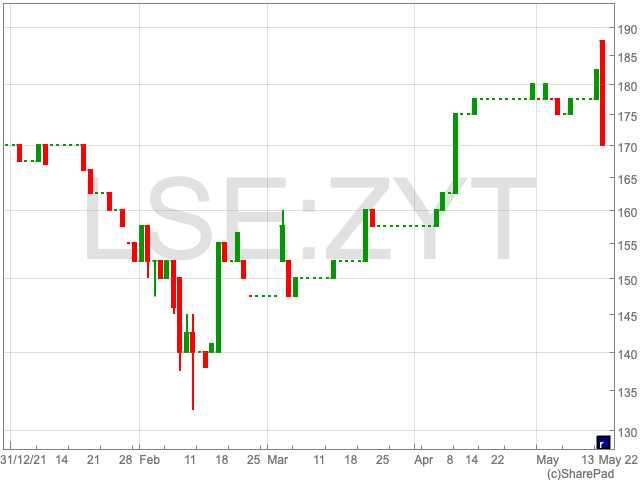

Zytronic shares dropped 6.9% to 170p as the group announced the decision to not pay interim dividend in 2022, which is the same as 2021. However, the group did say they will consider a final dividend. Zytronic recorded a 23% rise in revenue to £5.9m and swung to profits of £399k from losses of £314k in 2022.