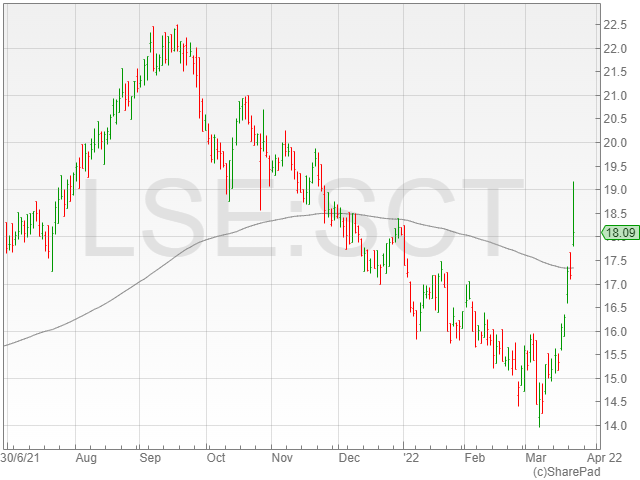

Softcat saw its shares increase 7.9% to 1,849.3p in early morning trading on Tuesday after the company released a 33% rise in revenue and a 12.4% increase in operating profit.

The IT firm reported revenue of £770.9 million compared to £577 million in 2020.

Softcat noted increased operating profits of £64.1 million against £57.1 million in 2020, alongside a gross profit of £150.2 million compared to £134.5 million in 2020.

The IT group attributed its successful results to strong growth across key income and profit measures.

Softcat reported that the income drivers have been broad-based, with progress across hardware, software and services, despite Covid-19 related supply chain issues.

The company reported a 12.4% increase to £30,200 in average gross profit per customer, alongside an increase in its customer base.

The company mentioned its operating profit for the half-year term had already exceeded company expectations, and Softcat reportedly predicts the following half-year to outperform preliminary projections into 2022.

Softcat currently has a PE ratio of 35.7 and a forward PE ratio of 35.3, indicating analyst expectations of company growth over the coming year.

“The Company continued to perform well across all areas of the business in the first half,” said Softcat CEO Graeme Watt.

“Transaction numbers grew strongly as we saw more customers emerge from the impacts of the pandemic, and this drove a 12.4% expansion in gross profit per customer.”

“All customer segments made good progress which included an acceleration in our enterprise business.”

“Various industry data and commentary suggest the overall market has maintained a mid-single digit growth rate which indicates that we have continued to gain share.”