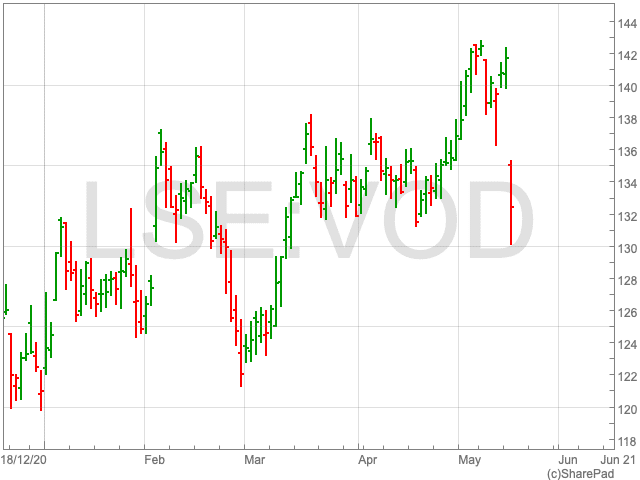

Vodafone Share Price

The Vodafone share price (LON:VOD) is down by over 6% on Tuesday. This move happened because the FTSE 100 company’s annual profits came in below expectations. Year-to-date the stock remains up by 10%, having made solid gains so far. Going further back to this time last year, it is up by around 5%, after a mini-resurgence following the coronavirus-induced crash. Investors will want to know if today’s fall marks the end of its bull-run in 2021, or if it presents an opportunity for value.

Results

Vodafone saw its revenue drop last year as its roaming and visitor numbers fell due to the pandemic. The FTSE 100 telecommunications company recorded a fall in its adjusted earnings by 1.2% to €14.4bn for the year to March. The company’s savings totalling €500m acted as a buffer.

It was at the bottom of its guidance range and was lower than the €14.5bn expected by analysts. Vodafone’s revenue fell by 2.6% to €43.8bn, while its net debt rose to €40.5bn.

These numbers are what caused the Vodafone share price to plummet today by 6%.

Vodafone’s guidance on Tuesday is for a minimum dividend of 9 eurocents per share. However, there was no hint at increasing the payout. At 5.8%, Vodafone’s current dividend yield is well above average.

There may be some concern that the company may struggle to maintain a dividend which it cut significantly in 2019.

Looking Ahead

Vodafone committed to spending money to upgrade its existing networks. The company will provide hundreds of millions of euros into its telecoms networks in an effort to secure a competitive advantage.

Over the past year Vodafone said it increased its capital expenditure by €500m. It also committed to going further. The telecommunications giant noted that 70% of the EU’s €750bn pandemic recovery fund, aimed at giving loans and grants to encourage investment, will be focused on markets where Vodafone operates.

A commitment to spending in order to bring about growth, along with the continued UK recovery, could be crucial in securing the Vodafone share price over the coming months.