Adsure Services Investor Presentation November 2025

Watch the online presentation for Adsure Services, featuring CEO Kevin Limn.

Adsure Services PLC specialises in providing dynamic support to organisations navigating the complex world of strategic risks.

The company’s portfolio of advisory and assurance services is designed to align with the key economic risks shaping today’s business landscape. With dedicated teams of specialists, the firm delivers bespoke solutions tailored to specific organisational challenges.

Empowering businesses to seize opportunities and thrive in an ever-evolving environment, Adsure Services stands ready to support the journey toward long-term success.

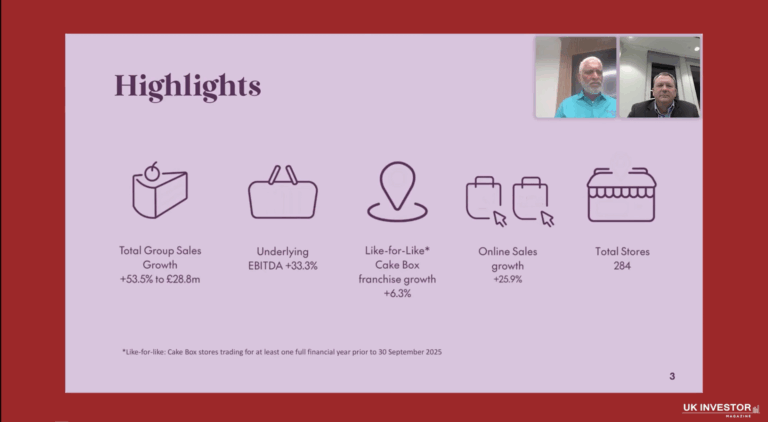

Cake Box Investor Presentation November 2025

Watch Cake Box Investor Presentation, featuring CEO Sukh Ram Chamdal.

A request from his daughter for an egg-free fresh cream birthday cake inspired businessman Sukh Chamdal to launch his first concept store in London in 2008. In 2018, with 91 stores, Cake Box was listed on AIM. It now has a franchise estate of 250+ locations, and aims to reach 400.

Cornish Metals Investor Presentation November 2025

Watch the online presentation for Cornish Metals, featuring Chief Development Officer Fawzi Hanano.

Cornish Metals is a dual-listed company (AIM / TSX-V: CUSN) focused on advancing the South Crofty high-grade, underground tin project towards a construction decision. South Crofty is a strategic tin asset in the UK and covers the former producing South Crofty tin mine in Cornwall which closed in 1998 following over 400 years of continuous production.

Aquis weekly movers: Valereum planning fundraising through US listed vehicle

Valereum (LON: VLRM) has entered into an agreement to raise $200m of royalty and streaming capital from new special purpose segregated portfolio company, Valereum QGP-SP, which is being formed to list on a US National Exchange. There will be a one year option over a stake of 49.9% in Valereum in return for the royalty and streaming income. This will help to accelerate development of the crypto and blockchain platforms and finance acquisitions. The share price jumped 146% to 14.75p.

Digital asset company Vaultz Capital (LON: V3TC) holds 135 Bitcoin. Two resolutions related to a share capital reorganisation and a reduction in nominal value were withdrawn from the AGM following shareholder feedback. The share price bounced back 53.3% to 2.875p.

Ajax Resources (LON: AJAX) had cash of £1.37m at the end of August 2025. It is in the process of acquiring the Paguanta silver lead zinc project in Chile. Drilling should commence soon at the Eureka project. The cash will finance this and a JORC compliant mineral resource estimate. The share price gained 34.9% to 7.25p.

AI software company IntelliAM AI (LON: INT) has won contracts in the building products sector. They cover 15 sites and should generate £250,000 in this financial year. Annual recurring revenues were £1.18m at the end of September 2025, Cash was £786,000 and a further £250,000 has subsequently been raised at110p/share. A WRAP retail offer could raise up to £150,000 more. This will fund the delivery of the co-development partnership with a global engineering manufacturer. The share price is 18.2% higher at 130p.

WeShop (NASDAQ: WSHP) shares ended the week at $145.21. WeCap (LON: WCAP) has an interest valued at around 28p/share. The share price increased 8.33% to 2.6p. Hot Rocks Investments (LON: HRIP) owns a stake worth $21.8m and the share price rose 3.7% to 1.4p, which values the investment company at £3.4m.

Mendell Helium (LON: MDH) has extended the broker option of up to 10 million shares until 3 December. A further £12,000 has been raised via subscription at 3p/share. The share price improved 4.35% to 3p.

Chairman Richard Oldfield bought 25,000 Shepherd Neame (LON: SHEP) shares at 467.6p each. The share price edged up 0.4% to 466p.

FALLERS

Cannabis medicines developer Ananda Developments (LON: ANA) is calling a general meeting on 12 December to gain shareholder approval to leave Aquis. This will save money and may make it easier to raise cash. Initial data from a phase 1 human study for MRX1 has shown a positive safety profile. The final study should be complete in the second quarter of 2026. The share price slumped 51.1% to 0.11p.

Trading in Amazing AI (LON: AAI) shares was suspended following the resignation of Guild Financial Advisory as corporate adviser. The company has hired Rosenblatt Law to pursue a legal action against Tom Winnifrith and Share Prophets Ltd. Chief executive Paul Mathieson is also pursuing legal action, although his social media comments will not help him. The share price had fallen 21.4% to 0.275p by the time of suspension on Wednesday.

Wishbone Gold (LON: WSBN) is consolidating 100 shares into one new share and trading will commence on 1 December. The pre-consolidation share price was 19.4% lower at 0.725p.

Café chain Cooks Coffee Company (LON: COOK) increased interim revenues by 111% to NZ$5.77m, helped by managed stores in Ireland via the partnership with Dairygold. Pre-tax profit fell from NZ$530,000 to NZ$68,000. Overall store sales were 26.9% ahead at NZ$45.5m. There are currently 100 stores, most of which are franchised, with a target of 300 by 2034. Net debt is NZ$1.73m. Since the half year end total sales have risen 21.8%. The share price dipped 5.56% from its 2025 high to 8.5p.

Sulnox Group (LON: SNOX) has secured a major distribution agreement for its reduced emissions additives in the marine sector through Drew Marine USA, which operates in 1,200 ports around the world. The share price slipped 4.17% to 57.5p.

FTSE 100 gains amid positive broker ratings

The FTSE 100 ticked higher on Friday as traders continued to move into UK stocks after this week’s budget.

The measures announced on Wednesday were much better than some had first feared. Investors will be encouraged by the lack of immediate impact on consumer spending, and the absence of immediate impact on the economy will be negligible.

The longer-term picture is much harder to gauge, but reaction from business hasn’t been overly negative, with JPMorgan even pledging to build a brand new 12,000-person headquarters in Canary Wharf.

This mild confidence was reflected in UK equities, with the FTSE 100 edging higher.

“The FTSE 100 looks set to end the week in decent fashion and US futures point to post-Thanksgiving gains when Wall Street opens for business,” says AJ Bell head of markets Dan Coatsworth.

“UK housebuilders remain in decent fettle after the Budget – which didn’t contain any nasty surprises in terms of property taxes, bar the so-called ‘mansion tax’.

“The exception to the sector’s positivity is Berkeley which has greater exposure to the premium end of the market where the new supplementary council tax charges are more relevant.”

Berkeley Group Holdings shares slipped 0.7% while Persimmon added 0.1%. Rightmove was also marginally higher, with the housing market left largely unscathed by the budget.

Whitbread was the top faller after being hit by two broker downgrades.

“Broker ratings changes don’t always grab investors’ attention but a double downgrade from analysts on Premier Inn owner Whitbread has sparked a big reaction,” Coatsworth said.

“The share price has been shaken to its foundations by Bernstein making a handbrake turn from a positive to a negative view on the hotels group.”

Whitbread shares were down 4.5% at the time of writing.

Weir Group was the top riser, adding 1.9%, after Exane BNP reinitiated the stock with an outperform rating.

UK MedTech, Occuity, Opens Investment Round to Deliver Unique Non-Invasive Disease Screening

In an era where early detection can transform outcomes, one British MedTech company is turning the world’s attention to a surprising but powerful diagnostic tool – the human eye.

Occuity is a Reading-based innovator pioneering the emerging field of Oculomics, the study of how the eye can reveal insights into wider systemic health. Using light to scan through the eye and analyse the reflections returned, Occuity’s patented optical technology can detect subtle biomarkers linked not only to eye conditions such as glaucoma and myopia, but also to major systemic diseases including diabetes and Alzheimer’s.

As CEO and Co-Founder, Dr. Dan Daly highlights: “Ultimately, our aim is to replace invasive finger stick tests used by millions daily to measure glucose, with a simple, pain free scan of the eye”

Revolutionising diagnostics through light

Whilst a non-invasive glucose meter is the main goal, the company is taking a strategic approach to delivering it. At the heart of the Occuity’s work is a versatile optical platform technology that enables a pipeline of handheld, non-contact devices capable of delivering clinical-grade measurements quickly and painlessly. Its first commercial product built on the platform, the PM1 Pachymeter, provides precise corneal thickness measurements used in glaucoma screening and laser eye surgery, whilst its next device, the AX1 Axiometer, is aimed at the fast-growing myopia management market – targeting a disease forecast to affect half the world’s population by 2050.

Further along the roadmap are devices designed to identify and monitor key biomarkers for diabetes and Alzheimer’s, where non-invasive screening could provide an invaluable step forward in early detection and patient management. This includes the future development of the ‘Indigo’ – a non-invasive glucose meter, which aims to measure glucose levels through the eye.

Platform power and protection

Occuity’s core advantage lies in its patented optical technology platform, which serves as the foundation for multiple devices. The company currently holds 15 patent families (14 granted, one pending) with a further six in draft. Each new product builds upon the same core architecture – from optics and scanning systems to alignment and data algorithms – creating scalability and strong intellectual-property protection.

As CTO and Co-founder Dr Robin Taylor explains, “Occuity is a patent-heavy organisation by design. Our patents are structured into a robust patent thicket that safeguards not just our core optical platform, but every product that stems from it, giving us real strength and long-term value as we grow.”

Accessibility meets opportunity

Traditional optical instruments are often large, complex and costly. Occuity’s design philosophy flips this on its head, focusing on portability, simplicity and patient comfort. Its devices require no chin rest, dark room or consumables, making them cost-effective for clinicians and easy to deploy not only in hospitals but in point of care providers such as optometry practices, community settings, pharmacies and even in the home.

This approach does not just simplify healthcare delivery; it broadens access to advanced diagnostics. With more than 19 global distributors already on board, Occuity is well placed to bring its technology to scale.

Investing in the future of health

With global markets for diabetes care (projected at US $62.73 billion by 2032) and Alzheimer’s diagnostics growing rapidly (US $14.14 billion by 2032), Occuity’s platform offers investors exposure to several multi-billion-pound opportunities, all built around a proven core technology.

The company’s crowdfunding round on Republic Europe gives investors the chance to join its mission from as little as £30. For those looking for an ethical, high-growth investment in an area with vast potential impact, Occuity stands out as one to watch.

“We’re using the eye as a window into the health of the body,” says CEO and Co-founder Dan Daly. “Our goal is to make disease detection and monitoring smarter, faster and completely non-invasive, improving lives on a global scale. Significantly, from an investor perspective, whilst our work on our non-invasive glucose meter is really exciting, we’re not a one trick pony and our technology is being proven by our current products.”

As Oculomics moves from research into real-world applications, Occuity’s optical platform places it firmly at the forefront of this healthcare revolution.

Occuity’s Republic Europe crowdfunding campaign is now live, giving you the opportunity to back a company that has proven its technology, established early revenues and built a clear roadmap to scale.

Disclosure: This article is for information purposes only and does not constitute investment advice. Capital is at risk.