The shares of AO World (LON.AO.) are beginning to rise again ahead of the major electrical retailer announcing its Final Results for its year to end-March 2025.

We have already had guidance that the group’s results will show positively, while I believe that they could well show a confident view of the current trading year when the company releases its figures on Wednesday 18th June.

The Business

The Bolton-based group is the UK's most trusted major electrical retailer, with a mission to be the destination for electricals.

Its strategy is to create value by offerin...

Over 100 Investors & Counting — Why Now Is the Time to Join Novorise on Crowdcube

by Novorise

Novorise is gaining serious momentum — and investors are taking notice. With 118+ investors already on board, our Crowdcube campaign is making waves as we build the UK’s most scalable and affordable alternative to single-use plastic packaging.

Backed by £48 million in government contracts across TUCO (£30M) and Scotland Excel (£18M), Novorise is no longer in startup mode — we’re scaling fast. We supply to councils, NHS boards, food services, restaurants and takeaways, with compliance-ready, compostable, and recyclable packaging. Now, with only a few days left to invest, this is your window to be part of the UK’s green packaging shift.

🏆 And it’s not just our numbers doing the talking — we’ve been recognised as finalists for both the Green Business Award and New Business Award, with results announced soon.

What’s in it for you?

• 30% EIS tax relief

• Entry into a high-growth market

• A front-row seat to our £61.8M Year 3 projection

Funds raised will help us fulfil large-scale contracts, expand distribution, and invest in R&D — including our patent-in-pipeline tree-free bags, plastic-free cups, and CO₂-cutting lids.

Sustainability is no longer a niche; it’s a necessity. With investor confidence rising, changing ISA allowances, and regulatory shifts like EPR accelerating demand, Novorise sits at the intersection of innovation and opportunity. Every pound invested helps scale a cleaner, greener future.

Your investment isn’t just about returns — it’s about being part of a meaningful movement that transforms how we consume and dispose of everyday products. From tackling plastic pollution to empowering conscious procurement, Novorise is driving real impact.

📅 Join our final webinar with the co-founders on Sunday, 18 May at 17:00 BST:

👉 Eventbrite

📈 View the pitch

Don’t miss out — invest in the future of sustainable packaging before it’s too late.

eEnergy Group signs ‘game-changing’ £100m deal to fund energy projects

eEnergy Group has announced a significant partnership with US-based Redaptive Inc. worth up to £100 million to fund energy efficiency projects across the UK.

The arrangement establishes eEnergy as a key delivery partner for Redaptive in the British market.

Under the deal, Redaptive will finance approved customer projects spanning all client sectors, whilst eEnergy will manage operations and handle warranty and service obligations. This collaboration leverages eEnergy’s strong presence in large-scale LED and solar installations to accelerate Redaptive’s UK expansion.

Denver-headquartered Redaptive, established in 2015, brings substantial experience in funding and installing energy-saving equipment for major clients, including T-Mobile and Iron Mountain.

The agreement provides eEnergy with a base to expand its operations across both public and private markets. Unlike their existing NatWest facility, which serves only public sector projects, the Redaptive partnership opens up both the public and private sectors. Perhaps most importantly, eEnergy will receive full payment upon project completion, substantially improving cash flow.

“This is a game-changing partnership,” said Harvey Sinclair, eEnergy CEO.

“Redaptive’s decision to provide up to £100m unlocks a massive growth opportunity for eEnergy, giving us the firepower to deliver more funded decarbonisation projects, faster, and across every sector. As their lead UK delivery partner, we’re not just accessing capital – we’re joining forces with a global player to deliver scale. This enables us to accelerate our mission, remove financial barriers, and bring clean energy solutions to more organisations on their path to Net Zero than ever before.”

Tekcapital’s Guident enters robotics market with new contract win

Tekcapital has announced that its portfolio company, Guident, has entered the robotics market with a fresh contract win.

Guident has secured its first contract with the Boca Raton Innovation Campus (BRiC), the sprawling 1.7-million-square-foot office complex formerly housing IBM’s research and development operations.

Today’s WatchBot contract win comes shortly after the launch of Guident’s autonomous shuttle in West Palm Beach, demonstrating the breadth of real-world applications for Guident’s AV technology.

The Boca Raton Innovation Campus partnership centres on deploying Guident’s WatchBot, an autonomous surveillance and inspection robot. Developed in partnership with Star Robotics, the WatchBot surveillance system delivers real-time monitoring capabilities, employs AI-powered analytics and handles automated security functions.

“We are proud to partner with BRiC to deliver cutting-edge autonomous solutions that redefine campus management,” said Harald Braun, Chairman & CEO of Guident.

“WatchBot demonstrates Guident’s commitment to innovation and safety, and we are thrilled to contribute to BRiC’s vision of creating a world-class environment for technology and life sciences tenants. Together, we are setting a new standard for operational efficiency and intelligent campus management.”

Teleoperation: the human safety net propelling autonomous vehicles forward

Autonomous vehicles have clocked millions of miles on public roads. Yet, even the most sophisticated software encounters difficulties when reality presents unexpected scenarios. Perhaps a construction sign toppled by wind, a traffic officer gesturing with their hands, or a dog dashing across four lanes of traffic.

Rather than grounding entire fleets until algorithms master every unusual situation, the autonomous vehicle industry is increasingly relying on remote human operators who monitor driverless cars from a distance and, when called into action, take temporary control within seconds. This practice, known as teleoperation, is rapidly becoming a strategic cornerstone for safer, more resilient and more publicly trusted autonomy.

Edge Cases Lay Bare Autonomy’s Limits

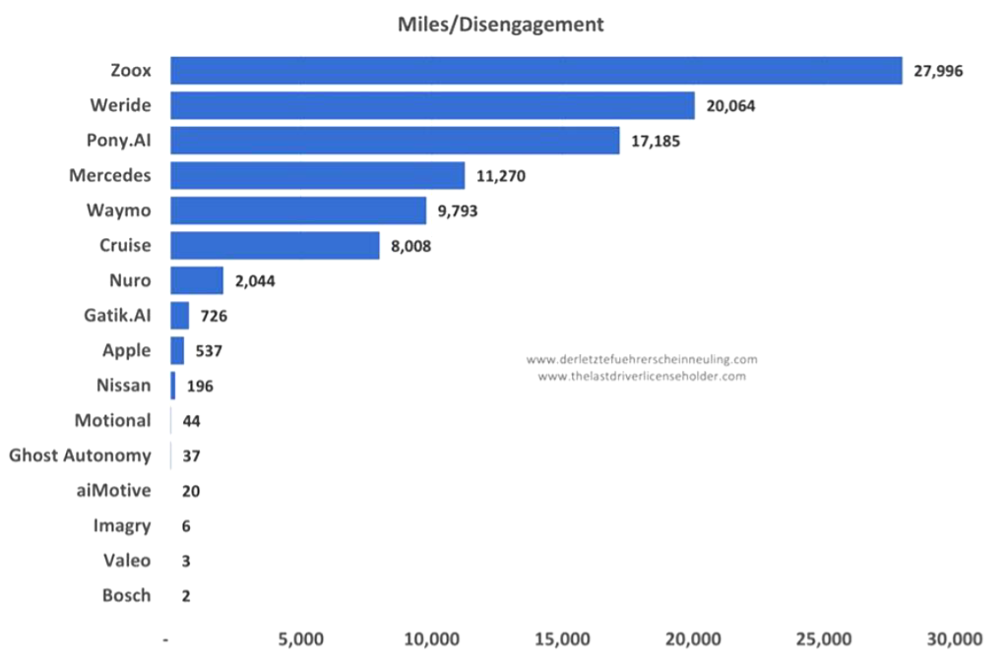

California’s 2024 disengagement data, the most closely watched measurement in the sector, reveals how frequently AVs still require assistance.

Waymo recorded one disengagement every 9,793 miles, whilst newer shuttle operators such as May Mobility needed an intervention approximately every 0.66 miles. These figures make two points unmistakably clear: edge cases remain abundant, and human backups are essential.

Number of miles driven per disengagement in California from December 2023 to November 2024

Teleoperation: A Real-Time Safety Valet

When an AV’s perception system hesitates, a remote operator can intervene—steering around an unmarked pothole or communicating with a traffic marshal—before returning control to the onboard computer.

This human-in-the-loop model significantly reduces the risk of a vehicle freezing or making a poor decision, reducing both collision risk and tariff disruption.

Moreover, a single operator can oversee dozens of vehicles because interventions are infrequent and brief. Such scalability means teleoperation adds minimal cost relative to the safety benefits, preserving the business case for autonomous ride-hailing and various AV service use cases.

Enhanced Safety Through Multi-Modal Communications

Contemporary teleoperation centres don’t simply maintain a video feed—they employ sophisticated communication systems that continuously monitor vehicle health, environmental conditions, and passenger status. These systems provide operators with comprehensive situational awareness through:

- Real-time vehicle telemetry data including speed, acceleration, and component diagnostics

- Multi-angle video feeds with depth perception and enhanced night vision capabilities

- Spatial audio mapping that allows operators to “hear” the vehicle’s surroundings

- AI-powered anomaly detection that pre-emptively flags potential issues before they escalate

The bidirectional nature of these communication systems enables immediate intervention during emergencies—operators can directly communicate with passengers, activate emergency protocols, or coordinate with first responders—all whilst maintaining positive control of the vehicle.

Redundant Communication Pathways: No Single Point of Failure

Leading AV companies now implement triple-redundant communication networks for teleoperation: a primary high-bandwidth 5G connection for normal operations, a secondary LTE/4G fallback network with optimised compression, and a tertiary satellite link for emergency connectivity in cellular dead zones.

This layered approach ensures that vehicles remain connected to operators even under challenging network conditions. When combined with advanced predictive buffering techniques that anticipate network problems, these systems remain operational with less than 0.001% communication downtime.

Confidence Builder for Regulators and Riders

Regulators view teleoperation as a tangible extra layer of safety insurance; several U.S. states now require or explicitly allow remote monitoring in commercial driverless deployments, especially when a safety driver is not present. Passengers, meanwhile, find comfort in knowing a trained human can step in if the robotic driver becomes confused. In consumer focus groups, willingness to ride increases markedly when teleoperation is mentioned as a safety net, a factor that may prove decisive in mainstream adoption.

The US is streets ahead of the UK in terms of AV deployment progress, although the UK is set to roll out self-driving vehicles in 2026.

Regulatory Frameworks Embracing Human Oversight

The regulatory landscape for teleoperation has matured significantly, with 21 states now incorporating specific teleoperation provisions in their AV legislation. The NHTSA’s 2025 AV Safety Framework explicitly endorses teleoperation as a key safety enhancement for Level 4 autonomous deployments, establishing minimum performance standards for:

- Maximum permissible latency (under 150ms)

- Minimum uptime requirements (99.97%)

- Operator-to-vehicle ratios (currently 1:12 maximum)

- Mandatory operator certification and ongoing training

These clear regulatory guidelines have accelerated commercial deployments whilst maintaining strong safety margins. Industry consensus suggests this regulatory certainty has shortened commercialisation timelines by approximately 18-24 months.

Glass-to-Glass Latency: Every Millisecond Counts

For teleoperation to work effectively, the video loop from the vehicle’s cameras to the operator’s screen must be nearly instantaneous.

Industry best practice is sub-100 millisecond “glass-to-glass” latency. Beyond approximately 250 ms, human steering accuracy declines materially and makes remote control useless.

A 2025 5G field trial averaged 202 ms end-to-end delay, a 2024 campus-network demonstration clocked 136 ms, and a controlled laboratory study achieved 88.9 ms. Older LTE experiments hovered well above 200 ms, highlighting why next-generation connectivity and aggressive video-pipeline tuning are mission-critical.

The Advanced Human Interface: Enhancing Operator Performance

Remote operation centres now utilise cutting-edge human factors research to maximise operator effectiveness whilst minimising fatigue and cognitive load.

Key innovations include AR-enhanced interfaces that overlay predictive path information and highlight potential hazards, feedback systems that provide operators with simulated road feel and vehicle dynamics, adaptive workload management that dynamically adjusts operator-to-vehicle ratios based on real-time complexity metrics, and physiological monitoring systems that detect early signs of fatigue or attention lapses.

These human-centred design approaches have reduced operator error rates by 67% whilst extending effective work sessions by up to 3 hours compared to earlier systems.

Passenger Experience: The Human Touch in Robotic Rides

Modern teleoperation systems prioritise passenger communication and comfort. When a vehicle requires remote assistance, passengers receive an immediate notification via in-vehicle screens and audio, whilst the remote operator can directly communicate through the vehicle’s audio system.

AI-driven emotion recognition can alert operators to passenger distress, and custom communication protocols address specific passenger needs, such as those of children, the elderly or disabled individuals.

This human connection transforms what could be an unsettling experience into a reassuring demonstration of the system’s safety architecture. Market research indicates that passengers who experience a smooth teleoperation handover report higher satisfaction scores than those whose journeys never required intervention, suggesting the visible safety net actually enhances the experience.

The Flywheel Effect: Faster Learning, Faster Deployment

Each remote intervention does more than resolve a single challenging moment; it generates a labelled data set that engineers can channel back into training. Over time, the fleet encounters fewer repetitions of the same edge case because the AI has learned from every human-assisted rescue. This virtuous cycle enables companies to scale services sooner, complete with human safety net, whilst systematically driving the disengagement rate ever closer to zero.

Catalyst, Not Crutch

For many in the industry, the long-term goal remains full self-reliant autonomy. Yet, if the industry waits for perfection, mass deployment could be derailed, and even if perfection were miraculously achieved, edge cases can easily transform from electro-mechanical errors to problems dealing with occupant health status or security. Teleoperation offers a pragmatic bridge: AVs can serve riders today under real-world conditions while a human guardian angel silently neutralises most of the rough edges. As WIRED recently quipped, remote driving may be the “sneaky shortcut” that finally enables robotaxis to scale.

In essence, teleoperation is the human safety net that allows autonomous vehicles to run before they can walk—and, paradoxically, may be the fastest path to teaching them to stride confidently on their own.

Genflow Biosciences’ longevity patent application advances in Japan

Genflow Biosciences reports that its longevity-related patent application has progressed to the national examination phase at the Japanese Patent Office.

The application, entitled “Variants of SIRT6 for Use in Preventing and/or Treating Age-Related Diseases,” was initially submitted on 13 May 2022.

It is jointly owned by the University of Rochester, the Trustees of Columbia University in the City of New York, and Albert Einstein College of Medicine, with Genflow holding the exclusive license to this intellectual property.

The IP encompasses novel SIRT6 gene variants crucial to genomic stability, metabolic regulation, and healthy ageing. These variants form the foundation of Genflow’s core therapeutic platform and represent a significant component of its pipeline targeting age-related diseases.

“We are pleased to see continued momentum in the protection of our SIRT6 intellectual property,” said Dr. Eric Leire, CEO of Genflow Biosciences.

“Japan represents a strategically important jurisdiction for Genflow, and advancing this patent application strengthens our global positioning as a leader in longevity gene therapy.”

Today’s news follows the recently announced launch of a development programme to explore SIRT6 in eyecare and a partnership with Heureka Labs, a technology spin-off from Duke University, to utilise Heureka’s AI-powered platform to analyse genomic data.

FTSE 100 consolidates as oil falls and UK GDP beat fails to inspire

The FTSE 100 was lower in early trade on Thursday before recovering as the recent rally in global stocks showed signs of consolidation after a surging recovery rally from Trump tariffs that has taken UK and US stocks into positive territory for the year.

Lower oil prices were the main detractor from improving investor sentiment as investors reacted to Trump’s comments on Iran and prepared for a number of risk events, including central bank speeches.

London’s leading index had just turned positive on the session at the time of writing after falling 60 points in the very early stage of trade on Thursday.

“A big pullback in oil prices weighed on markets across Europe,” says Russ Mould, investment director at AJ Bell.

“Traders focused on the prospect of a US/Iran nuclear deal which could see economic sanctions lifted on the latter and potentially lead to greater supplies of oil. That weighed on shares in BP and Shell which pulled down the FTSE 100. Commodities trader Glencore was also weak.”

Investors also digested stronger-than-expected UK GDP figures, which showed the economy successfully navigated a number of risks in Q1 to produce growth of 0.7% – the fastest pace of growth for a year.

However, analysis of the numbers reveals that the uptick in activity can be attributed to businesses preparing for the trade war as opposed to any meaningful improvement in demand.

“The better-than-expected growth snapshot also appears to have underwhelmed investors,” explained Susannah Streeter, head of money and markets, Hargreaves Lansdown.

“UK GDP data may have surprised on the upside, but the upswing in activity risks fizzling out given the uncertainty on the horizon. There was a surge in business investment during the quarter, after a fall at the end of last year. With the threat of tariffs hovering which looked set to push up prices, it looks like there was a spell of buying of machinery and IT.”

FTSE 100 movers

Aviva shares helped the FTSE 100 turn positive with a 2% gain after releasing a very respectable round-up of Q1 trading. General insurance premiums rose 9%, wealth flows boosted AUM, and retirement sales increased 4%.

“Aviva’s prowess as an insurance titan shone through in the first quarter with strong signals across the board. The benefits of recent acquisitions are starting to manifest with both new business and the Probitas deal driving General Insurance premiums up 12% to £2bn in the UK and Ireland,” said Derren Nathan, head of equity research, Hargreaves Lansdown.

“Meanwhile, last year’s acquisition of assets from AIG helped spur a 19% increase in Protection and Health Sales. And despite a major client loss, net flows into Wealth were positive at 5%.”

JD Sports was the FTSE 100’s top riser as investors bought into the sports retailer after Footlocker shares soared 60% in the US pre-market on a takeover approach from Dick’s Sporting Goods.

Natural resources shares BP, Glencore, and Antofagasta were among the fallers amid lower commodity prices. Recent gains for the sector have also created short-term profit-taking opportunities for traders.

3i was the top faller after the investment trust reported NAV growth that fell short of analyst estimates. 3i shares were down 7% despite NAV increasing 22% in the year to 31 March.

GreenFox: Unlock your share of the UK’s £20bn Domestic Solar Opportunity

With half their current funding target already met, and its co-founders committing an additional 30% new money over and above the raise target, GreenFox Energy is a differentiated renewable energy company in a hurry. Hosted on the CrowdCube platform, there’s just over a week left to get a share of this rapidly growing, and already consistently profitable business. Find it here

The UK is on the cusp of a renewable energy revolution—and GreenFox is ideally positioned to lead it.

GreenFox is an installer of domestic solar systems, batteries, and related technologies, offering customers a trusted, high-quality route to clean energy. The company combines expert installation with a branded care and maintenance plan that keeps systems efficient, productive, protected, and supported over the long term.

With a growing addressable market and customer appetite for clean energy and peace of mind, GreenFox is poised for scale.

A Premium & Differentiated Proposition

GreenFox selects top-tier components from trusted brands and manages installation and commissioning for domestic customers. Its model centers on:

- Customer trust & transparency: Fixed pricing, reliable timelines, and responsive support

- Best-in-class service – as evidenced by their status as a Which? 5-star trusted trader with full industry accreditations and an unblemished 5-star record of customer reviews

- ’Good/Better/Best’ brand and product offerings from trusted partner brands like Solis, Duracell & Tesla.

- Lifetime value: An optional annual care plan offering performance checks, issue diagnosis, cleaning and expert support – including ‘on-tap’ tariff advice.

This combination of reliability and ongoing care positions GreenFox as a “safe pair of hands” with the reasurring feel of a premium consumer brand for homeowners joining the renewable energy transition.

Vixen Care Plan: Meeting an Overlooked Need

The company’s most powerful growth lever is its subscription-based care and maintenance plan. For a modest annual fee, customers receive diagnostics, system health checks, performance reports, and priority support.

While 55% of UK homeowners pay for annual boiler cover, fewer than 1% of solar owners have any structured maintenance—despite investing thousands in these systems.

GreenFox is already capitalising on this gap. It has a 35% attachment rate from installation to care plan subscription, reflecting strong customer demand. Additionally, 40% of service plan sales come from non-GreenFox installation customers, showing brand appeal beyond its install base. As yet, very few providers are seeking to offer this service giving GreenFox a valuable head-start.

The care plan offers not just homeowner reassurance—it builds a predictable, high-margin recurring revenue stream, compounding with each installation and pulling in third-party customers. Gross margins to date sit at 30% and are intended to ease off to 26% as the company seeks to acquire scale and customer volume rapidly over the next two years.

The Market: A Sleeping Giant

The domestic solar market in the UK is both large and underpenetrated:

- 70% of UK homes are suitable for solar, yet only 10% have made the switch, leaving 12 million homes untapped and a profit pool over £20 billion.

- 99% of installed systems lack care plans, despite concerns about long-term performance and savings.

- GreenFox projects a 55% adoption rate for care plans among solar homes, suggesting an ARR opportunity of £125 million.

This dual opportunity—conversion and care—places GreenFox at the heart of the UK’s clean energy growth story.

A Clear Path to Exit

While installations deliver upfront income and open up a selling channel for subscriptions and future add-on sales, the Vixen care plan is the driver of long-term, recurring value and elevates this investment opportunity.

Crucially, GreenFox’s founders are pursuing a short sprint to growth and exit. Only one more raise is planned—in around 18 months—contingent on achieving FY25/26 and FY26/27 financial targets – none of which require the introduction of new service lines or propositions – just scaling across the UK through higher impact marketing and the acquisition of further technical delivery resources . Having achieved these milestones the company intends to pursue a strategic sale to a major utility or domestic services provider.

This exit strategy is aligned with market trends. Most large utility providers are currently delivering renewable services through fragmented, arms-length third-party arrangements, which often produce inconsistent customer outcomes and leave parts of the UK un or under-serviced. As pressure mounts on these companies to decarbonise homes and professionalise solar delivery, acquisition will become the logical path to scale.

GreenFox, with its national installer base, growing subscription footprint, and strong consumer brand, is an ideal platform for acquirers lacking direct customer relationships or service capability.

Timing and Tailwinds

GreenFox is entering the market at an ideal time:

- Energy prices remain unstable, prompting consumers to seek self-sufficiency

- Climate awareness is high, with policy and planning rules shifting in favour of solar

- Homeowners want stability and energy independence

Market readiness, policy momentum, and consumer demand all support GreenFox’s model and growth potential.

A Scalable National Platform Ready for Exit

GreenFox is building a national platform for the installation and maintenance of domestic clean energy systems. By prioritising high quality products, honest & transparent advice, excellent customer service and care plans, we focus on what homeowners truly want: clarity, reliability, savings and a trusted partner to help them navigate renewables.

The opportunity is clear. Millions of homes remain unconverted. Millions more lack care. GreenFox is uniquely positioned to serve both markets—earning immediate revenue from installations and long-term ARR through subscriptions.

For investors, this is a chance to back a high-growth, time-limited value creation story, supported by strong fundamentals and a well-structured exit path.

GreenFox isn’t just participating in the clean energy transition—it’s building the consumer brand and service platform that others will aspire to.