Ikea plans to open high street stores in city centres

Home wares retailer Ikea are planning to open down-sized high street stores across city centres in the UK, following a takeover by Javier Quinones as retail manager.

Quinones has stated that the new stores will open as part of a modernization programme, which will also involves expansion of the company’s online services.

Online shopping is the “new world for retailers” and “Ikea are not outside of this”, Mr Quiñones said.

“It’s not that we have to change because otherwise we will not exist tomorrow, but . . . I’m convinced that if we do not do the transformation then in the long-run we will not exist,” he added.

The new developments come after Ikea enjoyed its sixth consecutive year of sales growth, though sales were down 40 percent last year – on-year – due to a weak pound. The firm are also on the cusp of opening their twenty-second mega store in the UK, in Greenwich, with the first of the smaller high street branches expected to open on Tottenham Court Road this Autumn.

The launch follows a study of consumer habits, and a note of how customers like to interact several times with staff before purchasing a product. Order and collection trials were carried out in locations around Birmingham and London, and within the next six months, over ten thousand of Ikea’s products will be available to order online, with a 24-hour delivery service.

“I think it’s the first time we really looked into the DNA of who we have been. We were born from the store and the typical way of retailing. It’s not unique to Ikea. Every retailer needs to adapt to the new digital era.” Said Mr Quinones.

These new adaptations are vital, as without restructuring, Mr Quinones said the firm would cease to exist. Indeed, the larger outlets take three to four years to fully open and plans to open a new store in Preston were recently scrapped.

The new high street outlets will focus on customer engagement and will offer Ikea’s trademark meatballs.

Ryanair reports 20pc drop in quarterly profits

Ryanair (LON: RYA) has reported a 20 percent drop in first quarter profits.

The airline blamed oil prices and a fall in fares for the fall in profits, which fell to €319 million (£285 million).

The group is also amid strike action by staff over pay and conditions.

“While we continue to actively engage with pilot and cabin crew unions across Europe, we expect further strikes over the peak summer period as we are not prepared to concede to unreasonable demands that will compromise either our low fares or our highly efficient model,” said Ryanair.

Wednesday and Thursday will see the cancellation of 600 flights due to strikes by cabin crew based in Spain, Portugal and Belgium. Over 100,000 passengers have been affected by this week’s strike.

“If these unnecessary strikes continue to damage customer confidence and forward prices/yields in certain country markets then we will have to review our winter schedule,” said Ryanair, warning that it might cut jobs at bases where industrial action has taken place.

The group also expressed concerns over a hard Brexit.

“While there is a view that a 21-month transition agreement from March 2019 to December 2020 will be implemented (and extended), recent events in the UK political sphere have added to this uncertainty, and we believe that the risk of a hard Brexit is being underestimated.”

“It is likely that in the event of a hard Brexit our UK shareholders will be treated as non-EU. We may be forced to restrict the voting rights of all non-EU shareholders in the event of a hard Brexit, to ensure that Ryanair remains majority owned and controlled by EU shareholders.”

Despite the fall in profits for the quarter between April and June, the airline has said that it expects to meet profit forecasts of €1.25 billion-€1.35 billion for the full year.

Quorn to invest £7m in R&D on growth in sales

Quorn is making a multi-million-pound investment in research and development, following a boom in vegan food.

The seven million pound investment at its North Yorkshire headquarters in an attempt to capitalise on the vegan boom, whilst keeping new rivals at bay.

“Nobody can yet produce the array of products available at such high quality and we want to keep that advantage,” said Quorn’s chief executive, Kevin Brennan.

“All over the world we have seen a real step-change in the way people are eating. Young consumers are really starting to have concerns around meat from a health and sustainability point of view. It’s not that younger consumers are all turning vegan or vegetarian but they are eating substantially less meat,” he added.

Whilst all Quorn products are vegetarian, many of the products contain some egg.

The group revealed a 12 percent rise in sales to £112 million in the first six months of 2018.

Quorn is aiming to reach $1 billion (£760 million) of annual sales by 2027 and is on target.

“We are already seeing amazing growth internationally: Australian sales are up 50 percent and US sales are up 23 percent. In the US supermarket giant Kroger, we now have the fastest selling product in the [meat alternative] category. With continued investment we believe we can continue this level of performance,” said Brennan.

“I think the irony is that the product was almost developed ahead of its time. We’ve been around for 30 years but the demand for this kind of product 30 years ago was quite small. It has come into its own in the last five years in the UK and the world,” he added.

The UK is Quorn’s biggest market, rising by 12 percent this year due to the popularity of snacks such as vegan scotch eggs and cocktail sausages.

The drive for vegan and vegetarian food is partly being driven by Netflix, who are releasing documentaries addressing the environmental and health effects of eating meat such as Cowspiracy.

Tesco discount chain to launch this year

Tesco (LON: TSCO) could launch its very own discount chain, Jack’s, as early as September this year.

The supermarket giant is advertising for new staff, whilst confirming a Tesco Metro in Merseyside will reopen under a new name.

“If Tesco puts some proper welly behind it in terms of infrastructure and store openings it could stand a decent chance of success,” said Bryan Roberts, an analyst at the retail marketing firm TCC Global.

The group is hoping to launch a supermarket to rival discounters Aldi and Lidl.

Aldi became the UK’s fifth-largest grocer in 2017, overtaking the Co-op. The group already surpassed Waitrose in 2015.

Figures from Kantar Worldpanel show that Aldi’s market share reached 6.9 percent in the 12 weeks to 28 January. Lidl increased its share to 5 percent, whilst Tesco, Sainsbury’s (LON: SBRY), Asda and Morrisons (LON: MRW) all lost market share over the past year.

Aldi and Lidl account for £1 in every £8 spent in UK supermarkets, it emerged last year.

It is not just Aldi and Lidl who have been taking customers from Tesco. B&M, Wilko and Poundland have increased the range of food sold in their stores, attracting more shoppers.

In February, Tesco promised that it would “develop new formats to better serve customers.”

There have been several rumours about this new format but the supermarket has declined to comment. The new format is a key part of its acquisition of Booker.

Charles Wilson, the chief executive of Booker, became the boss of the Tesco’s core UK and Ireland retail operations in March.

“He brings substantial commercial and retail experience and has an exceptional track record of increasing performance and driving growth in customer-focused businesses,” said the group chief executive, Dave Lewis.

Donald Trump trade comments send FTSE 100 lower

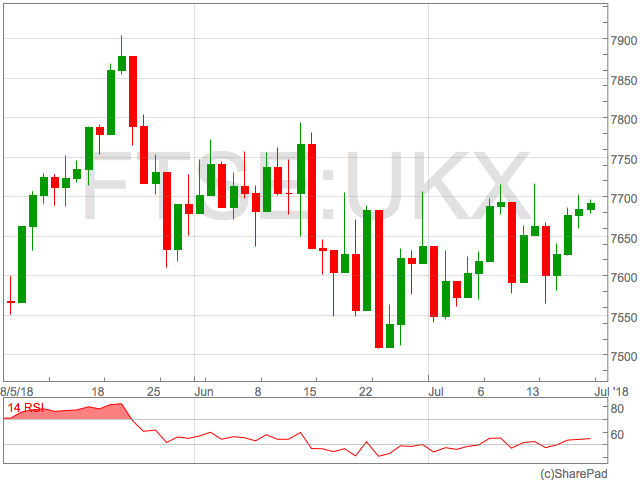

Donald Trump almost single handedly erased Friday morning’s FTSE 100 gains and sent the index sharply lower in afternoon trade.

Trump again threatened the US could impose tariffs on the entire $500 billion worth of imports from China and once again sent investors running for the hills on the prospect of a full blown trade war that could rock the global economy.

Having reached highs of 7706, the FTSE was trading below 7635 at 14:15 in London trade.

In an interview with CNBC’s squawk box, the president said he was ‘ready to go to 500’ if China didn’t fall into line with his demands.

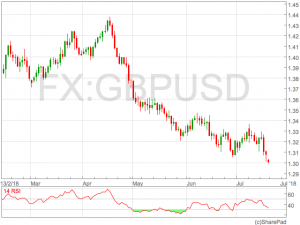

Not stopping with threats on trade, Trump accused the EU and China of manipulating their currencies. The dollar sank sharply on the comments with GBP/USD jumping back above 1.3100 having touched 1.2994 earlier in the day.Trump says he’s ready to put tariffs on ALL goods imported into the U.S. from China.

— Jamie McGeever (@ReutersJamie) 20 July 2018

Friday’s comments ended a brief period of softening in tone on trade and overseas relations which had been accompanied by a gentle move to the upside in the FTSE 100. The FTSE 100 has a substantial exposure to China through commodity companies such as Anglo American, BHP Billiton and Glencore, all of which were down over 2% on Friday afternoon.China, the European Union and others have been manipulating their currencies and interest rates lower, while the U.S. is raising rates while the dollars gets stronger and stronger with each passing day – taking away our big competitive edge. As usual, not a level playing field…

— Donald J. Trump (@realDonaldTrump) 20 July 2018

FTSE 100 heading for a week of gains as sterling falls

The FTSE 100 is set for minor gains on the week as sterling weakness supports London’s leading index.

Concerns over a No deal Brexit and the threat of a general election hit the pound sending it beneath 1.3000 against the dollar. On Thursday GBP/USD hit the lowest level since October following hawkish comments from Federal Reserve Chair Powell suggesting the Fed would continue with rate hikes due to a robust US economy.

Sterling weakness has been one of the biggest influences on the FTSE 100 since the vote to leave the EU as exporting shares benefit from a weaker pound, boosting earnings.

Despite the boost from weaker sterling, the FTSE 100 has failed to break out of a tight trading range where it has been held since mid-June.

The 7700-7730 region has proved to be a strong level of resistance with rallies failing in this region on multiple occasions in the past four weeks.

Sterling weakness has been one of the biggest influences on the FTSE 100 since the vote to leave the EU as exporting shares benefit from a weaker pound, boosting earnings.

Despite the boost from weaker sterling, the FTSE 100 has failed to break out of a tight trading range where it has been held since mid-June.

The 7700-7730 region has proved to be a strong level of resistance with rallies failing in this region on multiple occasions in the past four weeks.

The biggest risers on the week include Unilever, Just Eat and Ocado all up over 3%. Unilever yesterday announced an increase in sales despite feeling the impact of striking workers in Brazil.

The biggest risers on the week include Unilever, Just Eat and Ocado all up over 3%. Unilever yesterday announced an increase in sales despite feeling the impact of striking workers in Brazil.

Sterling weakness has been one of the biggest influences on the FTSE 100 since the vote to leave the EU as exporting shares benefit from a weaker pound, boosting earnings.

Despite the boost from weaker sterling, the FTSE 100 has failed to break out of a tight trading range where it has been held since mid-June.

The 7700-7730 region has proved to be a strong level of resistance with rallies failing in this region on multiple occasions in the past four weeks.

Sterling weakness has been one of the biggest influences on the FTSE 100 since the vote to leave the EU as exporting shares benefit from a weaker pound, boosting earnings.

Despite the boost from weaker sterling, the FTSE 100 has failed to break out of a tight trading range where it has been held since mid-June.

The 7700-7730 region has proved to be a strong level of resistance with rallies failing in this region on multiple occasions in the past four weeks.

The biggest risers on the week include Unilever, Just Eat and Ocado all up over 3%. Unilever yesterday announced an increase in sales despite feeling the impact of striking workers in Brazil.

The biggest risers on the week include Unilever, Just Eat and Ocado all up over 3%. Unilever yesterday announced an increase in sales despite feeling the impact of striking workers in Brazil. WH Ireland shares tumble on financial loss

Financial services firm WH Ireland (LON:WHI) saw shares tumble over 8 percent on Thursday morning, reporting a financial loss and the departure of its CEO.

The group recorded an operating loss of £1.6 million in its annual results for the 16 months to the end of March, after significant changes to the business and the reporting period took its toll.

CEO Richard Killingbeck also announced that he would be stepping down at the end of July to pursue other opportunities. He will be replaced by Phillip Wale, the current Head of Fixed Income (Europe) at Cantor Fitzgerald Europe.

“We have made considerable progress continuing the transformation of WH Ireland. However, as we previously stated, this process of change has not been without its challenges given market conditions and the scale of change that we have been implementing; this has resulted in losses being incurred last year – but a much clearer path to profitability is now ahead of us in the new financial year and beyond,” said Tim Steel, Chairman of WH Ireland.

Shares in WH Ireland are currently trading down 8.20 percent at 117.50

Hilton Food Group shares up on solid half year trading

Food packing firm Hilton Food Group (LON:HFG) reported trading in line with expectations for the first half of the year, as it looks to expand both domestically and overseas.

In a trading update for the 28 weeks to the 15 July the company reported growing UK turnover, with “encouraging” growth in its Irish business.

Its business in Holland reported lower turnover than in 2017, but the group added that in Portugal “good progress” was being made.

The company also said first-half double-digit growth was achieved in Australia.

“The group’s financial position remains strong and Hilton continues to explore opportunities to invest and grow the business in both domestic and overseas markets,” Hilton Food Group said.

Shares in the company are currently trading up 1.23 percent on the news at 984.00 (1034GMT).

Everyman Media Group shares up 5pc

Alternative cinema chain Everyman Media Group (LON:EMAN) reported performance in line with expectations for the year to July, sending shares up over 5 percent.

The group, who are spearheading the “rise of independent cinema”, ended the period with 22 cinemas in operation, including a new four screen cinema in York.

In an update, Everyman said contracts had been exchanged for venues in Cardiff (four screens) and London Broadgate (three screens), both of which are expected to open in 2019.

‘The board is confident of a successful outcome for the full year and the pipeline is continuing to be developed in line with the Board’s expectations,’ Everyman Media Group said.

The group was founded in 2000 after the acquisition of the original Everyman cinema in Hampstead, and has grown steadily since. Its share price has risen significantly over the past five years, and is currently up 5.39 percent at 215.00 (1011GMT).

June retail sales boosted by food and beer

Retail sales increased by 2.1 percent in the three months to June, with food sales strong on the back on good weather and World Cup celebrations.

In the three months to June 2018 the quantity bought in retail sales increased by 2.1 percent, with sales at food stores growing by 2.2 percent, the largest growth since May 2001.

Supermarkets said they had seen sales boosted by continued good weather and World Cup celebrations, raising sales of BBQ food and beer.

However, along with non-store retailing, the quantity bought saw a 0.5 percent decline on the pervious month.

Office for National Statistics senior statistician Rhian Murphy said:

“Retail sales grew strongly across the three months to June 2018 as the warm weather encouraged shoppers to buy food and drink for their BBQs.

“However, in June retail sales actually fell back slightly, with continued growth in food sales offset by declining spending in many other shops as consumers stayed away from stores and instead enjoyed the World Cup and the heatwave.”

Online sales remained strong, taking 18 percent of the total spent. Online spending in clothing and footwear stores continued to achieve new record proportions of online retailing, for the fourth consecutive month, at 17.5 percent.